Central banks around the world's massive gold purchases have driven international gold prices to new highs this year. However, after gold prices surged and then quickly retreated this month after breaking through the $4,000 mark, at least one Asian central bank official has indicated that his country may need to consider selling its gold reserves.

According to reports, Benjamin Diokno, a member of the Monetary Council of the Central Bank of the Philippines and former central bank governor, said on Monday, "Our current gold holdings are already too high."

Currently, gold accounts for approximately 13% of the Philippine central bank's total international reserves of US$109 billion, higher than most central banks in Asia. Diokno believes that the ideal gold reserve ratio should be maintained in the range of 8%-12%.

It's worth noting that the Philippine central bank began continuously increasing its gold reserves when the price was around $2,000 per ounce. Since then, the price of gold has more than doubled, briefly breaking through $4,380 last week before falling back below $4,000 due to easing geopolitical tensions and profit-taking by investors.

"Shouldn't we sell?" Diokno asked in an interview. "What if the price of gold falls?"

Diokno's remarks clearly highlight the debate within central banks around the world about whether to continue buying gold or start taking profits.

In 2024, the Central Bank of the Philippines sold some of its gold reserves before a surge in gold prices, which drew criticism at the time. The Central Bank of the Philippines has stated that it will actively manage its reserve assets, including gold, to meet the Philippines' foreign exchange needs.

Eli Remolona, the current governor of the Philippine central bank, stated earlier this year that the central bank would not speculate on gold prices. He also noted that gold is a "very bad investment"—although it still has hedging value in a diversified portfolio.

Gold at $4,000 evokes both love and fear.

Gold prices have risen by about 52% so far this year, with a 30% increase in the past two months.

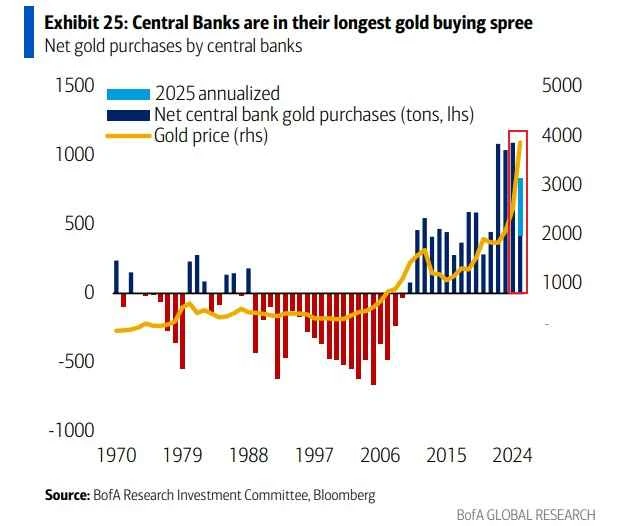

The sustained rise in gold prices over the past few years has been primarily driven by large-scale gold purchases by central banks—especially after Western sanctions against Russia, as emerging market countries actively increased their gold reserves to reduce their dependence on the US dollar. Geopolitical uncertainty and concerns about US debt following President Trump's inauguration earlier this year have also contributed to the rise in gold prices.

However, gold prices have fallen sharply over the past week after hitting a record high. Although many had anticipated this given the recent rapid price increase.

Last week, Goldman Sachs The bank attributed the gold price plunge to the liquidation of speculative positions and the spillover effects of volatility in the silver market. However, it expects central banks and institutional investors to continue increasing their gold allocations amid heightened global uncertainty. It forecasts that gold prices will reach $4,900 per ounce by the end of 2026.

The bullish camp in gold also includes precious metals . Market veteran Ed Yardeni predicts that gold prices will reach $10,000 per ounce by 2030.

However, not everyone agrees with these bullish views...

Capital Economics predicts that gold prices will fall to $3,500 per ounce by the end of 2026 as it enters a "minor collapse." The research firm also believes that since gold already accounts for more than 20% of national reserves, central banks worldwide may not continue to increase their gold reserves.

Indeed, many industry insiders believe that the current gold price of around $4,000 is a position that evokes both love and fear – those who previously held gold may want to sell, while those who haven't bought yet may be tempted to do so. In contrast to the Philippine central bank officials, who have expressed a willingness to sell despite continuously increasing their gold reserves in recent years, news broke on Tuesday that the Bank of Korea is considering increasing its gold reserves for the first time in over a decade – the last time the central bank increased its gold reserves was in 2013.

Overall, at least 23 countries and regions increased their gold reserves in the first half of 2025 alone. By 2025, central banks worldwide had been net buyers of gold for the 16th consecutive year, marking the longest streak on record. Previously, central banks had made net purchases of 1080 tons, 1051 tons, and 1089 tons of gold in 2022, 2023, and 2024, respectively.

However, with gold prices reaching high levels, while central banks' gold purchases haven't stopped this year, the pace may indeed be slowing. As shown in the chart below, based on current monthly data estimates, the annualized total of global central bank gold purchases in 2025 may reach 830 tons. While this annual purchase figure remains unusually high, it will be lower than the previous three years.

(Article source: CLS)