1. The longest government shutdown in US history has ended, but US stock futures remain weak and uncertain in pre-market trading; 2. Gold and silver continue their upward trend, with spot silver approaching its historical high; 3. A major short seller terminated the registration of his fund, again hinting at trouble on November 25th; 4. Alibaba... The stock rose more than 4% in pre-market trading, reportedly due to rumors that the company is preparing for a major battle with a thousand consumer-facing (C-end) clients.

Although the longest government shutdown in U.S. history has ended, the market is still awaiting a large backlog of economic data, and the three major U.S. futures indices remained weak and volatile in pre-market trading.

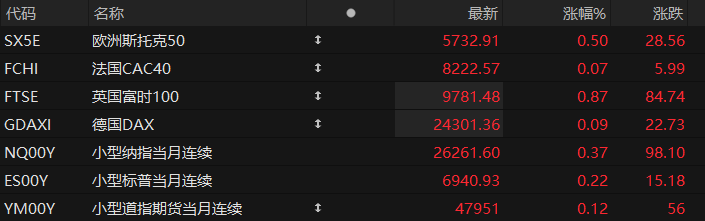

As of press time, Nasdaq S&P 500 futures (2512 contract) fell 0.26%, S&P 500 futures fell 0.19%, and Dow Jones futures fell 0.12%. Although a December rate cut by the Federal Reserve remains uncertain, spot gold, which had risen for five consecutive days, climbed more than 1% intraday, returning above $4,200 per ounce . Spot silver, which had risen for seven consecutive days, briefly reached the $54 per ounce mark, just a stone's throw from its all-time high set on October 17 .

(Spot silver daily chart, source: TradingView)

The White House stated Wednesday evening that October's U.S. employment and inflation data might "never be released," and the Bureau of Labor Statistics, the governing body, has yet to make a decision. Furthermore, the agency's staff has been reduced by 25% since February, and one-third of its leadership positions are vacant, all of which makes it unlikely that economic data will be released quickly.

Morgan Stanley Based on the experience of the 2013 shutdown, it is estimated that after the government restarts, the September non-farm payroll report, which has already completed data collection, may take about 3 days to be released, while the other major September data will take about 1-2 weeks to prepare.

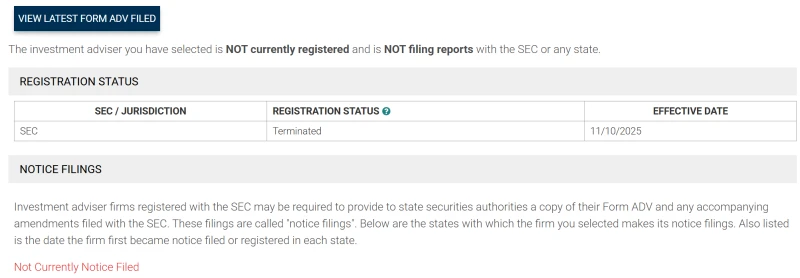

Besides waiting for data, there has been progress in the much-discussed issue of "a major short seller predicting a downturn in AI leaders." According to Michael Burry's own disclosure on social media, his fund, SCION Asset Management, terminated its registration with the U.S. SEC on November 10.

This move means that Berry will no longer serve external investors and therefore will no longer be required to publicly disclose details of his holdings or transactions. He also reiterated the "November 25th" deadline, a date he had previously mentioned when questioning tech companies about extending the depreciation period for computing chips, stating that "more details will be released."

In addition, Berry disclosed details of his purchase of put options, including 50,000 Palantir put options expiring on January 15, 2027, with a strike price of $50. Berry stated that the total premium for these options amounted to $9.2 million, which is not as alarming as the "$900 million shorting Palantir" reported in the media.

Other market news

Alibaba shares surge over 4% amid rumors that the company is preparing for a "battle of a thousand questions for consumers."

As of press time, Alibaba, a Chinese technology company, saw its shares rise over 4% in pre-market trading. According to the Science and Technology Innovation Board Daily, Alibaba has secretly launched the "Qianwen" project, developing a personal AI assistant app based on the Qwen model, directly competing with ChatGPT. An international version of the Qianwen app, targeting the global market, is also under development, aiming to leverage the overseas influence of the Qwen model to directly compete with ChatGPT for overseas users.

Baidu Release of Wenxin Large Model 5.0, and the new generation Kunlun Chip M100 and M300

At the Baidu World Conference held on Thursday, Baidu released Wenxin Large Model 5.0, with a parameter scale exceeding 2.4 trillion. Baidu also announced the latest progress of its self-developed Kunlun chip. Specifically, the Kunlun Chip M100, primarily optimized for large-scale inference scenarios, will be available in early 2026, while the Kunlun Chip M300, mainly designed for ultra-large-scale multimodal model training and inference, will be available in early 2027.

[Quick Overview of Financial Reports of Leading Chinese Companies Listed in the US]

Tencent Holdings reported revenue of RMB 192.87 billion in the third quarter, up 15% year-on-year, compared to an estimated RMB 188.8 billion; net profit for the third quarter was RMB 63.13 billion, up 19% year-on-year, compared to an estimated RMB 55.88 billion.

As of press time, JD.com The stock rose nearly 2% in pre-market trading. The company's third-quarter revenue was RMB 299.1 billion, a year-on-year increase of 14.9%, exceeding expectations.

As of press time, Bilibili The stock rose nearly 3% in pre-market trading. The company's net revenue for the third quarter was RMB 7.69 billion, a year-on-year increase of 5%. Net profit was RMB 469 million, compared to a net loss of RMB 79.8 million in the same period last year.

[AI-Driven Demand Growth, Cisco] [Pre-market surge]

Based on artificial intelligence Driven by product demand, Cisco Systems now projects revenue of $60.2 billion to $61 billion for the current fiscal year, up from its previous range of $59 billion to $60 billion. The company has also raised its adjusted earnings per share forecast for the current fiscal year from $4-$4.06 to $4.08-$4.14. As of press time, Cisco shares were up over 7% in pre-market trading.

【 Microsoft [CEO claims he has the right to "draw inspiration" from OpenAI's self-developed chip design]

In a podcast episode released on Wednesday local time, Nadella explained that, according to the agreement between Microsoft and OpenAI, Microsoft has access to all the research and development information for the chips that OpenAI is working on with its partners. Therefore, Microsoft's current chip strategy is to first help OpenAI implement what they want to build, and then expand upon existing achievements.

European chemical giant Solvay signs rare earth supply agreement

Solvay, a European chemical giant and one of the few non-Chinese companies capable of complex rare earth separation, announced on Wednesday that it has reached two agreements to supply rare earths to US magnet manufacturers, while also working to expand its processing plant in France. Solvay reportedly reached agreements with Noveon Magnetics and Permag to supply rare earth oxides.

Other events/data to watch tonight

November 13

21:00 San Francisco Fed President Daly delivers a speech

November 14

01:15 St. Louis Federal Reserve President Musalaim delivers a speech

01:20 Cleveland Fed President Hammarck participates in an interview

02:00 Results of the US 30-Year Treasury Auction

(Article source: CLS)