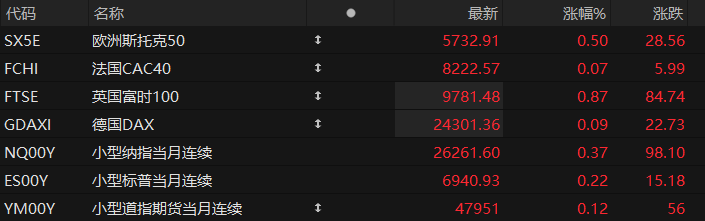

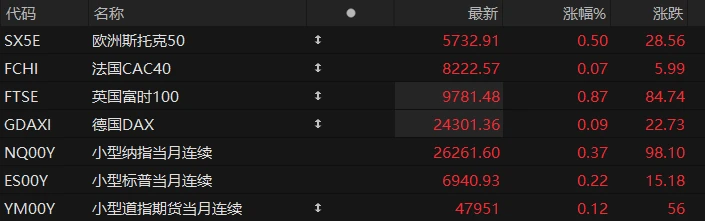

U.S. stock index futures rose across the board in pre-market trading on Wednesday, while major European indices also generally gained. As of press time, the Nasdaq... S&P 500 futures rose 0.37%, S&P 500 futures rose 0.22%, and Dow Jones futures rose 0.12%.

In terms of individual stocks, large-cap technology stocks generally strengthened in pre-market trading, with semiconductors leading the gains. Stocks generally rose, with Nvidia among the top gainers. Micron Technology rose approximately 3%. It rose by about 2%, and AMD rose by about 2%.

Popular Chinese concept stocks generally rose in pre-market trading, with Alibaba leading the gains. JD.com rose nearly 2% Baidu Pinduoduo Bilibili It rose by more than 1%.

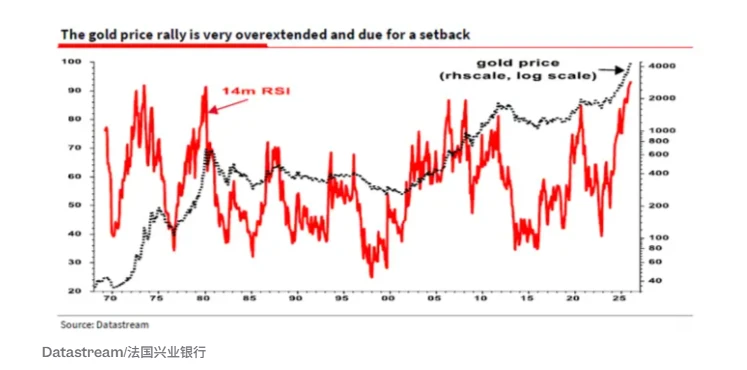

Spot gold rose to the $4,000/ounce mark, gaining over 1% on the day. Spot silver rose over 2% to $48.05/ounce. LME copper hit a record high, rising nearly 1% on the day, as operational problems at major mines exacerbated supply risks. Bitcoin fell over 1%, and Ethereum's price fell over 2.6%.

The Federal Reserve will announce its interest rate decision early Thursday morning Beijing time. Powell will hold a press conference 30 minutes after the announcement. No new economic projections or a dot plot will be released at this meeting.

The market has widely anticipated two things at this week's Federal Reserve policy meeting: policymakers will decide to cut interest rates by 25 basis points; Powell is unlikely to provide much forward guidance, as the widening divergence among policymakers is making the future policy path unclear.

Powell stated earlier this month that the Federal Open Market Committee (FOMC) will continue to focus on threats to the labor market. Weaker-than-expected U.S. September CPI data released last Friday may have temporarily dampened hawkish sentiment within the Federal Reserve.

Hot News

The US government shutdown has created a "data vacuum" in the market, impacting inflation-linked securities. Activate dust-sealed backup mechanism

In a market worth $7 trillion, traders are facing an unprecedented situation: they must price securities that are linked to U.S. inflation, but there is no consumer price (CPI) data available.

The US government shutdown that began earlier this month could extend this data gap, especially after the White House indicated that the US might not release October inflation data. This has prompted investors to resort to "backup mechanisms" embedded decades ago in legal documents for inflation-linked bonds and derivatives—untested mechanisms that are now seen as alternatives.

These contingency plans were originally designed for "tail risks" (low-probability, high-impact risks), and until recently, given the systemic importance of U.S. economic data, such risks were unimaginable.

The end of QT failed to avert liquidity alarms! JPMorgan: The Fed may need to restart a massive "2019-style" injection of funds.

JPMorgan Chase Strategists say the Federal Reserve may take additional measures to address pressures in the money markets, even after it ends its balance sheet reduction (i.e., quantitative tightening, QT) as early as this week, and that pressure could persist.

Several Wall Street banks, including JPMorgan Chase It is widely expected that the Federal Reserve will stop reducing its $6.6 trillion portfolio of U.S. Treasury securities and mortgage-backed securities (MBS) as early as this month.

However, JPMorgan strategists Jay Barry and Teresa Ho said that even so, market volatility will persist during the key payment period. In a report to clients on Tuesday, they wrote: “The impending end of QT will prevent further liquidity outflows from the system, but funding pressures are likely to continue. Therefore, we believe the Fed may take similar action as it did in September 2019.”

The world's largest sovereign wealth fund achieved a 5.8% return in Q3, with its total assets exceeding $2 trillion.

On Wednesday (October 29) local time, the world's largest sovereign wealth fund, the Norwegian Government Pension Fund Global, released its investment report for the third quarter of this year. Thanks to the strong stock market performance, the sovereign wealth fund achieved a return of 5.8% in Q3.

In terms of asset allocation, equities account for the vast majority of this sovereign wealth fund, reaching 71.2%; the remaining major asset classes are fixed income, unlisted real estate, and renewable energy infrastructure, accounting for 26.6%, 1.8%, and 0.4%, respectively. The Norwegian Government Pension Fund Global's Q3 return on equity investments was 7.7%, fixed income investments 1.4%, renewable energy infrastructure contributed 0.3%, and real estate yielded a return of 1.1%.

U.S. stocks comprise approximately 40% of its stock portfolio, with major holdings including Meta, Alphabet (Google's parent company), and Amazon. Nvidia and Microsoft Tech giants such as JPMorgan Chase and Walmart are also involved. Lilly Pharmaceuticals and Coca-Cola Major shareholders of companies such as [Company Name].

During the reporting period, the stock market experienced significant volatility, with US stocks seeing both sell-offs and record highs due to factors such as tariffs. Despite this, large-cap technology stocks generally performed strongly, with investors continuing to bet on artificial intelligence. The AI boom. However, recently, following the end of the reporting period, as market concerns about the risk of an AI bubble intensified, the stock prices of tech giants experienced significant fluctuations.

US Stocks Focus

Nvidia shares rise over 3% in pre-market trading, poised to become the first company in history to reach a market capitalization of $5 trillion.

On Wednesday, Nvidia, a leading artificial intelligence (AI) chipmaker, rose more than 3% in pre-market trading. If it maintains this momentum until the market opens, it will become the first company to surpass a market capitalization of $5 trillion, further solidifying its position as the world's most valuable company. Just a few months ago (in July), Nvidia became the first company to close with a market capitalization exceeding $4 trillion.

As of Tuesday's close, Nvidia's market capitalization stood at $4.89 trillion, with its stock price rising 4.98% to a new all-time high. Year-to-date, Nvidia's stock price has surged over 50%, more than doubling since its April lows.

Nvidia's stock price surge was recently fueled by a speech from CEO Jensen Huang, who announced a series of positive developments at Nvidia's GTC conference on Tuesday. Huang stated that the company has secured $500 billion worth of AI chip contracts. The company has received orders and plans to build seven supercomputers for the U.S. government, one of which will be equipped with 10,000 Blackwell GPUs.

Nvidia showcases its AI technology in the global robotics world . With its wide range of applications in the field, it will participate in companies including Amazon and Foxconn. Caterpillar Collaboration projects with numerous companies, including Belden.

Bloom Energy, a top-performing stock, surged another 20% in pre-market trading, with its performance taking off across the board amid the AI wave.

US fuel cell stocks opened in pre-market trading on Wednesday. Shares of manufacturer Bloom Energy surged nearly 20%, bringing its year-to-date gain to over 400%. This followed the company's announcement of third-quarter revenue and profit that both beat Wall Street expectations, and its statement that 2025 results would exceed previous guidance, reigniting bullish sentiment.

According to its financial report, Bloom Energy's revenue reached $519 million in the third quarter, far exceeding analysts' estimates of $428 million, representing a year-on-year increase of 57.1%. Adjusted earnings per share were $0.15, exceeding market expectations of $0.10.

In a statement, Bloom Energy CEO KR Sridhar said, "The company is at the center of a once-in-a-century opportunity to reshape the way electricity is produced and supplied. Strong tailwinds are converging, driven by artificial intelligence- driven surges in electricity demand, national energy strategy priorities, and our continuous technological innovation, propelling Bloom Energy to accelerate its ambitious goal: to become the industry standard for distributed power globally."

The company highlighted a key development this quarter as a $5 billion artificial intelligence infrastructure partnership with Brookfield Asset Management. Additionally, Bloom Energy's services division achieved double-digit profit margins for the second consecutive quarter.

Q3 profits rose instead of falling! Deutsche Bank's strong financial report proves the effectiveness of its transformation efforts as the project nears completion.

Deutsche Bank The bank reported a 7% year-over-year increase in third-quarter profit. This was contrary to market expectations of a profit decline, as significant revenue growth in its global investment banking division reversed those expectations.

Deutsche Bank , Germany's largest lender, reported total revenue of €8.04 billion and net profit attributable to shareholders of €1.56 billion (approximately US$1.82 billion) this quarter. This figure represents an increase from €1.46 billion in the same period last year and also exceeds analysts' expectations of approximately €1.34 billion.

Investment banking once again became Deutsche Bank 's largest source of revenue. Strong performance in bond trading and issuance drove the growth of investment banking this quarter.

UBS's Q3 profits surged 74% as investment banking and stock trading businesses attracted significant revenue.

Swiss financial giant UBS Group The newly announced third-quarter profit exceeded market expectations, mainly due to a significant increase in revenue from the firm's investment banking and equity trading businesses, as well as lower-than-expected legal costs that significantly boosted overall performance.

UBS's net profit surged 74% year-on-year to $2.5 billion in the three months ending in September, compared with analysts' consensus estimate of about $1.4 billion.

UBS's key wealth management business saw better-than-expected inflows of $38 billion in the third quarter, although pre-tax profits fell short of expectations. Underlying revenues for UBS's investment banking division surged 23%.

(Article source: Hafu Securities)