1. Japanese memory chips 1. A tech giant's financial report revealed a major disappointment, causing its stock to hit its daily limit down for the entire day, dragging down a collective pullback in AI star stocks; 2. Rumors circulated about a major reversal in the UK fiscal case, with the market anticipating a "Tesla moment"; 3. Applied Materials... 4. Merck $9.2 billion acquisition of Flu Drug developer.

As Japanese AI stocks suffered a dramatic drop , coupled with the impact of a triple whammy of stock, currency, and bond declines in the UK , the US stock market also experienced turmoil in pre-market trading on Friday, with technology stocks leading the losses. Doubts from Federal Reserve officials about the prospect of a December rate cut also weighed on market sentiment.

As of press time, Nasdaq S&P 500 futures (2512 contract) fell 1.51%, S&P 500 futures fell 1.01%, and Dow Jones futures fell 0.62%. Nvidia, a star tech stock... Tesla All stocks were down at least 3% in pre-market trading.

Spot gold and Bitcoin also saw a significant drop in pre-market trading, with some safe-haven funds flowing into US Treasury bonds.

(Minute chart of the yield on the 10-year U.S. Treasury note; note: a decrease in yield means an increase in bond prices)

Kioxia, one of the world's three largest NAND memory manufacturers, suffered the worst decline among today's star tech stocks after releasing its half-year report, with its market value evaporating by 23%.

(Kioxia daily chart, source: TradingView)

It's worth noting that Japanese stocks have daily price limits based on price ranges, so Kioxia was essentially locked at its daily limit down for the entire day. That said, Friday's closing price was still four times its early September level. Meanwhile, OpenAI shareholder SoftBank Group has fallen nearly 30% from its late October high . This has impacted SanDisk... Micron Technology Even the top-performing US storage stocks fell in pre-market trading on Friday.

Meanwhile, news that the UK was preparing to abandon its income tax hike sent a negative message through financial markets, dragging down European and even US stock markets. The UK's FTSE 100 index fell nearly 2% intraday, and if it doesn't recover by the close, it will record its biggest single-day drop since April.

(FTSE 100 Index daily chart, source: TradingView)

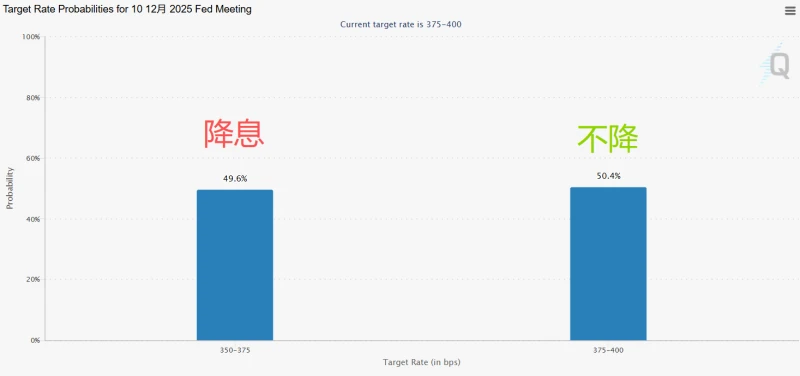

In the US stock market, following a series of Federal Reserve officials expressing doubts about the need for three consecutive rate cuts, the swap market pricing reflected in FedWatch has adjusted the probability of a rate cut on December 9-10 to 50/50 , whereas a month ago, the predicted probability of a December rate cut was 95%. Three Federal Reserve officials are also scheduled to speak on Friday, including Schmid, who has a voting right this year.

(Source: CME)

Aneeka Gupta, Head of Macro Research at Wisdom Tree (Europe), explained that technology stocks are hit hardest when the market experiences setbacks because their valuations are the most "bubble-like." Conversely, the longest-duration sectors are most severely impacted when the market worries about the Federal Reserve shifting to a more hawkish stance.

Other market news

Applied Materials shares fell more than 6% after the company released its earnings report.

US semiconductor Equipment giant Applied Materials shares fell more than 6% after releasing its earnings report. Although the report itself showed better-than-expected results, the company stated that tightened U.S. export controls on semiconductors had severely impacted its revenue from China, causing investors to increasingly worry about the company's performance prospects.

Google rejects European Commission's demand to break up its business.

Google announced on Friday that it will appeal the European Commission's antitrust ruling. The company rejected the Commission's demand to break up certain business units.

In September, the European Commission fined Google €2.95 billion ($3.4 billion). This decision stemmed from an investigation four years ago, which began with a complaint from the European Publishers Council. The European Commission formally accused Google in 2023 of favoring its own platform and excluding competitors in its advertising services. The Commission demanded that Google submit measures by November to address conflicts of interest in the ad technology supply chain and recommended that Google sell off parts of its business.

Merck acquires Cidara Therapeutics for $9.2 billion

Merck announced on Friday that it will acquire Cidara Therapeutics, a biotechnology company developing influenza drugs, with a cash offer of $221.50 per share. The offer is more than double Thursday's closing price, and the total value of the deal is approximately $9.2 billion. Following this news, Cidara Therapeutics shares surged over 100% in pre-market trading.

Other events/data to watch tonight

November 14

22:20 Atlanta Fed President Bostic delivers a speech

23:05 Kansas City Fed President Schmid delivers a speech

November 15

03:30 Dallas Fed President Logan participates in the dialogue.

04:20 Atlanta Fed President Bostic participates in another dialogue session.

(Article source: CLS)