① As of the week ending November 12, due to investor concerns about artificial intelligence... Concerns have been raised about the sustainability of the AI-driven market rally, leading to a significant cooling in demand for US equity funds; in addition to valuation concerns, thwarted expectations of interest rate cuts have further pressured market sentiment.

In the week ending November 12, demand for U.S. equity funds cooled significantly as investors worried about the sustainability of the artificial intelligence (AI)-driven market rally.

In addition to valuation concerns, the US government shutdown has delayed the release of several key economic data points, increasing uncertainty surrounding the Federal Reserve's December policy meeting and potentially making policymakers more cautious about interest rate cuts. This thwarted expectation of a rate cut has further pressured market sentiment.

Data shows that U.S. investors bought only $1.15 billion in equity funds in the week ending November 12, marking the lowest weekly net buying activity since the week ending October 15, when there was a net outflow of $557 million.

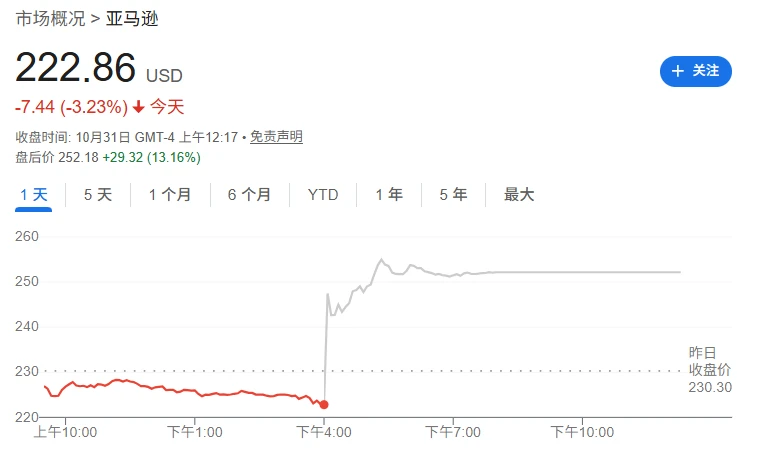

Another pullback in large-cap tech stocks dampened market sentiment, raising questions about whether high valuations are still justified. By Thursday's close, the Nasdaq was down nearly 5% from its record high reached on October 29.

Weekly inflows into U.S. large-cap funds fell to $2.35 billion from $11.91 billion the previous week; mid-cap and small-cap funds were under pressure, experiencing outflows of $1.36 billion and $889 million, respectively.

Technology sector funds received $1.74 billion, the least in three weeks; while healthcare sector funds received $777 million, the first net inflow in four weeks.

Meanwhile, global investors made only a net purchase of $4.11 billion in equity funds in the week ending November 12, far below the $22.27 billion of the previous week.

Regionally, Asian equity funds received $3.04 billion, marking the fifth consecutive week of net inflows; while European funds saw net outflows of $1.87 billion.

Mark Haefele, chief investment officer of UBS Global Wealth Management, said: "While stock valuations are high, the reality may not be as extreme as it seems."

Haefele points out that current valuations are significantly lower than during previous bubble periods. The forward P/E ratios for top tech companies over the next 12 months are currently around 30, while in 1999, the P/E ratios of tech giants exceeded 70.

(Article source: CLS)