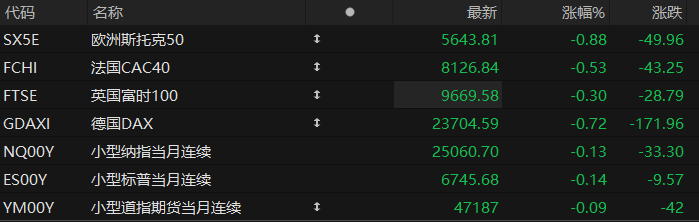

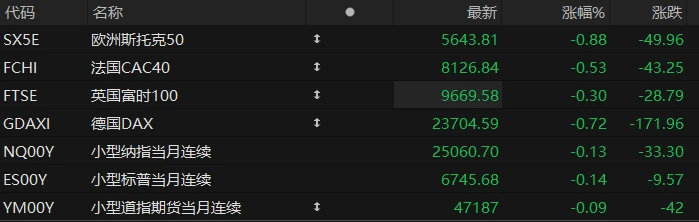

U.S. stock index futures fell across the board in pre-market trading on Monday, while major European indices also generally declined. As of press time, the Nasdaq... S&P 500 futures fell 0.13%, S&P 500 futures fell 0.14%, and Dow Jones futures fell 0.09%.

In terms of individual stocks, Google rose nearly 4% in pre-market trading. Berkshire Hathaway, owned by Warren Buffett, established a position in Google in the third quarter, making it the tenth largest holding in the company. Alibaba... The stock price rose by more than 2.5% as the company officially announced its "Qianwen" project, marking its full-scale entry into the AI to C market.

Nvidia Micron Technology fell 1% after documents disclosed over the weekend revealed that billionaire Peter Thiel had sold his entire stake in Nvidia ; Prices rose by more than 1%, after reports indicated that Samsung had raised the prices of some memory chips by 30%-60% compared to September.

The final full trading week of November will bring investors two key earnings reports and the resumption of the September jobs report, events that will set the tone for trading in the final weeks of the year.

Nvidia will release its earnings after the market closes on Wednesday, and Walmart... The company will release its earnings report on Thursday morning, and the results will provide an update on AI trading and the state of U.S. consumers, factors that have both excited and cautioned investors in recent weeks.

On Thursday, the U.S. government will release the September jobs report, originally scheduled for October 3, marking the first official update on the U.S. labor market since September. However, comments from White House officials late last week suggested that the market may not receive a complete report this month.

Hot News

Expectations for interest rate cuts have cooled significantly, with the 10-year US Treasury yield rising to 4.15%, as important delayed data is about to be released.

Following the end of the US government shutdown, US Treasury yields continued to rise due to increasingly hawkish rhetoric from the Federal Reserve. The 10-year Treasury yield moved further away from 4.0%, reaching 4.15% today. With official data releases delayed during the shutdown, the September non-farm payroll data, to be released on November 20th, may become a crucial indicator.

Influenced by factors such as the implementation of interest rate cuts and the US-China trade negotiations, US Treasury yields initially fell and then rose in early November. On October 20, the 10-year US Treasury yield hit a low of 3.95% for the year.

The fixed income research team at Xingzheng Securities believes that the expected interest rate cut in October has increased uncertainty regarding subsequent cuts, leading to greater market divergence in pricing in a December rate cut. Meanwhile, the lifting of the US government shutdown, which had been weighing on the US equity market, before the next Fed decision will likely result in a repricing of expectations for US Treasury bonds.

Recently, hawkish voices have increased within the Federal Reserve. Cleveland Fed President Hammark stated last week that the Fed should maintain stable interest rates to continue putting downward pressure on inflation. Minneapolis Fed President Kashkari, however, shifted from dovish to hawkish, stating that the fundamental resilience of economic activity is stronger than expected and that he does not support the Fed's previous rate-cutting decision, remaining cautious about the best course of action at the December meeting. Fed Chairman Powell stated at the end of October that a December rate cut is far from a certainty.

Is the US economy facing a second bubble? The surge in buy-now-pay-later schemes is causing concern.

Inflationary pressures are changing American consumers' spending habits. Data shows that more and more Americans are using buy-now-pay-later services, and the rate of late payments is also rising.

Nigel Morris, an early investor in buy-now-pay-later giant Klarna, warned that many people are using buy-now-pay-later services to buy basic things like groceries, which means people are already struggling.

Because most buy-now-pay-later loans are not reported to U.S. credit agencies, they may eventually become what regulators call phantom debt. Lenders struggle to monitor an individual's multiple buy-now-pay-later loans across various platforms, leaving the credit system in a state of flux, like the blind men and the elephant.

However, given the market size of the buy-now-pay-later market is in the hundreds of billions of dollars, its risks do not yet pose a systemic threat. But because the issue is developing rapidly, lacks transparency, and is largely concentrated on borrowers already in distress, buy-now-pay-later may have become the "canary in the coal mine" of the US economy, foreshadowing widespread risks.

Morris also emphasized that the current situation is far from crisis-level. Loan delinquency rates have not yet risen significantly, nor have bad debt rates, but a number of factors, including fictitious debt, rising unemployment, the end of student loan deferral policies, and regulatory deregulation, could cause the problem to worsen rapidly.

Elon Musk, the world's richest man, warned former richest man Bill Gates: He should liquidate his Tesla holdings as soon as possible. short positions

Elon Musk, the world's richest man, warned former billionaire Bill Gates over the weekend that he should act quickly if Gates has not yet fully closed his nearly eight-year short position in Tesla .

Gates' long-term shorting of Tesla stock is one of the key reasons for Musk's persistent dissatisfaction with him. Musk pointed out that Gates' shorting of Tesla... Shorting the company at a critical moment undermined the investment confidence of ordinary Tesla investors.

Musk's latest warning stemmed from a post on Sunday by a tech blogger. The account, Tesla Owners Silicon Valley, indicated that the Gates Foundation was selling its Microsoft holdings. Gates cashed out nearly $9 billion in shares, while also closing out his short positions in Tesla .

Musk's warning to Gates may be an expression of his long-standing dissatisfaction with Tesla short sellers, but it also reveals his firm belief in the future rise of Tesla's stock price.

Earlier this month, Tesla shareholders voted to approve Musk's trillion-dollar compensation package, granting him the right to acquire a large number of Tesla shares and further expanding his influence within Tesla, which has given him great confidence.

US Stocks Focus

Alibaba's 1,000 questions have stirred up a thousand waves in applications! The battle for AI entry points is in full swing, and the potential of the C-end ecosystem remains to be unleashed.

On November 17th, Alibaba announced the launch of the public beta version of its Qianwen app. Based on the open-source model Qwen3, it aims to compete fully with ChatGPT by offering a free service and integrating with various lifestyle scenarios. Currently, it is available on major app stores, with both web and PC versions available.

In addition, according to reports, an international version of the Qwen app, targeting the global market, is under development simultaneously. It will leverage the overseas influence of the Qwen model to directly compete with ChatGPT for overseas users.

It is reported that Alibaba's core management team regards the "Qianwen" project as "the battle for the future in the AI era," and has already secretly deployed hundreds of engineers to work on it. Two floors of office space in Alibaba 's Hangzhou headquarters have been designated as a dedicated area for the project. In the future, the company plans to integrate various aspects of daily life, such as maps, food delivery, ticketing, office work, learning, shopping, and health, into the Qianwen app, giving it even greater capabilities.

The launch of the Qwen app is seen as a key step for Alibaba in its foray into the AI-to-consumer (AI to C) market. From an AI strategy perspective, Alibaba's management pointed out that this move is an important step related to the 380 billion yuan AI infrastructure plan announced at the beginning of the year; and based on the Qwen big data model's experience in the domestic and international B2B AI market, now is the right time to enter the mass-market AI application market for consumers.

Nvidia is being sold off again! Following SoftBank, the "godfather of Silicon Valley venture capital" has also made a move.

Documents disclosed over the weekend show that billionaire Peter Thiel has sold his entire stake in Nvidia .

Thiel is the co-founder of fintech giant PayPal and defense AI company Palantir. He has also achieved remarkable success in the investment field, not only founding well-known investment funds such as Founders Fund, but also accurately betting on many star companies, such as investing in Facebook in its early stages and reaping huge returns. He is known as the "Godfather of Silicon Valley Venture Capital".

According to a 13F filing by Thiel's Thiel Macro Fund, Thiel sold approximately 537,742 Nvidia shares (representing nearly 40% of his portfolio) between July and September, and as of September 30, he no longer held any Nvidia shares.

According to relevant calculations, based on Nvidia's average stock price from July to September, the value of the shares sold is close to $100 million.

Earlier this year, Thiel warned that Nvidia was overvalued, drawing parallels between the surge in tech stock valuations and the bursting of the dot-com bubble in 1999-2000. He had previously warned that artificial intelligence... The hype surrounding it far outpaces its actual economic benefits.

Google's new flagship AI model is already generating hype before its market launch; Berkshire Hathaway's unrealized gains exceed 40%.

All signs indicate that Google, the only stock Berkshire Hathaway bought in the third quarter, will become the focus of the AI narrative this week.

As of press time, data from Polymarket, the world's largest prediction market, shows that nearly 90% of participants predict the highly anticipated Google Gemini 3.0 megamodel will be released this week. Even regarding the specific release date, nearly 79% of market participants are betting on November 18th.

For Google, a long-time participant in the AI race but rarely the center of attention, Gemini 3.0 has garnered significant attention for three reasons: 1) With the GPT-5 upgrade being criticized as "mediocre," the AI narrative urgently needs new developments that are immediately clear to the public ; 2) The number of Google Gemini users is rapidly approaching ChatGPT's position as the leading AI application; 3) On the eve of Buffett's retirement, Berkshire Hathaway added Google to its top ten holdings , attracting widespread attention in the capital markets.

As Google becomes the new darling of the AI narrative, its Class A shares rose more than 5% in overnight trading as of Monday's press time, with the latest price exceeding $292, and it is expected to hit a new all-time high again tonight. This also means that Berkshire Hathaway, which bought Google shares at an average price of $200 in the third quarter of this year, has gained more than 45% unrealized profit in just a few months.

(Article source: Hafu Securities) )