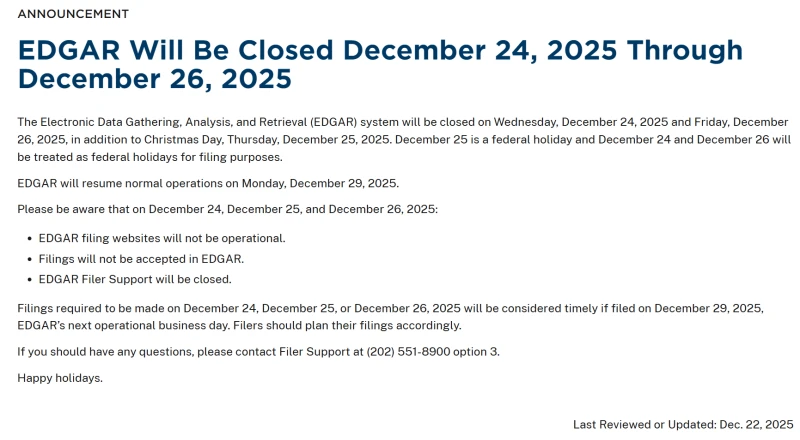

① Trump's impromptu five-day Christmas holiday unexpectedly created a special window for the US stock market—trading continued uninterrupted, but the SEC's core disclosure system, EDGAR, was suspended; ② US-listed companies will be unable to submit key documents such as 8-Ks, executive transactions, and changes in major shareholders from Wednesday to Friday this week.

Last week, US President Trump made a bold move, announcing that the two days before and after Christmas would be designated as federal employee holidays, thus creating a five-day "Christmas long weekend".

Trump's actions also caused a minor problem for the capital markets: the US stock market still had two trading days during the holiday, but the US Securities and Exchange Commission... The SEC’s official disclosure system will be closed during this period.

Specifically, while Trump's executive order allows agency heads to remain in certain positions for "public needs," the securities disclosure system is clearly not included in this category.

In its announcement on Monday, the SEC stated that the Electronic Data Collection, Analysis, and Retrieval (EDGAR) system would be closed on the 24th and 26th. Given that the 25th was already a holiday, the system would not resume normal operation until next Monday (December 29th). Therefore, during these three days (December 24th-26th), the EDGAR filing website would be unavailable, no filings would be accepted, and support services would be suspended.

(Source: U.S. SEC)

The SEC also announced that any document with a statutory filing deadline between the 24th and 26th will be considered on time if it is filed by the 29th.

During the SEC shutdown, major U.S. exchanges will continue trading according to their usual schedules. Specifically, the U.S. stock market will close three hours early on the 24th and will be closed for the entire day on the 25th. However, normal trading will resume on the 26th, when most overseas markets will remain closed for the holiday.

Given that the Christmas holidays are typically a slow season, the impact of the disclosure system's "holiday" on US stock traders is uncertain. After all, during the US Lunar New Year holiday, listed companies typically don't choose to disclose major events at this time.

With the EDGAR system shut down, investors will not see real-time 8-K (material event), Insider Form 4 (official buying and selling), and SC 13D/13G (major shareholder changes) forms for the next three days. However, listed companies can still release press releases on their official websites, and mainstream news media will continue to operate, so information affecting stock trading will still be circulating.

Conversely, if stocks exhibit unusual price movements in the next few days, the interval for verification through official announcements will also lengthen. Greater uncertainty lies ahead of Monday, when a large number of announcements will be released retroactively, potentially amplifying volatility in individual stocks.

(Article source: CLS)