Investors showed interest in artificial intelligence Amid growing concerns about a bubble, AI chips Nvidia, the leading company Nvidia delivered another better-than-expected earnings report. After the US stock market closed on Wednesday, November 19th (Eastern Time), Nvidia released its financial data for the third fiscal quarter of 2026 (hereinafter referred to as "Q3"). The report showed that Nvidia's Q3 revenue was $57 billion, a year-on-year increase of 62%; net profit was $31.9 billion, a significant year-on-year increase of 65%; and adjusted earnings per share were $1.30, higher than the market expectation of $1.25.

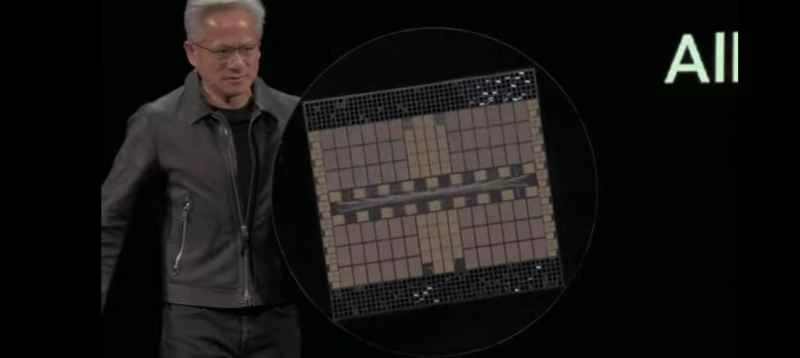

Data Center Data center revenue is Nvidia's most important business segment. Financial reports show that Nvidia's data center revenue reached $51.2 billion in the third quarter, a year-on-year increase of 66%. Nvidia CEO Jensen Huang stated in a press release, "Blackwell sales far exceeded expectations, and cloud GPUs are sold out."

This highly anticipated earnings report may alleviate growing market concerns about an artificial intelligence bubble. "I don't see an AI bubble," said Jensen Huang. Following the data release, Nvidia, which closed up nearly 3%, saw its gains rapidly expand in after-hours trading, exceeding 6% at one point at the time of writing.

Nvidia's performance exceeded expectations.

After-hours gains once exceeded 6%.

After the US stock market closed on Wednesday, November 19th (Eastern Time), Nvidia released its third-quarter financial results, once again exceeding expectations. The report showed that Nvidia's third-quarter revenue was $57 billion, a year-on-year increase of 62%, exceeding market expectations of $55.19 billion; net profit was $31.9 billion, a year-on-year increase of 65%; adjusted earnings per share were $1.30, higher than the market expectation of $1.25.

Data center business is Nvidia's most important business segment. Financial reports show that Nvidia's data center revenue reached $51.2 billion in the third quarter, a year-on-year increase of 66%. Of this, the "Computing Business" (i.e., GPUs) contributed $43 billion in revenue; the Networking Business (i.e., components that allow multiple GPUs to work together) contributed $8.2 billion.

In a statement, Nvidia CFO Colette Kress said the company's best-selling chip line is Blackwell Ultra, the second generation of the Blackwell chip. Jensen Huang added in the statement, "Cloud GPUs are also sold out."

game Business revenue reached $4.3 billion, a 30% year-over-year increase; professional visualization revenue reached $760 million, a 56% year-over-year increase; automotive and robotics revenue ... Business revenue reached $592 million, a year-on-year increase of 32%.

This quarter, Nvidia's GAAP and non-GAAP gross margins were 73.4% and 73.6%, respectively. GAAP and non-GAAP diluted earnings per share were both $1.30.

In terms of earnings guidance, Nvidia expects fourth-quarter revenue to reach $65 billion, plus or minus 2%; the adjusted gross margin on a non-GAAP basis for the fourth quarter is expected to be 75.0%, plus or minus 50 basis points.

Nvidia's third-quarter results exceeded analysts' expectations, and its guidance for the fourth quarter also exceeded expectations. Following the data release, Nvidia's stock price rose nearly 3%, and its after-hours gains quickly expanded, exceeding 6% at one point.

The three major U.S. stock indexes all closed higher.

Google's stock price surged nearly 7% at one point during trading.

On November 19th local time, all three major U.S. stock indexes closed higher. At the close, the Dow Jones Industrial Average rose 0.10% to 46,138.77 points; the Nasdaq Composite Index rose 4.5%. The index rose 0.59% to 22,564.23 points; the S&P 500 rose 0.38% to 6,642.16 points.

The U.S. Bureau of Labor Statistics (BLS) said Wednesday it will not release a separate October non-farm payrolls report, but will instead include the relevant employment data in the November report. The November non-farm payrolls report will be released on December 16, after the Federal Reserve's December interest rate meeting. The September non-farm payrolls report will be released this Thursday. The BLS has not yet announced when or whether it will release the October Consumer Price Index (CPI).

Most major tech stocks rose, with Nvidia up 2.85% and Microsoft... Apple fell 1.35%. Google rose 0.42%, Amazon rose 3%. Up 0.06%, Meta down 1.23%, Tesla Broadcom rose 0.70%. Oracle rose 4.09%. Up 2.29%.

Google shares surged as much as 6.9% intraday, hitting a record high, before closing up 3%. This followed the launch of Gemini 3, described as "the company's smartest model to date," on November 18th. The phone received widespread acclaim for its performance, boosting investor confidence in the company's competitiveness in the AI field.

Most popular Chinese concept stocks fell, with the Nasdaq China Golden Dragon Index down 1.54%, and Alibaba... JD.com down 0.52% Pinduoduo fell 1.95%. NIO fell 1.30%. Automotive stocks fell 3.85%, including XPeng Motors. Li Auto fell 6.41%. Bilibili fell 3.27%. Baidu fell 3.43%. NetEase fell 1.43%. Tencent Music fell 4.15%. Up 0.16%, Pony.ai It fell by 4.17%.

Serious disagreements emerged in the Federal Reserve meeting minutes.

On Wednesday (November 19), Eastern Time, the Federal Reserve released the minutes of its October 28-29 Federal Open Market Committee (FOMC) monetary policy meeting. The minutes showed that participants were significantly divided on whether to continue cutting interest rates in December.

At its October policy meeting, the Federal Reserve voted 10-2 to cut interest rates by 25 basis points. Fed Chairman Jerome Powell stated at the monetary policy press conference that a December rate cut was not a certainty.

The minutes stated, "Several participants believed that if the economy performs broadly as they expect between the next two meetings, a further reduction in the target range for the federal funds rate in December might be appropriate. However, many participants indicated that, based on their economic outlook, maintaining the target range unchanged for the remainder of the year would be more appropriate." In the Fed's wording, "many" is a stronger term than "several," suggesting a weaker inclination towards a December rate cut. The minutes also noted that "most participants" believed further rate cuts were likely, but not necessarily in December.

Federal Reserve officials are concerned about the current slowdown in the U.S. labor market and the fact that inflation "shows little sign of a sustainable return to the 2 percent target." "Against this backdrop, many participants supported lowering the target range for the federal funds rate at this meeting, some supported this decision but were equally comfortable with keeping rates unchanged, and several opposed a rate cut," the minutes stated.

(Source: Shanghai Securities) (Report)