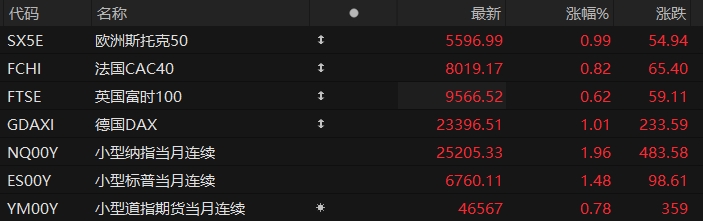

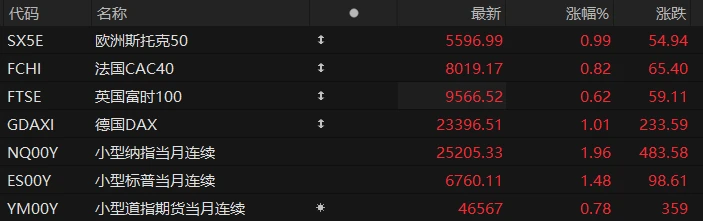

U.S. stock index futures rose across the board in pre-market trading on Thursday, while major European indices also generally gained. As of press time, the Nasdaq... S&P 500 futures rose 1.96%, S&P 500 futures rose 1.48%, and Dow Jones futures rose 0.78%.

In terms of individual stocks, most star tech stocks rose in pre-market trading, with Nvidia among them. Oracle rose about 5%, AMD rose more than 4%, and Oracle rose by about 5%. Broadcom TSMC rose about 3%. Micron Technology Google, Tesla Intel rose more than 2%. , Microsoft Amazon Qualcomm It rose by more than 1%.

The U.S. Bureau of Labor Statistics released September's non-farm payroll data, ending the period of inactivity in official employment data caused by the government shutdown. The report showed that the U.S. unemployment rate was 4.4% in September, compared to a forecast of 4.3% and a previous reading of 4.3%. U.S. non-farm payrolls increased by 119,000 in September, exceeding expectations of 51,000 and a previous reading of 22,000. The dollar index fell back to around 100.15, after reaching a high of 100.36. The 10-year U.S. Treasury yield was essentially unchanged at 4.13%. Spot gold fell nearly 0.4% to $4,060 per ounce, while Brent crude rose more than 0.7% to $63.95 per barrel.

Hot News

The Fed's October meeting minutes revealed escalating internal divisions and increased uncertainty due to missing data, leading to a rapid cooling of expectations for a December rate cut.

The latest minutes of the Federal Reserve's October FOMC meeting revealed an unusually deep division among policymakers on whether to continue cutting interest rates. The discussion focused on a range of issues, from inflation risks to a cooling labor market and the discrepancy between economic growth and financial conditions, presenting a situation of multiple uncertainties.

Although the Federal Reserve ultimately voted 10-2 to cut interest rates by 25 basis points, lowering the federal funds rate range to 3.75% to 4%, the minutes indicated that the decision was a hard-won consensus reached amidst heated debate, and the prospect of another rate cut in December is becoming increasingly uncertain. The most noteworthy aspect of the minutes was the clear division within the Fed regarding the policy path in December.

Muddy Waters CEO: Now is not a good time to short large-cap tech stocks machine

Nvidia's third-quarter results far exceeded expectations, silencing the ever-watchful short sellers.

Carson Block, CEO of renowned short-selling firm Muddy Waters Research, stated that despite market concerns about artificial intelligence... Warnings of a potential bubble are mounting, but now is not the right time to short America's largest tech companies. In a Bloomberg TV interview on Thursday, he explicitly warned investors that shorting large tech stocks like Nvidia carries significant risks.

Block admitted that in the current market environment, he "would rather go long than short." This investor, known for his aggressive short-selling strategy, pointed out that any investor who tries to short Nvidia or other large-cap tech stocks "won't stay in this industry for long."

US stocks have recently been volatile due to investor concerns about an overheated rally in tech stocks. Goldman Sachs... Group and JPMorgan Chase Executives at Nvidia have indicated that the market may face further declines. Nevertheless, Nvidia's strong revenue forecast released on Wednesday and its rebuttal of bubble theories somewhat eased market concerns, with Nvidia shares rising more than 6% in after-hours trading, and Nasdaq 100 futures, representing technology stocks, rising 1.5% on Thursday.

Leveraged gamblers are trapped, institutional funds are withdrawing, and the cryptocurrency market is experiencing its most severe correction since 2017.

On Wednesday, Bitcoin prices plunged 4%, briefly falling below the $90,000 mark, hitting a low of $88,522 during the session. Meanwhile, Ethereum (ETH) fared even worse, plummeting 6.5% and breaching the $3,000 level.

This crash, occurring against the backdrop of a rising Nasdaq index, completely shattered the narrative of crypto assets as "safe-haven assets." Even more worrying is the fact that a crisis, driven by leveraged funds, is brewing deep within the market: on one hand, institutional funds are resolutely exiting the market, while on the other hand, retail investors are frantically "buying the dip" and gambling recklessly.

Vetle Lunde, head of research at K33, warned that this unusual combination of "high leverage without rebound" systematically increases the risk of a future "run." These trapped long traders not only face asset devaluation but also have to pay persistently high funding rates, making them the most vulnerable link in the market.

US Stocks Focus

Nvidia's performance breaks records! AI computing power demand continues to surge, data centers Revenue surged 66%

Nvidia's Q3 FY2025 earnings report showed that revenue, profit, and outlook for the next quarter all significantly exceeded market expectations, greatly alleviating investors' concerns about an AI bubble.

Data shows that Nvidia's Q3 revenue increased by 62% year-on-year to $57 billion, better than the market expectation of $55.2 billion; adjusted earnings per share were $1.30, better than the market expectation of $1.26. Data center revenue surpassed the $50 billion mark for the first time, surging 66% year-on-year to $51.2 billion, better than the market expectation of $49.1 billion.

The company also projects fourth-quarter revenue to grow further to $65 billion, significantly exceeding market expectations of $61.66 billion, continuing to demonstrate strong demand for AI computing power. As of press time, Nvidia's stock was up nearly 5% in pre-market trading on Thursday.

Walmart Q3 revenue increased by 5.8% year-on-year, with e-commerce sales growing by 27% being a highlight.

Walmart raised its full-year sales and profit forecasts after reporting sales growth in the third fiscal quarter. This performance was driven by double-digit e-commerce growth and an influx of new customers across income levels. The retail giant's optimism contrasts sharply with the cautious approach of competitors such as Target and Home Depot.

Walmart 's financial report shows that it expects full-year net sales to grow by 4.8% to 5.1%, higher than the previous forecast of 3.75% to 4.75%. Adjusted earnings per share are expected to be $2.58 to $2.63, slightly higher than the previous range of $2.52 to $2.62. This is the second consecutive quarter that Walmart has raised its full-year forecast.

Chief Financial Officer John David Rainey stated that consumer habits remained unchanged this quarter, with shoppers still making selective purchases and seeking deals. He indicated that regardless of the economic climate or the company's own strategic adjustments, Walmart is attracting "value-seeking" customers across income levels.

Walmart also announced that it will change the listing venue of its common stock from the New York Stock Exchange on December 9. The exchange has moved to Nasdaq, but the stock ticker remains "WMT". As of Wednesday's close, Walmart shares are up about 11% year-to-date, slightly underperforming the S&P 500's nearly 13% gain.

NetEase Q3 revenue increased by 8.2% year-on-year, and net profit increased by more than 30% year-on-year, with games... Business growth of 11.8%

On November 20th, NetEase released its Q3 financial report, showcasing the stability expected of a mature gaming company, but also seemingly revealing a reliance on a single business. Games and value-added services contributed 23.3 billion yuan in revenue, accounting for 82% of total revenue, while non-gaming businesses such as Youdao and NetEase Cloud Music significantly dragged down the overall performance.

Ding Lei, CEO and Director of NetEase, stated that over the years, NetEase has continuously honed its innovation capabilities and proven this through delivering exceptional gaming experiences with each game. This advantage has laid a solid foundation for NetEase in China, enabling it to bring unique and high-quality games to players worldwide.

The financial report also shows that gross profit was RMB 18.2 billion, a year-on-year increase of 10.3%, faster than the revenue growth rate of 8.2%, and the gross profit margin increased from 62.8% in the same period last year to 64.1%. Non-GAAP net profit was RMB 9.5 billion, with a net profit margin of approximately 33%. Operating expenses were RMB 10.2 billion, a year-on-year increase of 8.9%, slightly higher than the revenue growth rate, but generally under control.

(Article source: Hafu Securities )