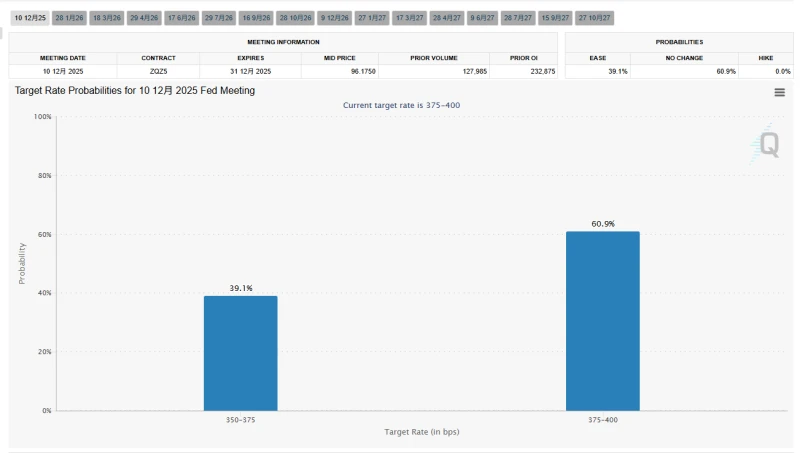

The latest data released by the U.S. Bureau of Labor Statistics shows that U.S. nonfarm payrolls unexpectedly surged by 119,000 in September, significantly exceeding market expectations of 50,000. This, to some extent, increases the likelihood that the Federal Reserve will not cut interest rates next month.

But Kevin Hassett, one of President Trump’s top economic aides and director of the National Economic Council, said on Thursday that now would be a “very bad time” for the Federal Reserve to pause interest rate cuts, given that the government shutdown has impacted economic growth in the fourth quarter.

Hassett stated that he expects the government shutdown to reduce fourth-quarter GDP by 1.5 percentage points. At the same time, he noted that the September Consumer Price Index (CPI) showed inflation was better than expected.

“I don’t think (pausing rate cuts) is a prudent approach; I think the headwinds for the fourth quarter are indeed very strong,” he said in a recent interview. He also noted that the strength of the September jobs report was insufficient to offset other factors.

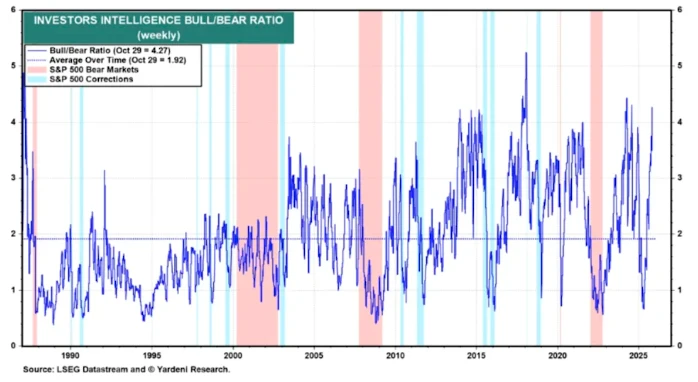

However, the views of most Federal Reserve officials appear to contradict those of the Trump administration, and market expectations for a December rate cut are increasingly lower. Cleveland Fed President Beth Hammark warned on Thursday that further rate cuts at this time could pose broad risks to the economy.

"Given that inflation continues to rise above the Fed's 2% target, lowering interest rates to support the labor market could extend Qualcomm's mandate." "It's an inflationary cycle, and it may also stimulate risk appetite in financial markets," she said.

That same day, Hassett further explained that airline executives complained to him about how much the government shutdown disrupted travel, leading many Americans to choose not to travel for Thanksgiving.

“ So I really don’t think we fully grasp the extent of the damage the government shutdown will do to fourth-quarter GDP. We are very optimistic about the future, but I think now is a very bad time for the Fed to pause its actions, ” he added.

Before the rebound in job growth in September, August's job gains were revised from an increase of 22,000 to a decrease of 4,000. Overall, the trend in recent months has been volatile: negative job growth in June, an increase in July, a decline again in August, and a rebound in September.

Hassett pointed out that although most of the job growth came from healthcare and education While the construction industry is declining, jobs are also increasing as new factories start up, incentivized by government tax laws, and as the demand for workers grows.

“In fact, we are starting to see people breaking ground on all those new factories, and we expect these factories to be completed in the next year or two, which is a very positive sign for the future outlook,” he said.

Finally, despite a significant increase in employment, the unemployment rate rose by 0.1 percentage point, from 4.3% to 4.4%—a level it had been slowly approaching for the past few months. Hassett attributed the rise in unemployment to an increase in the labor force participation rate, prompting more workers to emerge from a wait-and-see mode and begin looking for work.

Dongcai Illustrated Guide: Some Useful Tips

(Article source: CLS)