Investors' belief that US stocks will only rise and never fall seems unshakeable. However, this situation has begun to worry one of Wall Street's most optimistic analysts: this extreme bullish sentiment may be flashing warning signs...

“There are too many bulls,” warned Ed Yardeni, a senior Wall Street strategist and founder of Yardeni Research, recently. Yardeni predicts that the S&P 500 could fall 5% from its peak by the end of December as market sentiment and technical indicators show signs of fatigue.

By October, US stocks had experienced a six-month-long frenzied rally, ignoring almost all warning signs—the S&P 500 had surged 37% since early April, a level of bullish momentum seen only five times since 1950. However, as investors again largely disregarded Federal Reserve Chairman Powell's cautious comments about the possibility of another rate cut in December, Yardeni began to question his earlier optimistic predictions for the year-end market.

“The key question is whether this rally has gone too far and whether it can continue into the last few months of the year,” Yardeni said in an interview. “A single unexpected event could pull stocks down from their highs if there isn’t enough market breadth. Of course, that could be difficult because traders are usually optimistic during the holidays.”

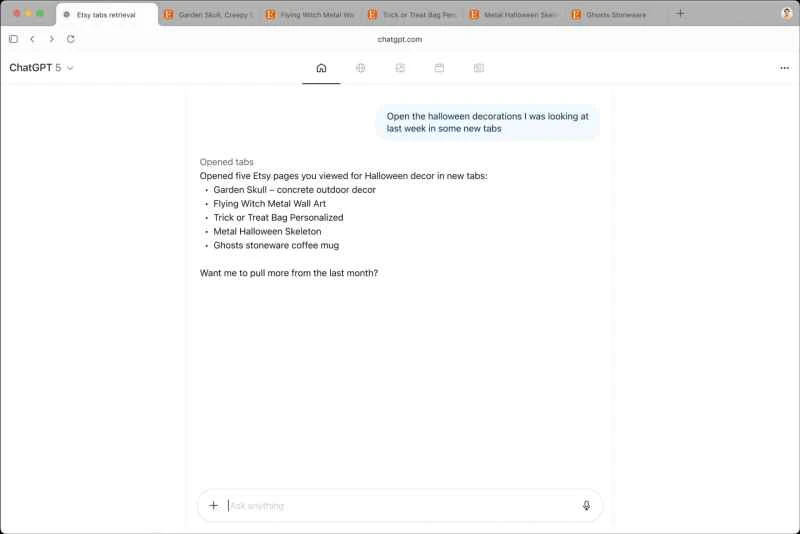

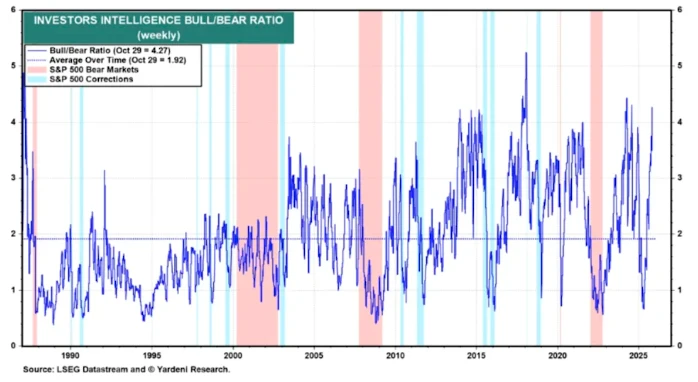

According to one metric, investor bullish sentiment toward U.S. stocks has reached its highest level in a year. Analysis by Yardeni Research shows that in a survey conducted by Investors Intelligence for the week ending October 29, the ratio of long to short positions jumped to 4.27—exceeding the 4.00 threshold, which historically indicates that market sentiment is becoming overly enthusiastic.

The weekly survey of retail investors conducted by the American Association of Individual Investors (AAII) also revealed another sign of rising optimism: bullish sentiment has exceeded the historical average of 37.5% for the fifth time in the past seven weeks.

Why are Yardeni's concerns attracting attention?

Yardeni's latest cautious stance on the outlook for U.S. stocks is particularly noteworthy, as he has been one of Wall Street's most steadfast bulls since the market bottomed out in April.

He had previously predicted that the S&P 500 would reach 7,000 points by the end of 2025—about 2.3% higher than last Friday's closing price, close to the highest prediction among more than 20 strategists in the industry.

From a technical perspective, after the S&P 500's market capitalization rebounded by approximately $17 trillion from its April lows, key market technical indicators are approaching historical extremes. Yardeni stated that the S&P 500 is currently trading 13% above its 200-day moving average, and such a large price difference typically indicates that the rally may have been excessive.

Currently, Nasdaq The S&P 100 is also trading 17% above its 200-day moving average—nearly the largest gap since July 2024, when yen carry trades triggered a stock market sell-off that shook global markets.

Of course, not all bulls are as hesitant as Yardeni in the face of unprecedented market optimism. Tom Lee, another well-known Wall Street bull and head of research at Fundstrat Global Advisors, pointed out that historically, market sentiment can remain in a bubble state for weeks or even months before a sharp decline occurs. Given that November is historically a strong month for stock market bulls, he is currently buying on dips.

In a report to clients last Friday, Lee stated, "While the strong gains in October may trigger a foreseeable correction, we expect the upward trend to continue in November. The current rally remains a 'most unwelcome rebound'."

The S&P 500 has climbed 16% so far in 2025. Historical data shows that when the index has risen at least 10% in the first ten months of the year, the stock market tends to perform well for the remainder of the year.

Data compiled by Jay Kaeppel, senior research analyst at SentimentTrader, shows that against this backdrop, the S&P 500's median gain in November and December was 4.2%, with the worst period occurring between November and December 1938, when the S&P 500 fell by 3.8%.

(Article source: CLS)