On Monday, as Alphabet's market capitalization approached $4 trillion, poised to become the fourth company to join this giant club, the Google parent company is undoubtedly riding the wave of artificial intelligence. The upward trend driven by this momentum has been advancing rapidly.

Many industry insiders believe that when this AI giant, boasting the highest degree of vertical integration in the industry, is crowned, the entire Silicon Valley may tremble, because the emergence of "Google Chain" could completely reshape the existing AI supply chain landscape...

Recently, investors have reacted positively to Google's latest AI building model, Gemini 3, the upcoming seventh-generation Tensor Processing Unit (TPU), progress on the AI image generation platform Nano Banana Pro, and the new intelligent agent platform called "Google Antigravity".

Melius analyst Ben Reitzes points out that Google's parent company has made a "strong comeback in the field of artificial intelligence ," with its latest upgraded Gemini AI model and self-developed TPU causing some investors to "deeply fear that Alphabet will win the AI war ahead of schedule."

Reitzes stated that if Alphabet ultimately wins, it will "actually damage" "multiple AI stocks" he is currently watching, therefore he warned investors to "be prepared for volatility."

Reitzes points out that Alphabet poses a threat to many AI companies because it is "the most vertically integrated AI hyperscaler," specifically mentioning the company's TPUs and custom network architecture. He adds, "Only the Alphabet team truly has the capability to internalize more chip designs and drive the application of custom-designed optical circuit switches."

Google: A true AI giant capable of taking on 10 opponents at once?

Reitzes stated that success in the chip sector will reduce Alphabet's long-term reliance on Nvidia. Advanced Micro Semiconductors He also mentioned the potential for collaboration with Arista Networks products. He further argued that Google is gaining more AI workloads through its latest Gemini model, which will harm Microsoft. Amazon and oracle bone script The interests of.

Other Wall Street institutions are also concerned that if Google defeats OpenAI, it could jeopardize the latter's ability to deliver on its financial commitments in the field of artificial intelligence.

Prior to this, OpenAI had spearheaded a series of interconnected, cyclical financing partnerships in the US AI sector. To support the industry's ambitious trillion-dollar AI computing power development plan, US tech companies have been betting heavily on the future through debt and other means, but this has also raised concerns about the risk of a bubble behind high valuations.

While Reitzes acknowledged that it is "too early" to judge whether Alphabet can become a long-term AI winner, he emphasized in a research report on Monday that " semiconductors and other hyperscale AI companies—especially Oracle —must be keenly aware of the threat posed by the 'Alphabet problem,' and we need more transparency in our deals with OpenAI and other customers to build confidence."

Reitzes points out that the Gemini craze has led some investors to worry that "OpenAI could become the modern-day AOL" —in the early days of the internet, dial-up was the mainstream. AOL initially rose to prominence by mailing free CDs to users, providing a "one-stop" online service. However, with the widespread adoption of broadband and the rise of the true World Wide Web, AOL's closed "walled garden" model quickly became obsolete.

Once a behemoth like Google, possessing full-stack capabilities—from chips to networks to models to cloud platforms—successfully navigates, OpenAI's first-mover advantage may quickly disappear. Just as users no longer need AOL as a "portal" to access the internet, in the future, developers may no longer need to access the most advanced AI capabilities through OpenAI's APIs; they can directly use complete solutions provided by giants like Google, which offer better performance and lower costs.

In addition, Reitzes mentioned that the surge in Gemini users could even force Meta to ultimately concede, causing Mark Zuckerberg to abandon his massive investments in the open model. The social media giant's capital expenditures could reach $113 billion by 2026, a 60% increase from this year.

Which Google Chain companies are benefiting?

While Google's rise may impact a series of OpenAI's "circle of friends," "Google Blockchain" is undoubtedly becoming the hottest "hot topic" in the US stock market recently...

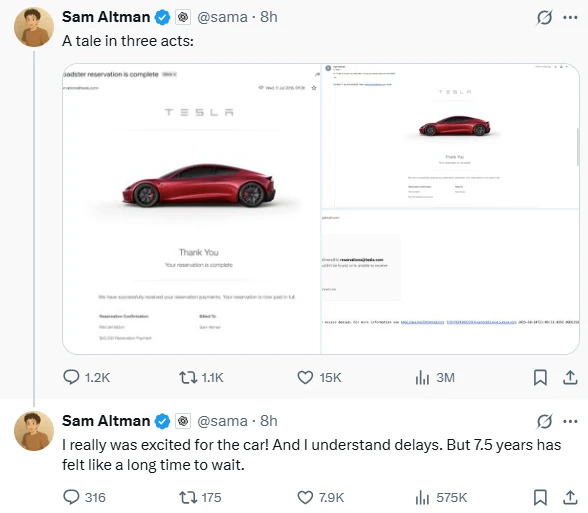

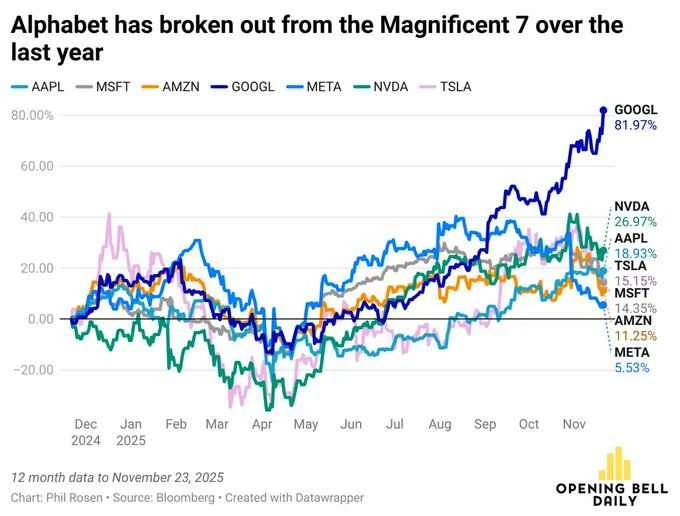

Since the beginning of November, Alphabet's stock price has been the best performer among the "Big Seven," with its year-to-date gains expanding to nearly 69%, potentially making it the top-performing stock among the "Big Seven" for the first time in its history...

Meanwhile, on Monday, Broadcom, a key chip partner of Google, The stock price also surged. By the close of trading, Broadcom's stock price had jumped 11.1% in a single day, marking its best single-day performance since April 9.

TPUs are application-specific integrated circuits (ASICs) designed by Google to accelerate machine learning and deep learning tasks. Broadcom has long been closely linked to Alphabet through its ASIC business, assisting in the design and manufacture of TPUs, which are now considered a strong competitor to Nvidia's graphics processing units in the AI workload field.

According to Dan Ives of Wedbush Securities, the market is "rediscovering" a huge market for ASIC chips. Google is largely leading this trend, and its TPU is one of the most mature ASIC chips on the market.

Jefferies analyst Blayne Curtis listed Broadcom as a top pick earlier this month, saying the ASIC market is reaching a "turning point" as Google's demand for custom chips continues to grow.

Goldman Sachs The trading desk pointed out that the combination of Google and Broadcom is showing a strong trend of replacing the "OpenAI chain" represented by Microsoft , Oracle and others, and investors are re-betting on Google's powerful cloud infrastructure and its self-developed chip ecosystem.

Besides Broadcom, Google's partners in the TPU supply chain also include Amphenol, a leading cable supplier. Network optical component supplier Lumentum, etc.

Furthermore, the number of downstream software application companies that benefit from Google's Gemini model is undoubtedly much greater.

Reitzes points out that Google's newly released Gemini 3 outperforms OpenAI's ChatGPT 5.1 and Anthropic's Claude Sonnet 4.5 in tasks such as academic inference, which is making him reconsider his previous sell rating on Adobe .

Google previously formed a strategic partnership with Adobe to promote the development of creative artificial intelligence.

At the same time, cloud computing It has deep cloud and AI technology collaborations with CRM giant Salesforce and Google; and is a global leader in cybersecurity . Palo Alto Networks is a global security partner of Google Cloud; MongoDB , a developer data platform, is a key ISV partner of Google Cloud; Accenture Large consulting firms such as Deloitte also have long-term partnerships with Google Cloud to help enterprise clients implement and apply Google's AI solutions...

Even Berkshire Hathaway, which disclosed for the first time its holdings of Google in the third quarter, has once again proven the keen insight of Warren Buffett or his successor. ( Interactive Brokers) Chief Market Analyst Steve Sosnick stated that Berkshire Hathaway's holdings have recently been a key factor attracting investors. "While there are still questions about whether Warren Buffett was involved in this purchase... the market still sees anything Berkshire does as worthy of emulation, and to be fair, this approach has worked for a long time."

Of course, many industry insiders say that although Alphabet is currently making strides across the entire AI industry chain, the competition in the field of artificial intelligence "will still take time to unfold, and ultimately, artificial intelligence may not be a zero-sum game." "...

(Article source: CLS)