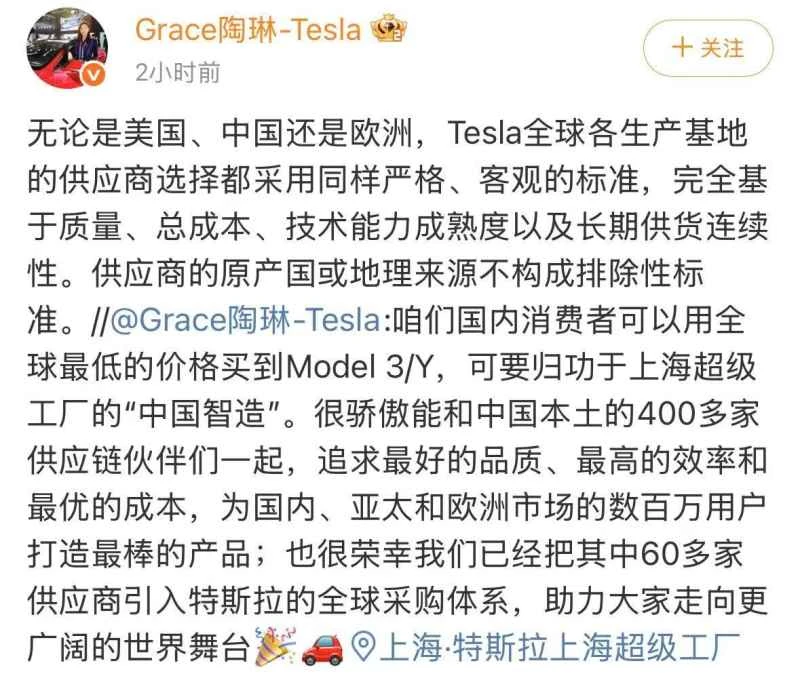

On November 26, Tesla Tesla's Global Vice President, Tao Lin, stated on social media that the selection of suppliers for all Tesla production bases worldwide, whether in the US, China, or Europe, adheres to the same rigorous and objective standards, based entirely on quality, total cost, technological maturity, and long-term supply continuity. Tao Lin emphasized that the supplier's country of origin or geographical location does not constitute an exclusionary criterion.

Image source: Sina Weibo (@Grace陶琳-Tesla)

In her response, Tao Lin emphasized that Tesla 's supply chain strategy, whether targeting the US, China, or European markets, always revolves around quality, total cost, technological maturity, and long-term supply continuity. She revealed that thanks to deep supply chain integration, the localization rate of parts for Model 3 and Model Y produced at Tesla's Shanghai Gigafactory has exceeded 95%, directly contributing to a competitive pricing system for these models in the Chinese market.

According to Tao Lin's previous post, Tesla Vehicles produced at the Shanghai Gigafactory have been exported to many countries and regions in Europe and the Asia-Pacific region.

Earlier reports suggested that Tesla planned to replace all Chinese parts in its US-made cars within the next year or two, sparking speculation about a "regional differentiation" in its supply chain strategy. In response, a Tesla China employee told the *Daily Economic News* that Tao Lin's statement today directly denied these rumors.

Tesla's official financial report shows that in the third quarter of this year, Tesla's revenue was $28.1 billion, a year-on-year increase of 12%, but net profit fell by 29% to $1.77 billion (non-GAAP). By business segment, in the third quarter of this year, Tesla's core automotive business revenue grew by 6% to $21.2 billion, compared to $20 billion in the same period last year.

In terms of delivery data, Tesla's global production in the third quarter of this year was 447,400 vehicles, a year-on-year decrease of 4.8%; global deliveries of new vehicles reached 497,000 vehicles, a year-on-year increase of 7.4%, exceeding market expectations of 439,600 vehicles. However, due to a significant decline in deliveries in the first half of the year, despite the strong performance in the third quarter, its total global deliveries for the first three quarters of 2025 are still expected to decrease by approximately 5.9% compared to the same period in 2024.

Focusing on the Chinese market, data from the China Passenger Car Association shows that in the first half of 2025, Tesla's total sales in China reached 263,400 vehicles, a decrease of approximately 5.4% compared to the same period last year (278,300 vehicles). Entering the third quarter of this year, its performance in the Chinese market changed, with sales reaching 169,200 vehicles, a 31% increase quarter-on-quarter. The Shanghai Gigafactory alone delivered over 90,000 new vehicles in September.

(Source: Daily Economic News)