On Thursday local time, the Chicago Mercantile Exchange (CME) experienced a system malfunction, bringing global foreign exchange, commodity, and stock futures trading to a standstill, leaving investors and brokers helpless. This marks the CME's first major outage in 11 years, the previous one affecting only agricultural products. The contracts are different this time, and the impact is much wider.

Meanwhile, silver prices surged to a record high after trading resumed, fueling market rumors of a "market manipulation" frenzy surrounding this precious metal , which possesses both industrial and financial attributes. The future direction of the market will undoubtedly be a major focus of the financial markets at the end of the year.

Thanksgiving shutdown

CME Group, the world's largest exchange operator, first notified its website of a system outage at 9:40 p.m. Eastern Time on Thursday. The outage originated from CyrusOne's CHI1 data center in the Chicago area. The problem stemmed from a cooling system issue. This malfunction has put brokers in a difficult position, including Saxo Bank. Saxo Bank, XTB, and eToro have all announced via their websites or statements that they have suspended trading services for various U.S. indices, Treasury bonds, and commodity futures.

The outage lasted until 8:30 a.m. Eastern Time, and the nearly 11-hour shutdown was one of the longest exchange outages in recent years.

Christopher Forbes, head of CMC Markets' Asia Pacific and Middle East region, said he had never seen such a widespread exchange outage in 20 years. " We are currently taking on a lot of unnecessary risk in order to continue providing pricing services. I suspect the market will not accept this, and some volatility is expected after the market opens."

Ben Laidler, head of equity strategy at Bradesco BBI , said, "This is a major 'stain' on the CME Group and perhaps a timely reminder of the importance of market structure and the close interconnections between different markets. It's the end of the month, and there's a lot of assets that need rebalancing." He added, "That said, it could have been worse. Trading volume is expected to be very low today (due to Thanksgiving), and even if this glitch had to happen, choosing this day is a 'fortunate misfortune,' as such problems would have a greater impact on other days."

The CME Group was formed by the merger of several major U.S. exchanges, including the Chicago Mercantile Exchange . The CME Group comprises the Chicago Board of Trade (CME), the Chicago Board of Trade (CBOT), the New York Mercantile Exchange (NYMEX), and the NYMEX Metals Division (COMEX). CME Group trading is primarily conducted through the CME Globex electronic trading system, which provides near 24-hour global trading access.

Futures are a core tool in financial markets, allowing traders, speculators, and businesses to hedge or hold positions in various underlying assets. Data from the CME Group earlier this month showed that the average daily trading volume of derivatives contracts reached 26.3 million contracts in October. The CME Group offers futures and futures options products covering a wide range of sectors, including commodities, interest rates, stock indices, foreign exchange, and cryptocurrencies.

A market speculation

It's worth noting that the sudden interruption of trading on the CME Group futures exchange sparked heated discussions online—especially among silver investors, who noted that the outage occurred just minutes after silver futures hit a record high above $54. Social media was flooded with speculation, suggesting the trading halt was related to the continued surge in silver prices.

Some posts mentioned the sharp correction in last week's gold data and the subsequent plunge in open interest, suggesting large banks were liquidating short positions. A few traders also noted that the trading halt "coincidentally" paused what appeared to be a major breakout for both precious metals . Some believe a repeat of the 2022 LME nickel short squeeze is possible.

COMEX gold futures and options trading is typically a crucial hedging tool in the London spot market. As a result, London spot precious metal prices initially surged, before retracing their gains amidst sharp fluctuations. Even more alarming was the sudden and dramatic increase in bid-ask spreads. Spreads, usually around $1 per ounce, soared to an astonishing $20 or more in a short period. This dramatic widening of spreads is a direct signal of extreme market liquidity shortages or a surge in extreme volatility. Some traders were forced to revert to the "old-fashioned" method of telephone trading, urgently contacting brokers for risk hedging.

"Spot and futures are two sides of the same coin," wrote Ole Hansen, a strategist at Saxo Bank. "Traders rely on futures to hedge spot risks. Once the 'hedging tool' fails, the spot market will inevitably suffer—spreads will widen and trading volume will shrink. Moreover, the market is already quiet during the Thanksgiving long weekend in the United States, making this 'black swan' event particularly untimely."

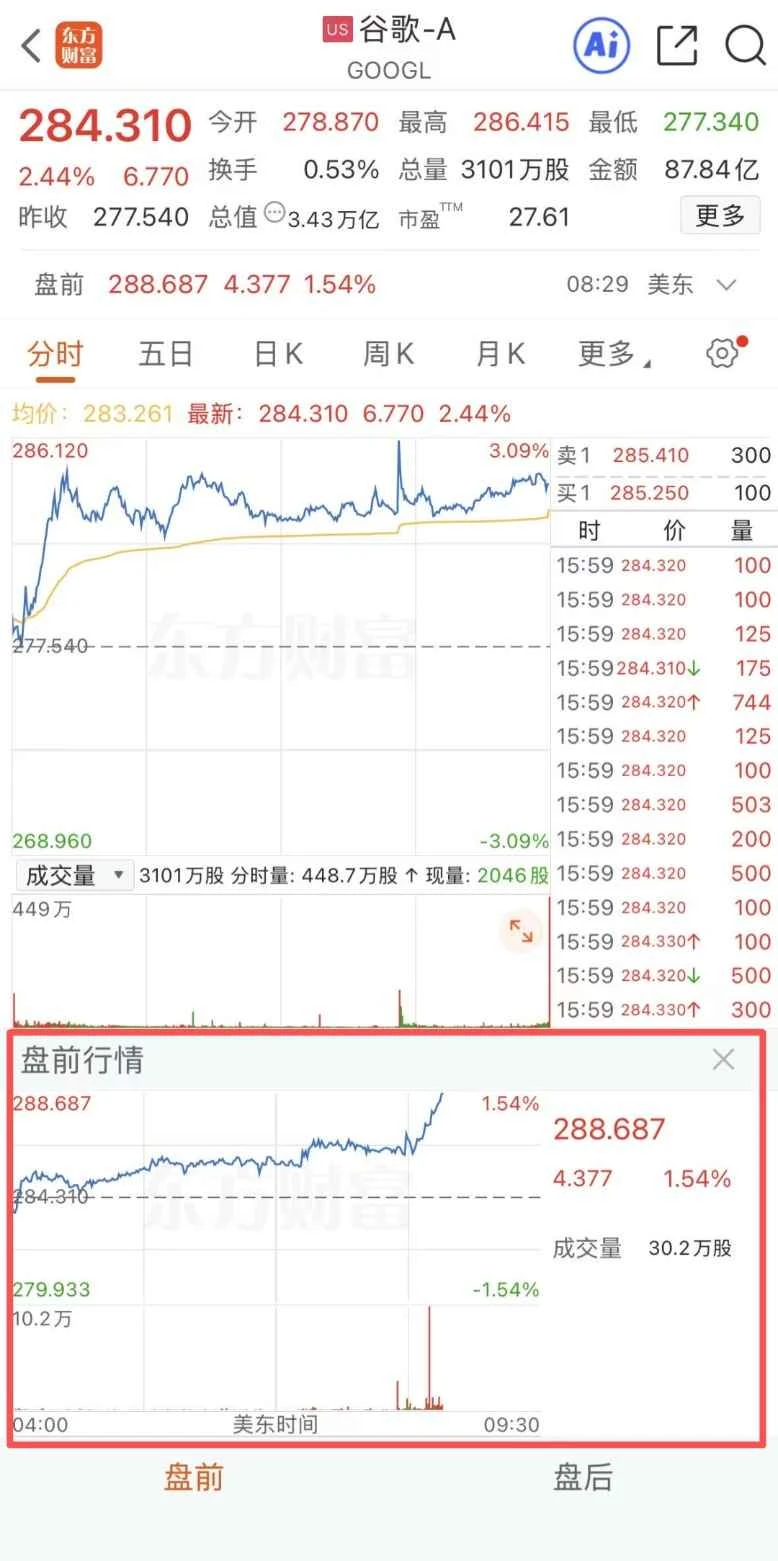

After trading resumed, the COMEX silver futures contract surged by more than 6%, breaking through $57 per ounce, and its year-to-date gain is approaching 100%.

Despite widespread speculation, there is currently no official evidence linking the CME Group futures trading disruption to silver market volatility. A CME Group spokesperson later reiterated that the outage was purely a technical issue, not market intervention.

However, a battle between bulls and bears in the silver market could still erupt at any moment.

Silver inventories on the Shanghai Futures Exchange (SHFE) have fallen to their lowest level since 2015. Wind data shows that silver inventories on the Shanghai Gold Exchange fell by 58.83 tons to 715.875 tons in the week ending November 24. China's silver exports surged to over 660 tons in October, a record high, with large quantities of silver being shipped to London to alleviate local supply shortages. The recent surge in silver prices has forced the market to urgently airlift silver from London to New York to meet delivery demands. First Financial Daily reporters noted that COMEX silver inventories have fallen from a high of 16,540 tons at the end of September to 14,280 tons this Wednesday, a decrease of nearly 14%.

Meanwhile, the market was supported by industrial demand, especially photovoltaic module production, with the fourth quarter being a strong period for solar energy. Peak installation season. Shanghai silver near-month contract prices are higher than far-month contracts, exhibiting a "backwardation" structure, reflecting short-term supply pressure.

Furthermore, the potential risks and uncertainties in the silver market lie in the fact that the Trump administration has included it on the list of critical minerals, raising investor concerns that the US may impose tariffs on it—if implemented, this would lock up silver already flowing into the US. Coupled with low Chinese inventories offering little buffer, this could exacerbate global supply shortages. While the London market has recently seen record inflows, silver borrowing costs remain high, and liquidity concerns persist.

It is worth mentioning that investors also need to guard against market volatility caused by exchange intervention.

In early 2021, at the Game Station Following the short squeeze, retail investors turned to silver as their new target. Driven by concentrated buying, COMEX silver futures prices surged, reaching $30.03 per ounce on February 1st, an eight-year high since February 2013.

The unusual surge in silver prices triggered sharp fluctuations in other assets, prompting the CME Group to intervene urgently. The CME Group announced on March 2nd that it would raise the margin requirement for each COMEX silver futures contract from $14,000 to $16,500. The CME Group explained that this move was based on a routine assessment of market volatility and aimed to ensure adequate collateral coverage. Essentially, it aimed to curb emotional speculative trading by increasing transaction costs and prevent further market escalation. COMEX silver futures prices plummeted that day, falling by more than 10%, marking the largest drop since August 2020.

Faults are not uncommon

A survey by CBN reporters found that major incidents have occurred frequently in European and American stock exchanges in the past two years.

In June 2024, the New York Stock Exchange... The exchange experienced a system outage caused by a technical glitch during a software update. Trading in approximately 40 stocks was suspended, and some stocks experienced abnormal price drops of up to 99%, causing a brief disruption to trading order.

In March 2024, Nasdaq The exchange experienced a system outage caused by a technical malfunction in its matching engine. This resulted in a more than two-hour disruption to pre-market trading and marked the exchange's second technical failure in three months. In December 2023, a system error on Nasdaq affected thousands of stock orders, leading to the cancellation of some orders and the submission of erroneous settlement information.

In December 2023, the London Stock Exchange experienced multiple outages. The malfunctions were caused by system crashes, resulting in the suspension of trading in thousands of stocks and impacting stock trading liquidity and investor confidence across Europe.

In January 2023, the New York Stock Exchange ( NYSE) experienced a system outage. Many stocks saw unusually large price fluctuations upon opening, and trading in some large blue-chip stocks was forced to halt. Twenty minutes after the market opened, the NYSE announced that all systems had been restored to normal operation.

(Article source: CBN)