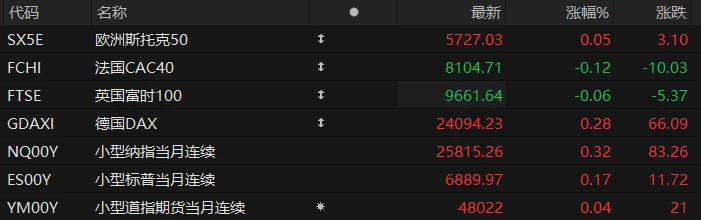

U.S. stock index futures rose across the board in pre-market trading on Monday, while major European indices showed mixed results. As of press time, the Nasdaq... S&P 500 futures rose 0.32%, S&P 500 futures rose 0.17%, and Dow Jones futures rose 0.04%.

In terms of individual stocks, prominent tech stocks showed mixed performance in pre-market trading, with Broadcom... Micron Technology Netflix rose more than 2%. Tesla rose nearly 1%; It fell by more than 1%. Most popular Chinese concept stocks rose in pre-market trading, with Baidu among them. Hesai rose nearly 3%. It rose nearly 2%.

Most cryptocurrency stocks rose in pre-market trading, with Bitmine Immersion Technologies up nearly 4%, Coinbase up over 2%, Strategy and Robinhood up nearly 2%, and Circle and IREN Ltd up over 1%.

Storage-related stocks rose in pre-market trading, with SanDisk Corp up nearly 4%, Micron Technology up nearly 3%, and Western Digital up 4%. It rose nearly 2%.

After the initial panic about whether the Federal Reserve would cut interest rates for the third time this year, the current market consensus is that the Fed will cut rates by 25 basis points this week, even if it may be a divisive decision.

“This is a difficult decision,” said Alan Blinder, a professor of economics at Princeton University and former vice chairman of the Federal Reserve. “ But I think they are more likely to cut rates than not… I wouldn’t be surprised if it’s a ‘hawkish rate cut. ’”

In other words, this week's rate cut may come as a warning to the market not to expect further rate cuts at subsequent meetings . Blinder stated that given the existing divisions within the committee, he believes the rate decision may provoke opposition from both sides.

Luke Tilley, chief economist at Wilmington Trust, also believes the Federal Reserve will cut interest rates . He predicts that Fed Chairman Powell will articulate the rate cut in the same way as at the last press conference: emphasizing differing opinions on further rate cuts and warning against assuming the Fed will continue to cut rates.

Hot News

The most optimistic prediction on Wall Street has emerged! Oppenheimer predicts the S&P 500 will reach 8100 points next year.

Wall Street's bullish sentiment towards U.S. stocks has reached a new high, with Oppenheimer Asset Management offering the most aggressive forecast on the platform to date. John Stoltzfus, the firm's chief investment strategist, predicts that the S&P 500 will climb further to 8,100 points by 2026, driven by strong corporate earnings growth and the resilience of the U.S. economy.

According to data compiled by Bloomberg, Stoltzfus's target implies a further 18% rise in the S&P 500 from current levels, ranking first among all surveyed strategists' predictions. The team points out that this optimistic outlook is primarily based on the continued resilience of US economic data and the better-than-expected performance of S&P 500 companies for most of this year, with projected earnings growth of 12% next year.

However, the market also faces short-term volatility risks due to the realization of expectations. (JPMorgan Chase ) Strategists warn that the recent stock market rally may stall, given that the market has already priced in a 92% rate cut by the Federal Reserve this week. Investors may prefer to lock in profits before the end of the year rather than increase their risk exposure once the policy is implemented, meaning that the stock market may lack catalysts for further gains in the short term.

Despite heightened short-term volatility, institutional confidence in the market remains robust for next year. An informal survey of asset management firms in Asia, Europe, and Wall Street revealed that over three-quarters of respondents are allocating their portfolios for a risk-averse environment in 2026. This trend suggests that despite concerns about a short-term pullback and even mixed signals from the US labor market, investors are generally optimistic about the medium-term performance of US stocks, supported by a broader macroeconomic environment.

Bank of America's "Best Hot Deals" Outlook for 2026: The Commodity Bull Market Will Continue!

According to Bank of America According to Bank of America, commodities will be the hottest and best investment option in 2026.

In a recent report, the team led by strategist Michael Hartnett stated that the corners of the market—often overshadowed by more glamorous risk assets such as stocks and cryptocurrencies—present the best "run-it-hot" trades investors may have to look forward to in 2026, as a series of economic tailwinds will allow commodities to continue to outperform.

Bank of America predicts that the 2026 economy will be characterized by strong growth, fiscal and monetary stimulus, and potentially escalating inflation. "We believe that going long on commodities is the best 'striking while the iron is hot' trade in 2016, and the long-undervalued oil/energy sector is undoubtedly the best 'striking while the iron is hot' contrarian trade," the team wrote. Bank of America further points out that commodities are poised for substantial returns in 2026, primarily because metals and energy commodities are ... (AI) Data Center Key investment priorities amid the boom.

Buying $45 billion in bonds per month? The Fed has something more important to do this week than cutting interest rates: will it expand its balance sheet?

Besides the market's expectation of a third rate cut this year, when the Federal Reserve concludes its interest rate meeting at 3 a.m. Beijing time this Thursday, industry insiders may also focus on one thing: Will the Federal Reserve, which just finished its balance sheet reduction process on December 1, immediately start expanding its balance sheet?

Michael Kelly, global head of multi-asset management at PineBridge Investments, an investment firm that manages $215.1 billion in assets, said, "The Fed's current interest rate policy is clearly still restrictive, but that may not be important."

Kelly argues that the United States is currently implementing a dual-track monetary policy: one is a balance sheet monetary policy targeting the "wealthy class," which has been increasing the "wealth effect," stimulating spending, and helping to keep the economy running; the other is a traditional interest rate policy targeting ordinary people.

Bank of America's global interest rate strategy team said over the weekend that it expects the Federal Reserve to announce this week the launch of a "reserve management purchases" program—purchasing $45 billion per month in short-term Treasury bills with maturities of one year or less, starting in January next year.

In its client report, the team emphasized that its assessment of the timing and scale of the (bond purchases) was earlier than the market consensus, and that investors may have generally underestimated the extent of the Federal Reserve's actions regarding its balance sheet.

US Stocks Focus

Renowned tech analyst bullish on Apple Next year will truly usher in the AI revolution, with the stock price expected to rise another 26%.

Dan Ives, managing director and renowned technology analyst at Wedbush Securities, raised his target price for Apple to $350 on Monday, about 26% higher than the current level .

Apple shares fell 0.68% to $278.78 on Friday. Year-to-date, the stock is up over 14%, compared to a Nasdaq 100 return of over 22% over the same period. Ives wrote on X on Monday that better-than-expected iPhone 17 sales and Apple's accelerated progress in artificial intelligence (AI) are the core catalysts for raising his target price for Apple.

The core logic behind this rating upgrade focuses on 2026. Ives believes that 2026 will be the year Apple truly enters the artificial intelligence revolution. This aligns with Ives' long-held view of a "consumer AI revolution," predicting that a hardware supercycle will enable Apple to continue leading the consumer technology field for many years to come. Ives also stated that with Apple's performance continuing to exceed Wall Street expectations, he believes iPhone 17 sales will remain strong until the end of the year, with equally impressive performance in the Chinese market.

Year-to-date gains surpass Nvidia's The core logic behind these two US-listed companies is actually consumption downgrade!

U.S. stocks have seen a significant surge this year due to artificial intelligence, with the S&P 500 rising 17.1% year-to-date and nearing its all-time high again; the Nasdaq has risen 22.3% and the Dow Jones Industrial Average has also gained 13.2%.

Among them, Nvidia , as the largest stock in the artificial intelligence industry, has seen its share price rise by nearly 32% this year, firmly holding the title of the most valuable listed company. However, Nvidia 's gains have lagged behind those of another quietly developing industry.

The two publicly traded dollar store chains in the US—Dollar Tree and Dollar General—have seen their stock prices rise significantly more than that of the tech giant Nvidia this year. To date, Dollar Tree is up 60% this year, while Dollar General is up 75%.

The two retailers, both specializing in low-priced goods, released their latest quarterly earnings reports last week. Dollar General's same-store sales grew 2.5% in the third quarter, while Dollar Tree's same-store sales grew 4.2%. In contrast, US retail giant Target's same-store sales declined by 3.8% in the most recent quarter.

Netflix and Warner's blockbuster acquisition deal stalled? Trump warns: Could trigger antitrust issues.

Last Friday, Eastern Time, a major earthquake struck Hollywood: Netflix , the American streaming giant, announced that it would acquire Warner Bros. Discovery for $27.75 per share. The company’s core business involves an overall enterprise value of $82.7 billion, of which the equity value is $72 billion.

However, on Sunday, Eastern Time, US President Trump raised potential antitrust concerns about the acquisition. This could lead to greater regulatory resistance for Netflix's acquisition of Warner Bros.

Netflix's acquisition of Warner Bros. has been a months-long battle, with several industry giants vying for the deal, but Netflix ultimately prevailed. However, Netflix is still facing scrutiny from the U.S. Department of Justice over the transaction, as it could reshape the global entertainment landscape.

According to prediction market Polymarket, before Trump's remarks, Netflix had approximately a 60% chance of completing the acquisition by the end of 2026. However, after Trump's speech, this probability immediately dropped to 23%.

If the acquisition goes through, it would mean that Netflix, the world's largest streaming platform, could merge with HBO Max, Warner Bros. Discovery Group's streaming platform, which has already raised concerns among competition regulators.

(Article source: Hafu Securities) )