On December 10 local time, the Federal Reserve announced that it would lower the target range for the federal funds rate by 25 basis points to 3.5% to 3.75%.

This was the Federal Reserve's third rate cut this year, in line with market expectations. However, the decision reflects growing divisions within the Federal Open Market Committee (FOMC). Of the 12 voting members on the FOMC, three voted against the cut, the most since September 2019.

Royal Bank of Canada Mark Dowding, chief investment officer of BlueBay Asset Management, Powell’s asset management arm, told the Daily Economic News that this week’s meeting is likely to be Powell’s last interest rate adjustment before leaving office.

Regarding the direction of monetary policy next year, the market is concerned that if Kevin Hassett, the White House National Economic Council director who is currently the most popular candidate to succeed Powell as the next Federal Reserve Chairman, he may cut interest rates sharply in order to cater to the wishes of the White House.

While the Federal Reserve cut interest rates, the Bank of Japan has strongly hinted at a rate hike on December 19. This shift in policy—one central bank cutting rates and the other raising them—could potentially reverse yen carry trades, leading to a tightening of liquidity in the dollar and globally.

China Merchants Bank According to the research institute's report, by the end of 2023, the scale of broad yen carry trade had reached 1,420 trillion yen (approximately US$9.3 trillion) , equivalent to 236% of Japan's total economic output at the time, accounting for 13% of all yen liabilities, and affecting more than 30% of the market capitalization of the Japanese stock market.

Three votes against, the most since September 2019.

The decision on December 10th marked the third consecutive rate cut by the Federal Reserve since September of this year, and the sixth rate cut since the Fed began this rate-cutting cycle in September 2024.

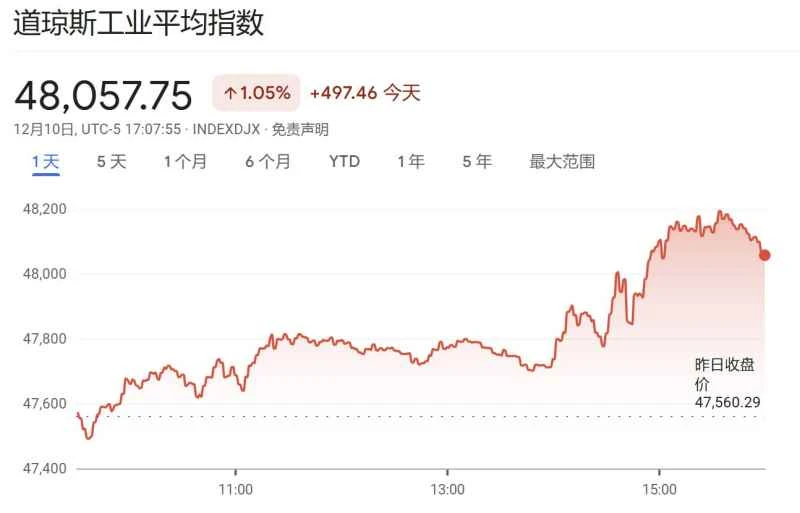

Following the announcement of the resolution, the market reacted positively, with all three major U.S. stock indexes closing higher. The Dow Jones Industrial Average rose 497 points, or 1.05% , and the S&P 500 index also approached its all-time high.

At the press conference following the meeting, Federal Reserve Chairman Jerome Powell, whose term ends next May, emphasized that after three consecutive rate cuts, interest rates are now at the upper end of the "neutral" range. This means that current policies will neither excessively stimulate the economy nor suppress economic growth, and the Fed is "fully capable of waiting and seeing how the economy evolves." At the same time, to reassure the market about tightening concerns, he explicitly stated that no one's baseline expectation includes a rate hike.

In addition, in order to stabilize the overnight funding market, which has recently been under pressure, the Federal Reserve announced that it will start purchasing $40 billion of short-term Treasury bills per month starting this Friday. This move is also seen by some market participants as a form of "hidden easing".

However, behind this seemingly "hawkish rate cut" decision lies a growing division within the FOMC.

Regarding the 25 basis point rate cut, 9 out of 12 FOMC members voted in favor, while 3 voted against, the highest number of dissenting votes since September 2019. As the chart above shows, Federal Reserve Governor Stephen Miran advocated for a larger 50 basis point rate cut; while Kansas City Fed President Jeffrey Schmid and Chicago Fed President Austan Goolsbee believed that interest rates should remain unchanged.

Powell acknowledged that the U.S. economy is facing the dual challenges of a cooling job market and rising inflation. He stated that curbing inflation could harm employment, while stimulating employment could push up inflation. This is a "challenging" situation.

The path of interest rate cuts next year remains uncertain: Is this week Powell's "last cut"?

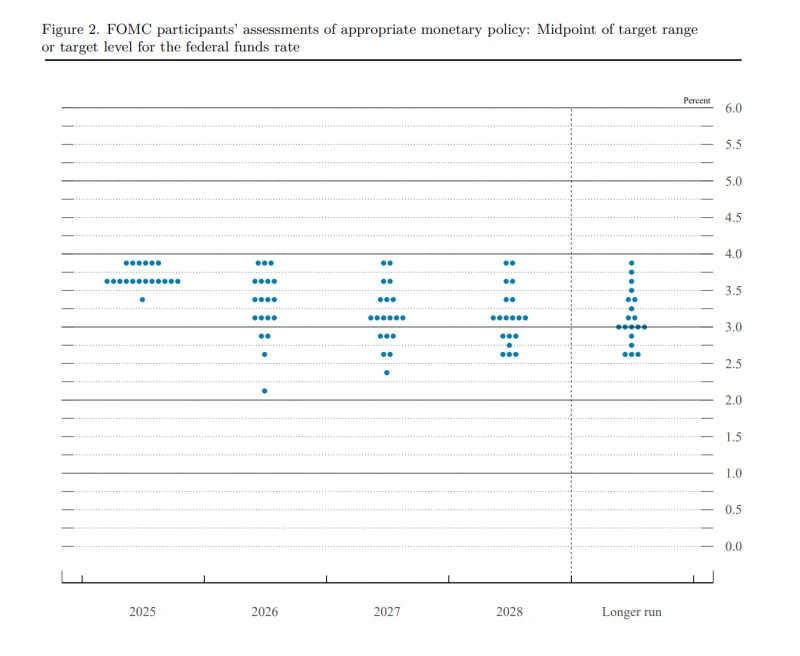

The latest dot plot projections show that most Federal Reserve officials expect one 25-basis-point rate cut each in 2026 and 2027. The Fed's median forecast shows a rate of 3.4% in 2026 and 3.1% in 2027. Seven Fed officials expect no rate cuts in 2026.

BlueBay Asset Management, an asset management arm of RBC Capital Markets , told the National Business Daily that this week's meeting is likely to be Powell's last interest rate adjustment before leaving office. His reasoning was based on previous rate cuts, tax cuts, and the impact of artificial intelligence. Driven by related investments, the US economy will continue to grow in the first half of 2026.

Blackstone Group Rick Rieder, head of fixed income, also stated, "Given the lack of consensus shown by the committee today, and the fact that the new Fed chair will take office in 2026, we believe the Fed is likely to remain on the sidelines for some time." Joseph Brusuelas, chief economist at RSM, believes that the Fed's upward revision of next year's economic growth forecast, coupled with the increased cash flow to households from tax cuts, will "significantly raise the bar for another rate cut in January."

However, data from the futures market shows that traders believe there is a 38% chance of two rate cuts next year.

Major investment banks have made even bolder predictions: Morgan Stanley Barclays and Goldman Sachs Both banks predict two interest rate cuts next year, ultimately bringing rates down to a range of 3.0% to 3.25%. (JPMorgan Chase ) They believe that January next year will be the last rate cut, while Bank of America... Deutsche Bank They then pointed to the timing of interest rate cuts in the middle of next year and September, respectively.

If Hassett takes office, will he cut interest rates significantly?

The prevailing market expectation is that Kevin Hassett, the current director of the White House National Economic Council, will succeed Jerome Powell as the next Federal Reserve Chairman. Hassett previously served as chairman of the White House Council of Economic Advisers during Trump's first term. There are widespread concerns that Hassett might sacrifice the Fed's policy independence to appease the White House's desire for interest rate cuts.

Trump recently stated that the "litmus test" for the next Federal Reserve chairman is whether he can immediately lower interest rates . "Our interest rates should be the lowest in the world," Trump said. "I'm looking for a new chairman who will be honest about interest rates."

According to media reports citing sources familiar with the matter, bond investors told the U.S. Treasury Department in October that they were concerned Hassett would push for significant reductions in borrowing costs to appease Trump. Morgan Stanley , meanwhile, predicted that concerns about the Federal Reserve's independence and interest rate cuts could push up the risk premium for the dollar.

However, Wang Tiancheng, a macro researcher at China Merchants Bank Research Institute, told the reporter from National Business Daily that Hassett will remain restrained because if the market completely loses confidence in the independence of the Federal Reserve, it could cause long-term Treasury yields to soar due to inflation expectations and risk premiums, which would completely contradict the Trump administration's original intention to reduce borrowing costs.

He further explained that (if Hassett becomes the Fed chairman) it could form a "dovish" camp consisting of Hassett, Vice Chairman for Supervision Bowman, and Governor Waller, in opposition to a "hawkish" camp (or "regional Fed triangle") consisting of Cleveland Fed President Hammark, Dallas Fed President Logan, and Kansas City Fed President Schmid.

Mark Dowding also told the reporter from National Business Daily that the assumption that Hassett would become very dovish after taking office might not be accurate . He pointed out that the US economy would still be growing at that time, inflation could accelerate to 3.5%, and the tariff effect would further push up prices, all of which would limit the room for interest rate cuts. " We believe that the Fed's policy in 2026 will be more orthodox, rather than adopting a strategy of large-scale aggressive interest rate cuts ," Dowding said.

Is the greater risk Japan raising interest rates?

In contrast to the Federal Reserve, Bank of Japan Governor Kazuo Ueda has strongly hinted at a rate hike on December 19. The Bank of Japan's actual rate hikes will begin in March 2024, and it has already raised rates three times, totaling 60 basis points to 0.5%.

The Bank of Japan's interest rate hikes are crucial to global market liquidity. Japan's prolonged period of low, even negative, interest rates has spurred a large volume of yen carry trades, involving borrowing low-interest yen and then converting it into US dollars or euros to invest in European and American stock and bond markets, as well as emerging markets.

Therefore, if Japan enters a rate hike cycle, carry trade funds (especially highly leveraged investors) will suffer a double blow from both interest rates and exchange rates, forcing some funds to reverse carry trades and exchange back for yen, which in turn leads to a tightening of the dollar and even global liquidity .

According to a report by China Merchants Bank Research Institute, as of the end of 2023, the scale of broad yen carry trade had reached 1,420 trillion yen (approximately US$9.3 trillion) , equivalent to 236% of Japan's total economic output at the time, accounting for 13% of all yen liabilities, and affecting more than 30% of the market capitalization of the Japanese stock market.

Guotai Haitong Securities Ji Pingzi, CEO of Haitong International Japan Branch, a wholly-owned subsidiary, pointed out to the reporter of National Business Daily that Japan is one of the world's largest net creditors. As of the end of 2024, Japanese investors held nearly 700 trillion yen (about 4.5 trillion US dollars) in overseas securities investments, with overseas bonds and stocks each accounting for half .

Such a massive scale means that if the Bank of Japan raises interest rates, causing the yen to appreciate significantly, carry trade investors will be forced to sell their overseas assets and exchange them for yen to repay loans, resulting in a large-scale capital repatriation.

The US market is particularly vulnerable to shocks.

First, Japan is the largest foreign holder of U.S. Treasury bonds. If Japanese investors decide to withdraw their funds back home due to rising domestic yields, the U.S. Treasury market will lose a crucial buyer.

Secondly, fluctuations in US Treasury yields directly impact US stock valuations. ( Societe Generale) U.S. equity strategist Manish Kabra believes that " the Bank of Japan's hawkish moves pose a greater threat to the U.S. stock market than the Federal Reserve or U.S. domestic policies ." He estimates that every 1 percentage point increase in the 10-year U.S. Treasury yield could trigger a 10% to 12% drop in the S&P 500.

Ji Pingzi stated, "If the Bank of Japan raises interest rates, causing the yen to surge, it could lead to a concentrated unwinding of yen carry trades. However, this mainly depends on whether it causes a drastic change in market expectations and significant exchange rate fluctuations."

She further explained, "In January of this year, the Bank of Japan's interest rate hike did not trigger a large-scale reversal in yen carry trades. Therefore, the key is whether the Bank of Japan can effectively communicate with the market and manage market expectations. In addition, yen carry trades also need to pay attention to whether any unexpected events will occur in the US market."

However, Wang Tiancheng analyzed for the National Business Daily that the risk of a repeat of the 2024 July yen reversal "tsunami" is not high at present, and the impact of the carry trade reversal on global assets may be relatively mild for two reasons: First, the Bank of Japan's interest rate hike pace is relatively slow, and the Federal Reserve is in a rate-cutting cycle and has stopped shrinking its balance sheet, which will supplement dollar liquidity; second, high-risk carry positions have declined significantly after the impact in July 2024, coupled with the long-term narrowing trend of the US-Japan interest rate differential, making it difficult for the "tsunami" to return in the short term.

He believes the greater risk lies in Japan's fiscal situation. Japan faces stagflation, with fiscal sustainability conditions (i.e., interest rates < economic growth) under continued pressure. Interest rates are rising steadily, driven by supply-side inflation, while economic growth is impacted by a series of external factors. Japan's economic growth is expected to turn negative in the third quarter of 2025, potentially ending the inflation recovery that began in 2022. A cautious approach is needed regarding the prospects for Japanese stocks, bonds, and the currency, avoiding linear narratives such as "inflation recovery equals Japanese economic recovery, and a narrowing US-Japan interest rate differential equals yen appreciation."

Disclaimer: The content and data in this article are for reference only and do not constitute investment advice. Please verify before use. Any actions taken based on this information are at your own risk.

(Source: Daily Economic News)