Goldman Sachs The group expects Chinese stocks to be affected by artificial intelligence. Supported by policy initiatives, it will continue to rise in 2026, although the increase will be slightly lower than in 2025.

In a report published Wednesday (January 7), Goldman Sachs strategist Liu Jinjin's team wrote that they expect MSCI China to reach a certain level by the end of 2026. The MSCI China Index is projected to rise 20% from its 2025 base, while the CSI 300 Index is expected to rise 12% to 5200 points.

In terms of market performance, since the first trading day of 2026, the CSI 300 Index has risen by 3.5%, reaching its highest level in four years; the MSCI China Index has risen by approximately 3.6%, outperforming the S&P 500. The S&P 500 index.

Earnings-driven rally

Goldman Sachs ' core argument in this report is that returns in 2026 will come more from earnings growth.

The strategist wrote, "We expect equity returns in 2026 to be almost entirely driven by earnings. Corporate profit growth will benefit from support from artificial intelligence , 'going global' strategies, and anti-involution policies."

Goldman Sachs predicts that five major capital flows will support the market: First, net inflows of southbound funds may reach a record high of $200 billion; second, domestic asset reallocation may bring approximately 3 trillion yuan into the stock market; third, total dividends and share buybacks may approach 4 trillion yuan; fourth, global active funds may change their underweighting of Chinese stocks, bringing incremental funds; and fifth, IPO financing may exceed $100 billion, demonstrating market vitality.

Furthermore, Goldman Sachs maintained its "overweight" rating on both Chinese A-shares and H-shares. The bank believes that, given the current low earnings growth, valuation levels, and generally low investor positioning, Chinese stocks offer an attractive risk-reward ratio.

Investment Logic

In addition to earnings growth, Goldman Sachs also explained its investment logic from multiple dimensions in the report.

Firstly, at the macro level, Goldman Sachs economists have raised their forecast for China's real GDP growth in 2026 to a level higher than the consensus, mainly supported by the resilience and strength of exports.

Strategists point out that, with exports as the core engine, China is showing a trend of diversifying its export destinations and improving the quality of its exports. Meanwhile, the other two of the "three drivers"—consumption and investment (especially real estate)—remain weak, but their drag is diminishing.

At the policy level, 2026 is the first year of the 15th Five-Year Plan, and China's pro-market policy window will remain open, including monetary easing, fiscal expansion, and supportive regulation for the private sector.

Furthermore, valuations have recovered to the midpoint of the cycle. The 12-month forward P/E ratios of the MSCI China Index and the CSI 300 are 12.4x and 14.5x, respectively, which are at or slightly above the 10-year average.

Industry and Company

From an industry perspective, Goldman Sachs expects the TMT sector (internet and hardware) to have the highest earnings growth (around 20%), driven by revenue growth from artificial intelligence and increased capital expenditure on AI.

Goldman Sachs also holds an "overweight" view on the following sectors: technology hardware (benefiting from artificial intelligence, hardware will be upgraded); media/entertainment (benefiting from content and games) . Regulatory easing will benefit companies involved in AI-powered agents, internet retail (where some platforms are building AI ecosystems), and materials (benefiting from new infrastructure development and increased demand for precious metals in the commodities market). Optimistic attitude), insurance (Benefiting from the interest rate environment).

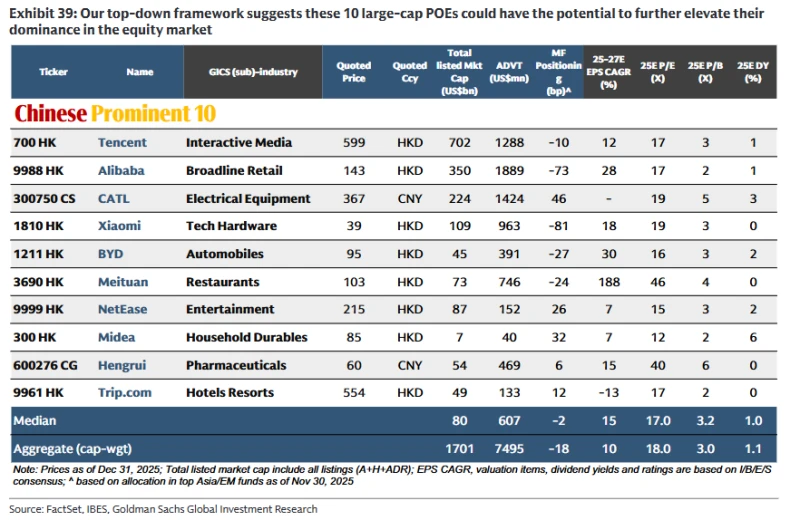

It's worth noting that in its report, Goldman Sachs listed ten leading Chinese companies comparable to the "Big Seven" US stocks, including Tencent, Alibaba, CATL , Xiaomi, and BYD. Meituan, NetEase Hengrui Medicine , Ctrip .

These ten stocks have a total market capitalization of $1.7 trillion, accounting for 40% of the MSCI China Index, with an average daily trading volume of $7.5 billion. Analysts predict that the earnings of these ten stocks will grow at a compound annual growth rate of 13% over the next two years.

Risk warning

Of course, Goldman Sachs also mentioned some headwinds in its report, such as the possibility of a global recession, geopolitical tensions, and an artificial intelligence bubble.

Goldman Sachs economists predict a 30% probability of a recession in the US/global economy over the next 12 months. Historical data shows that the MSCI China Index has fallen by an average of about 30% during recessions, but A-shares are typically more resilient.

Furthermore, competition in geopolitics and capital markets will continue. Although market sensitivity to trade frictions has decreased, some geopolitical conflicts and financial decoupling events remain disruptive.

Furthermore, if global (especially in the US) optimism surrounding artificial intelligence fades, it could impact related Chinese stocks. However, the report suggests that the low concentration and significant valuation discount of Chinese AI stocks could act as a buffer.

(Article source: CLS)