On Friday (November 14) local time, Bridgewater, one of the world's largest hedge funds, raised funds from U.S. securities firms . The Securities and Exchange Commission (SEC) filed a report on the holdings as of the end of the third quarter of 2025, namely Form 13F.

The documents show that as of September 30, 2025, Bridgewater's total holdings amounted to $25.5 billion, an increase from $24.8 billion at the end of the second quarter.

According to data platform Whalewisdom, Bridgewater increased its holdings in 325 stocks, reduced its holdings in 194 stocks, added 493 new stocks, and liquidated 64 stocks in Q3.

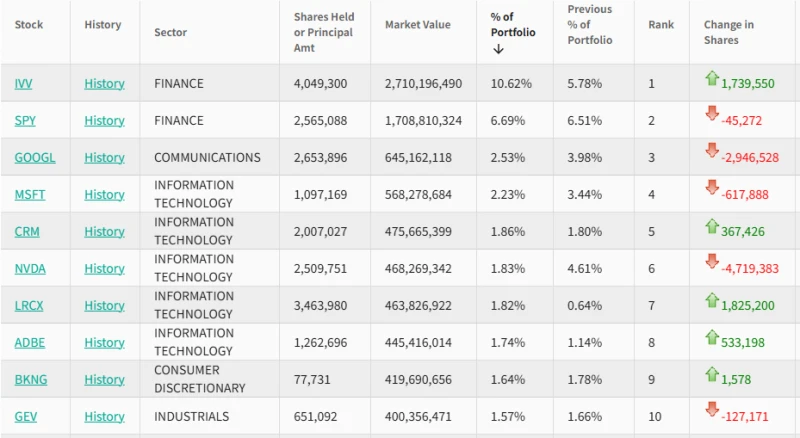

As of the end of the quarter, Bridgewater's top ten holdings accounted for 32.54% of the portfolio, with the iShares Core S&P 500 ETF (IVV) and SPDR S&P 500 ETF (SPY) still ranking first and second.

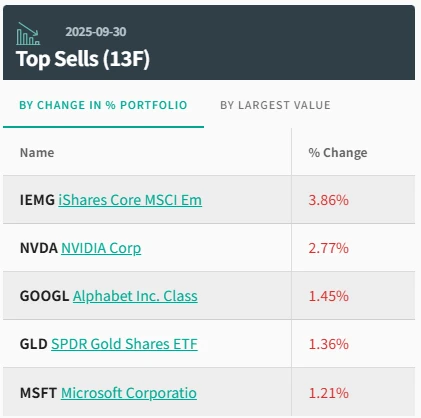

Nvidia, which was originally the third largest holding, It fell to sixth place. Data shows that Bridgewater reduced its holdings by nearly 4.72 million shares in the third quarter, which also put Nvidia on Bridgewater's "Top Sells" list.

As of the end of the third quarter, Bridgewater held 2.51 million shares of Nvidia , a 65.3% decrease from the 7.23 million shares held at the end of the second quarter.

In the second quarter of this year, Bridgewater increased its holdings in Nvidia by as much as 154.37%. This reduction in holdings indicates that Bridgewater is becoming more cautious about Nvidia's future performance.

Market data shows that Nvidia's stock price rose 46% and 18% in the second and third quarters of this year, respectively. However, as of yesterday's close, the stock had only risen slightly by 0.15% this quarter.

Besides Nvidia, Bridgewater also significantly reduced its holdings in the iShares Core MSCI Emerging Markets ETF (IEMG), Google A, SPDR Gold ETF (GLD), and Microsoft in the third quarter. The upward momentum of these targets has slowed this quarter.

Last week, Bridgewater Associates founder Ray Dalio again warned that the US economy may have entered the later stages of a "major debt cycle," and that the Federal Reserve's loose monetary policy is stimulating further expansion of the bubble. The moment the Fed is forced to tighten monetary policy will be the moment the bubble bursts.

Dalio believes that the bull market driven by US tech stocks this year will continue in the short term, primarily driven by the ongoing development of artificial intelligence. upsurge.

“Once inflation risks reappear, companies with tangible assets, such as mining companies, infrastructure companies, and companies with physical assets, may outperform companies that are purely engaged in long-term technology businesses.”

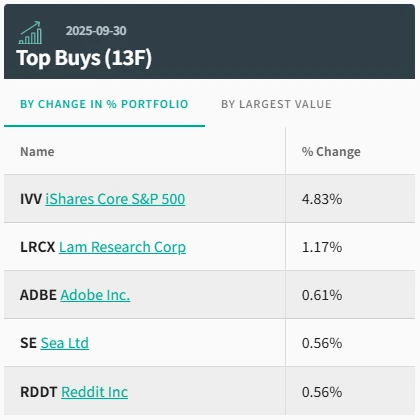

Bridgewater's top five "Top Buys" in the third quarter were iShares Core S&P 500 ETF (IVV), chip stock Lam Research (LRCX), Adobe, Sea ("Southeast Asia's Tencent"), and Reddit ("US version of Baidu Tieba").

(Article source: CLS)