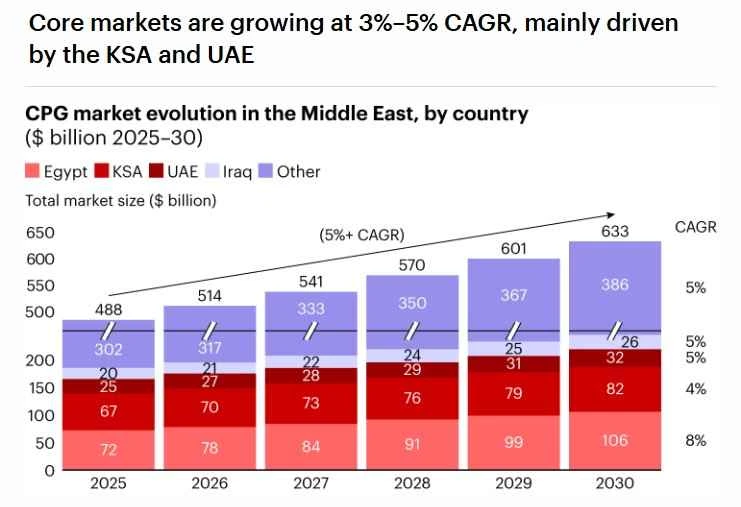

Bain & Company, a leading global strategy consultancy, recently released its first "Middle East Consumer Goods Report 2025," which indicates that the packaged consumer goods market in the Middle East and North Africa (MENA) is expected to expand by nearly one-third by 2030, primarily driven by continued growth in the consumer markets of Egypt, Saudi Arabia, and the United Arab Emirates.

The report explains that, with the support of government initiatives to encourage consumption, local residents' disposable income will steadily increase, thereby driving the continued release of consumer demand in the region, making MENA one of the top destinations for global sales growth, alongside China and India.

The region’s consumer market is projected to reach approximately $633 billion by 2030, representing a nearly 30% increase from the estimated $488 billion in 2025.

Egypt, as the most populous country in the Arab world, will continue to lead market growth, with the market size expected to reach US$106 billion by 2030.

Saudi Arabia, the largest economy in the Arab world, is projected to see its consumer market grow by 22% to $82 billion. The UAE, the second-largest Arab economy, is expected to see its market expand by 28% to $32 billion, according to Bain & Company.

According to their research, the MENA region is projected to grow at a CAGR of 5% over the next five years, with Egypt, Saudi Arabia, and the UAE expected to grow at CAGRs of 8%, 4%, and 5%, respectively, all significantly higher than the global average of 1.7% during 2023-2024.

The report also emphasizes that Egypt possesses "strong long-term growth potential" due to its large population, the rise of modern trade channels, and a growing group of young urban families reliant on modern retail models. Furthermore, the country is developing a sizable middle class, which will become a new driving force for consumption.

Given the polarization trend in the Egyptian market—a price-sensitive mass market and a smaller but quality-conscious middle class—the future of Egypt's consumer market can be foreseen: high-volume, low-priced goods will continue to dominate the market, while branded goods and high-end products will experience selective growth.

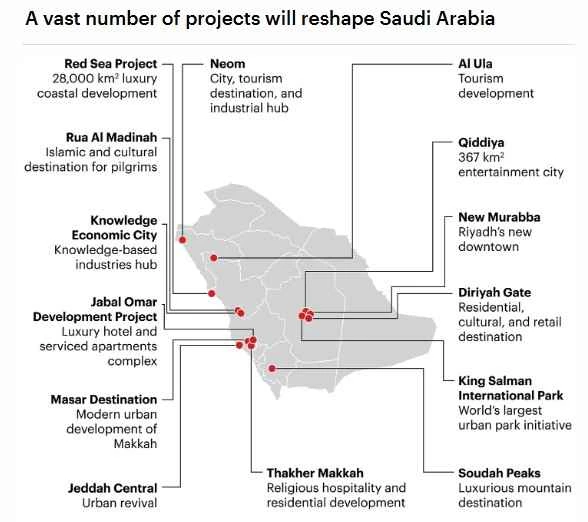

Meanwhile, domestic consumption in Saudi Arabia is accelerating due to several major infrastructure projects (including the Red Sea project and the Jeddah city center project) and economic diversification plans, while the UAE continues to enjoy strong economic growth, leveraging its position as a regional tourism, retail, and business hub. Furthermore, rising wages in both countries are further supporting healthy growth in household consumption.

Note: Large-scale projects under construction in Saudi Arabia, such as the NEOM City project.

Currently, Gulf governments are increasing investment in retail, manufacturing, and tourism while implementing supportive regulations and infrastructure reforms. Therefore, despite macroeconomic uncertainties, the MENA region's consumer market holds significant potential in the coming years.

It is worth noting that local consumers are becoming more rational in their purchasing decisions, with more and more people choosing practical spending, while high-income groups are increasingly inclined to "meaningful" consumption.

Bain & Company emphasizes that demand remains strong for core categories such as groceries, housing, and personal care, while non-essential consumer goods such as dining, fashion, and entertainment are performing differently across different consumer groups.

Specifically, low-income households focus on necessities, while middle- and high-income consumers increasingly favor "high-end, meaningful, and desire-fulfilling products and experiences." Gulf region consumers are not reducing their spending, but rather becoming more selective in their consumption, favoring brands that offer the greatest value and a sense of trust.