Berkshire Hathaway, the company owned by Warren Buffett, recently received a rare "sell" rating – some institutional analysts are cautious about its earnings prospects and continue to express concerns about Buffett's impending departure as CEO and macroeconomic risks.

The latest rating downgrade reportedly comes from Keefe, Bruyette & Woods. The investment bank downgraded Berkshire Hathaway's Class A shares from "market perform" to "underperform," citing "numerous factors moving against the company."

This is the only sell rating among the six analysts who consistently cover Berkshire Hathaway in the industry.

"In addition to the macroeconomic uncertainties we continue to monitor and the succession risks that are unique to Berkshire in its history, we believe the stock will underperform the market as earnings challenges emerge and/or persist," KBW analyst Meyer Shields wrote in a report on Sunday.

Earlier this year, Berkshire Hathaway announced the appointment of Vice Chairman Greg Abel to succeed Warren Buffett as CEO. Buffett will hand over the $1.2 trillion business behemoth, which he personally built, to a new leader on January 1st. While Buffett will remain chairman of Berkshire Hathaway, this move paves the way for his gradual withdrawal from the company's day-to-day management.

In addition to traditional insurance In addition to its energy, railroad, and consumer businesses, Berkshire Hathaway currently also holds a stake in Apple. The company and American Express A portfolio of stocks, etc.

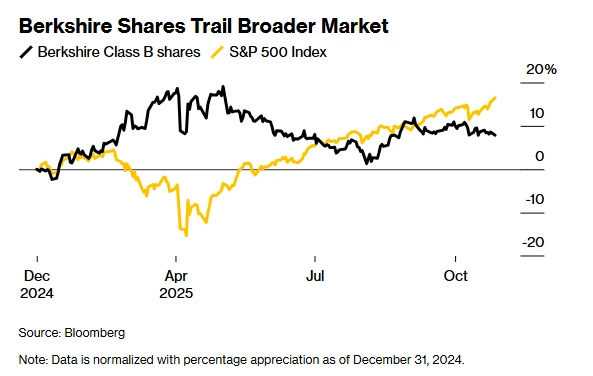

Berkshire Hathaway Class B shares fell 0.82% on Monday. Year-to-date, the stock is up only 7.8%, while the S&P 500 has risen by 16%.

In its report, Shields wrote, "Succession issues could further drag down Berkshire's stock price because we believe the company's lack of disclosure could deter investors once they can no longer rely on Buffett's presence at Berkshire."

Furthermore, he anticipates that Berkshire Hathaway's stock price will continue to underperform the market as its business segments, including GEICO (Berkshire Hathaway's auto insurance company), Berkshire Reinsurance Group, Berkshire Energy, and BNSF Railway, continue to face or experience profitability challenges.

“We believe that GEICO underwriting margins may have peaked, property catastrophe reinsurance rates are declining, short-term interest rates are falling, tariffs are putting pressure on rail transport… coupled with the risk of the gradual withdrawal of alternative energy tax credits, this will drive Berkshire’s performance to lag behind in the next 12 months.”

(Article source: CLS)