On Friday (January 9), the U.S. Supreme Court is likely to rule on the legality of President Trump's tariffs, a decision that will have a profound impact not only on trade policy but also on the U.S. fiscal situation .

The U.S. Supreme Court has designated January 9 as its "Opinion Day," but has not announced any specific cases. The market widely expects the tariff case to be among the decisions.

The core of this ruling will revolve around two issues: first, whether the Trump administration has the right to impose tariffs under the relevant provisions of the International Emergency Economic Powers Act (IEEPA); and second, if the tariffs are determined to be illegal, whether the U.S. government must refund the tariffs to importers who have already paid them.

However, the final ruling may be a compromise.

The court may grant the government limited taxation rights under IEEPA, requiring only a partial refund. Furthermore, the court has several other options for handling this sensitive case that has garnered significant attention from Wall Street.

Even if the White House loses this case, the government still has other policy tools to impose tariffs without having to invoke the emergency powers granted by IEEPA.

U.S. Treasury Secretary Bessant said on Thursday that he expects the Supreme Court to make a compromise ruling.

“There is no doubt that, in terms of overall revenue, we have the capacity to continue to impose tariffs at roughly the same level,” Bessant said. “What is truly worrying is that it would be a great pity for the American people if the president loses the flexibility to use tariffs to protect national security and increase negotiating leverage.”

Economic impact of halting tariff policy

Jose Torres, a senior economist at Interactive Brokers, pointed out that if the tariff policy is ruled invalid, it will have multiple consequences. However, he also stated that if the Supreme Court halts these tariffs, the government will seek alternative solutions.

“Hacking tariffs will hinder the U.S. industry repatriation program and negatively impact the fiscal situation, which in turn will push up interest rates,” Torres said. “But from a corporate profitability perspective, it will be a major benefit—business input costs will decrease, and trade will be smoother.”

U.S. government officials have stated that they have prepared multiple contingency plans to mitigate the impact should the ruling be unfavorable to them. Data from the prediction market platform Kalshi shows that the probability of the Supreme Court ruling in favor of the current tariff policy is only 28%. Torres revealed that his agency's clients have similar expectations.

Bessant had revealed that if he lost the case, he planned to continue to enforce import tariffs through three provisions of trade laws from the last century, including Sections 301 and 122 of the 1974 Trade Act and Section 232 of the 1962 Trade Expansion Act.

However, he also expressed concern that tariff refunds could put pressure on the government and its efforts to reduce the fiscal deficit . Data from the U.S. Treasury Department shows that tariff revenues are expected to reach approximately $195 billion in fiscal year 2025, and have already reached $62 billion so far in 2026.

What impact will this have on the stock and bond markets?

Meanwhile, the upcoming ruling will be the next major test for the US stock and bond markets .

If the U.S. Supreme Court rules that Trump's comprehensive tariffs on countries around the world are beyond his authority, and given that the White House may invoke different legal grounds to reimpose similar tariffs, markets will face long-term uncertainty.

In the short term, the market seems easier to predict.

Analysts believe that if the courts overturn the tariffs, it could boost corporate profit margins and ease the burden on consumers, thereby bolstering the stock market. At the same time, the potential economic stimulus from halting the tariffs could complicate the Federal Reserve's interest rate cut path and potentially exacerbate the government's budget deficit, putting pressure on U.S. Treasury bonds .

Wells Fargo's chief equity strategist, Ohsung Kwon, predicts that if the Supreme Court overturns the tariff policy, S&P 500 companies' EBITDA in 2026 could increase by about 2.4% compared to last year. In this scenario, investors are likely to push up stock prices due to anticipated profit increases.

James St. Aubin, chief investment officer at Ocean Park Asset Management, said this would be "a catalyst for a small rebound."

Analysts believe that companies heavily reliant on imported goods (such as clothing and toy companies) will be the biggest winners; while financial institutions such as banks will also benefit as consumers have more disposable income; the industrial manufacturing and transportation sectors are also expected to benefit from tariff refunds and potential economic stimulus.

On the other hand, those materials, commodities, and U.S. domestic producers that benefit from trade protectionism may lag behind.

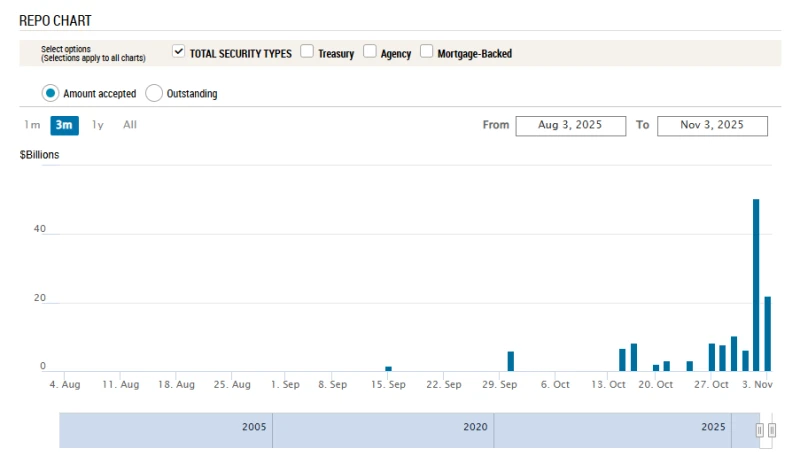

Bond traders are also bracing for market volatility. Last year, U.S. Treasuries rose more than 6%, their best performance since 2020, as markets prepared for the Federal Reserve to resume interest rate cuts. Furthermore, tariff revenues have somewhat eased budget deficit pressures, thus alleviating long-term market concerns about surging government debt.

In a report, JPMorgan strategists noted that removing tariffs could "rekindle fiscal concerns, risking higher long-term yields and a steeper yield curve." However, they added that the impact "should be fairly limited," as the Trump administration is likely to seek other legal avenues to reinstate most of the tariffs.

Morgan Stanley's team advised investors to closely monitor the timing and size of potential government tax rebates to importers, as this would affect the issuance of Treasury bills. However, they also believed that given the market had already priced in some of the risk and anticipated the ruling, the bond market sell-off was likely temporary, and "a more persistent secondary reaction could be investors 'buying the fact,' thus pushing yields down again."