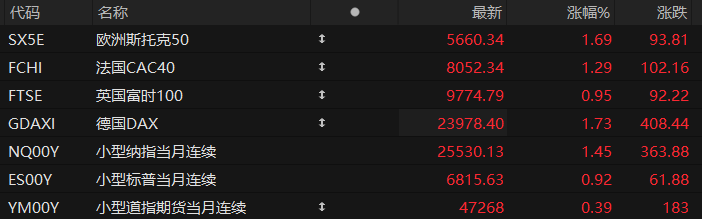

Although the Federal Reserve has formally announced the end of quantitative tightening (QT), repurchase market indicators such as the Secured Overnight Financing Rate (SOFR) and General Collateralized Repurchase Agreement (GC) rates, as well as the usage of the Federal Reserve's Standing Repurchase Facility (SRF), suggest that the US financial system... The system's funding situation has continued to deteriorate even after last week's Federal Reserve decision...

Many had expected liquidity to stabilize by the end of the month, as banks... Traditionally, this would be a time for bookkeeping and liquidity absorption, but that's not the case.

Conversely, some market participants' earlier observations that "delaying the end of quantitative tightening until December may be the latest policy mistake by Powell and the Fed" seem to be being confirmed. At last week's policy meeting, while the Fed announced the end of quantitative tightening as expected, the timeframe was not from November 1st as some had speculated, but rather a full month later, on December 1st.

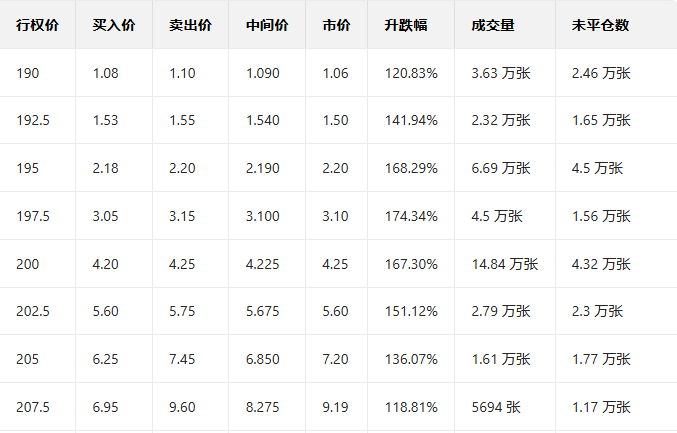

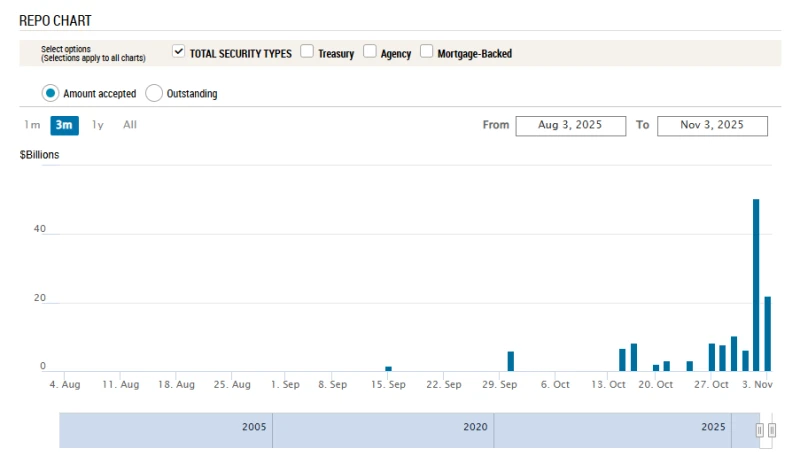

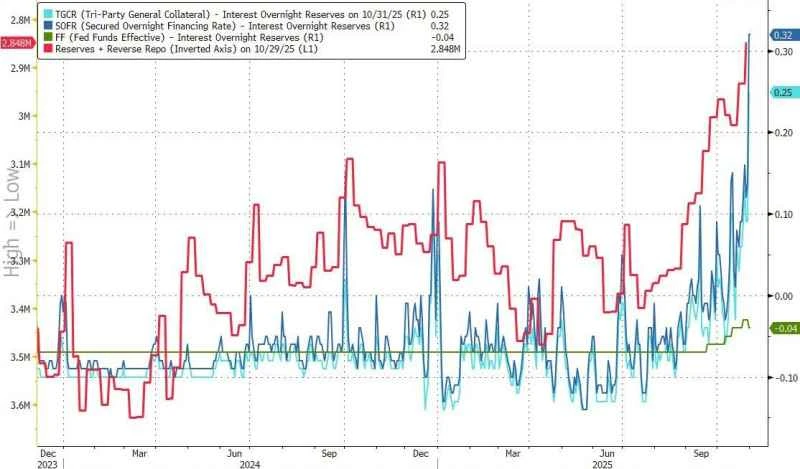

The problem is that last Friday, the Federal Reserve's main liquidity support tool—the Standing Repo Facility (SRF)—reached a record $50.35 billion in usage , primarily driven by month-end factors (some institutions reduce lending and related business). Logically, SRF demand should have declined this Monday—and it did, but the drop was far less than what should be expected for the repo market to normalize.

As shown in the chart below, on Monday, the Federal Reserve lent a total of $22 billion to eligible financial institutions through its Standing Repurchase Agreement (SRA). While this was lower than the unusually high peak last Friday, it still marked the second-highest figure since the SRA became permanent. This facility, introduced in 2021, aims to provide rapid loans using Treasury securities or mortgage-backed securities as collateral.

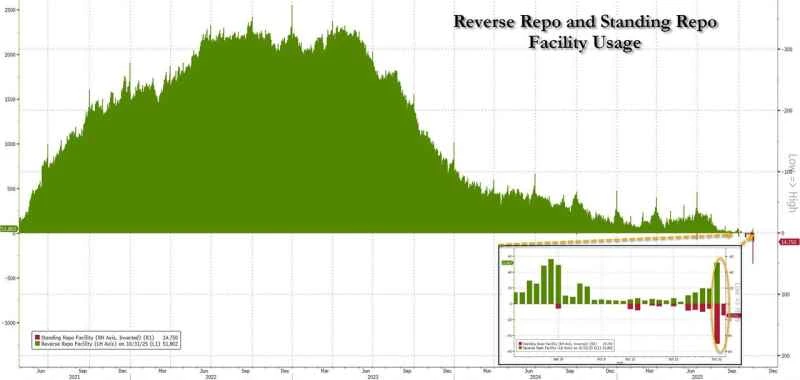

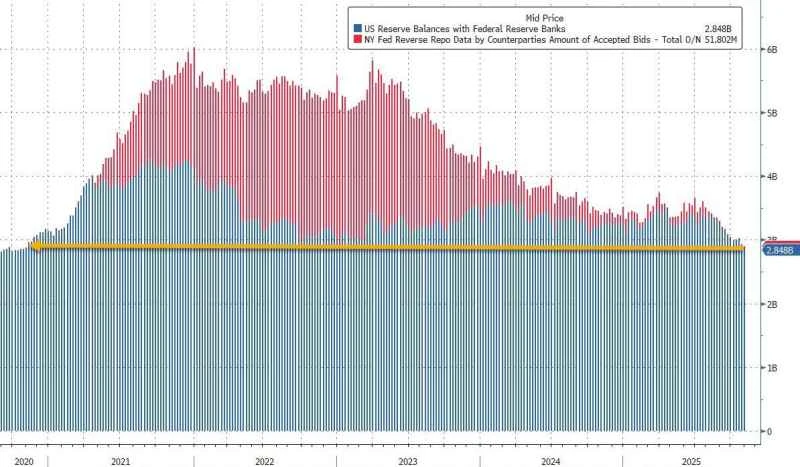

Given that the Federal Reserve's reverse repurchase facility has been largely exhausted, all other things being equal, the above trend undoubtedly indicates that liquidity in the US repurchase market is tightening further, especially considering that November is still in the final stage of the balance sheet reduction operation.

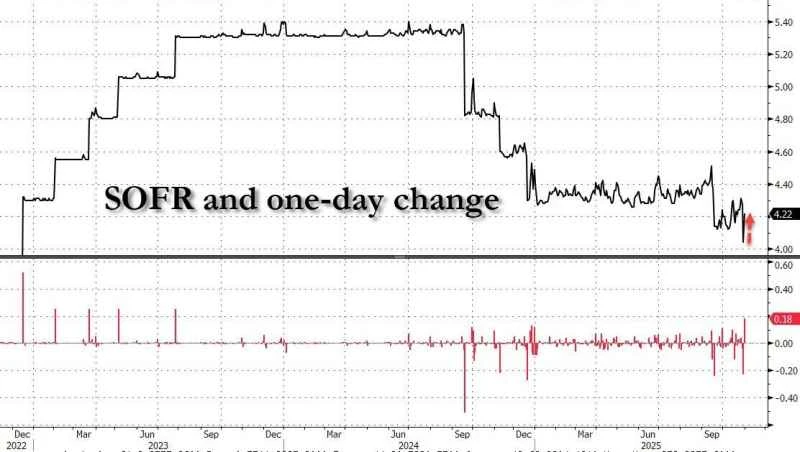

Worse still: to understand just how tight the US money market was last Friday, one only needs to look at the secured overnight funding rate (SOFR)—which surged 18 basis points to 4.22% on October 31. Logically, given the Fed's further rate cut last week, this rate should have remained around 4.00%, but the reality was as if the Fed had never cut rates at all…

The 18-basis-point increase is the largest single-day rise since 2023 (when the Fed last raised rates). Excluding rate hike cycles, this is the largest single-day fluctuation since March 2020.

This upward movement pushed the spread between the SOFR and the effective federal funds rate to 35 basis points, the highest level since 2020. The SOFR is now 32 basis points above the interest rate on reserves (IORB), also the largest spread since 2020—when the COVID-19 pandemic triggered a collapse in basis trading and nearly froze the repo market.

Not only did the SOFR spread widen, but the spread between the Tripartite General Guarantee Rate (TGCR) and the overnight IORB also surged to 25 basis points, reaching its highest level since the pandemic.

While the aforementioned staggering figures were all set last Friday (at the end of October), Monday's data showed that interest rates and spreads showed little sign of stabilizing—remaining volatile, even though market participants had anticipated that funding costs would return to normal as seasonal factors disappeared.

In response, some industry insiders said that although many key factors that have caused the current tight money situation have been discussed before, perhaps the most important factor is still worth reiterating - that the situation will continue to worsen as long as the Federal Reserve and the government do not end the shutdown.

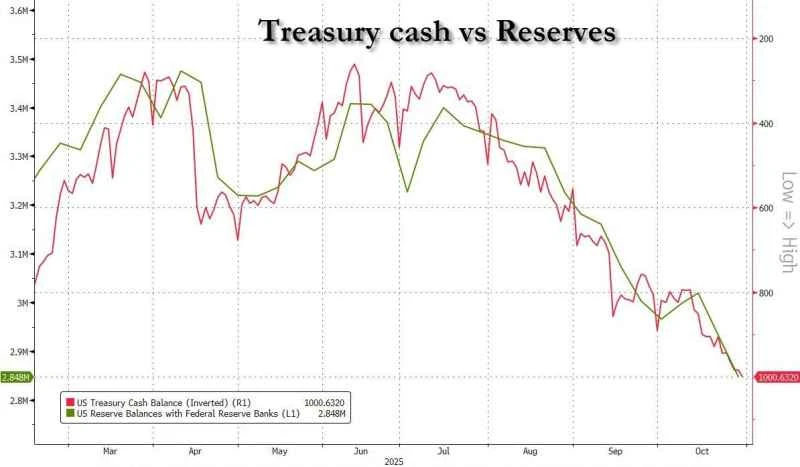

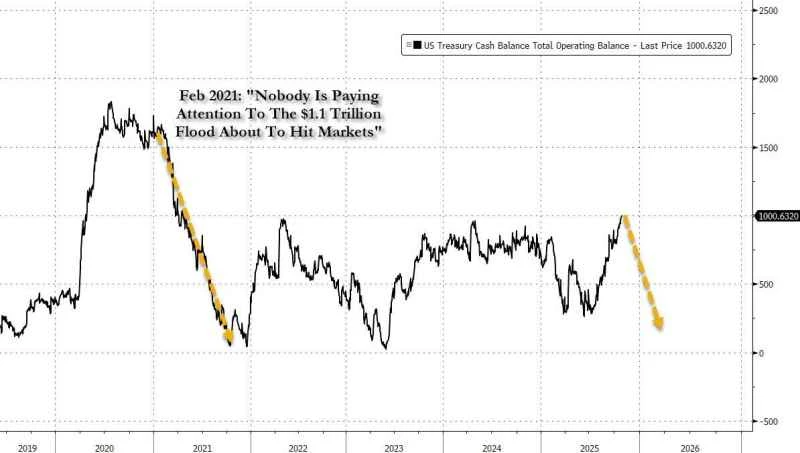

It's important to note that one of the largest uses of market financing is for the U.S. Treasury itself , particularly its general account (TGA). As of last Friday's close, the U.S. Treasury's cash reserves had just surpassed the $1 trillion mark, reaching a near five-year high and the highest level since April 2021.

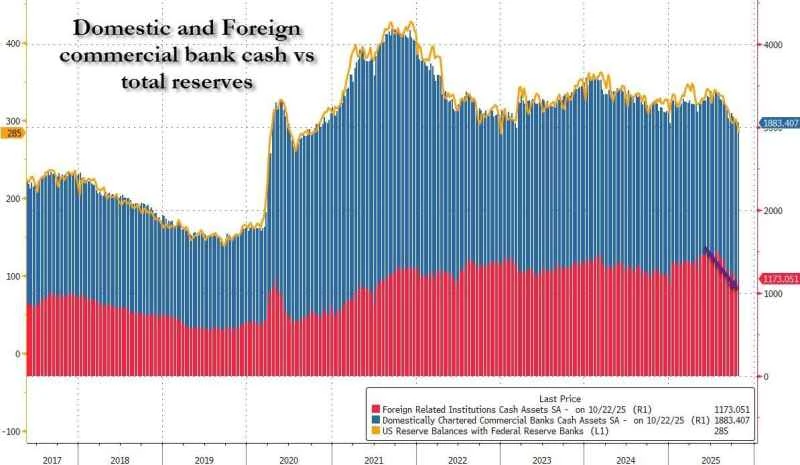

The ongoing US government shutdown has forced the Treasury to absorb all available funds, resulting in a sharp drop in bank reserves on the Federal Reserve's liabilities side—currently standing at just $2.85 trillion, the lowest level since early 2021…

Meanwhile, foreign commercial banks ' cash assets have plummeted (as shown in the Federal Reserve's H.8 report), peaking at just over $1.5 trillion in July before falling by more than $300 billion to $1.173 trillion. In other words, the biggest victim of the government shutdown, and the main reason for the sharp tightening of financing conditions, appears to be the cash held by foreign banks—which has declined sharply over the past four months and was effectively requisitioned by the Treasury to pay for daily expenses during the shutdown.

Finally, to illustrate just how precarious the broader funding situation is, consider this chart showing Federal Reserve bank reserves plus overnight reverse repos (which served as a store of excess liquidity over the past three years, primarily to fund Treasury bill purchases, but are now exhausted). As you can see, the sum of the two is now at its lowest level since the end of 2020!

in conclusion

In summary, several observations and inferences can be drawn regarding liquidity:

The U.S. funding situation is dire and could deteriorate rapidly, as the Fed's ongoing QT this week could continue to drain liquidity from an already strained system. Moreover, given the brutal reflexivity of market liquidity—if daily indicators of repo market tightness (SOFR, general collateral rate, standing repo facility usage) worsen further, the market could retreat further, withdrawing even more liquidity, creating a toxic negative cycle similar to what was observed during the repo crisis of September 2019 and the basis trading crash of March 2020.

The above conclusion is bad news. The good news, however, is that, as shown above, the primary cause of the capital outflow lies with the U.S. Treasury itself, which raises some rather ironic questions: Does Bessant now effectively control the Federal Reserve—is its fiscal policy (especially during the government shutdown) dominating the direction of monetary policy?

In fact, there is a saying that if the U.S. Treasury’s TGA account had not surged from $300 billion to $1 trillion in the past three months, the Federal Reserve would not have needed to end QT so soon.

This naturally leads to the conclusion that since the government shutdown effectively “raised interest rates” by withdrawing more than $700 billion in liquidity from the market, a reversal of the current situation (government shutdown) could also lead to a new influx of funds into the market, as the Treasury will no longer be bound by special government shutdown accounting rules and will release hundreds of billions of dollars in cash from the Federal Reserve’s fiscal accounts into the broader economy.

Indeed, Wall Street traders experienced almost the exact same scenario in 2021, where the accelerated depletion of the Treasury’s cash reserves—similar to “implicit QE”—once the government reopened could trigger a massive rush to buy risky assets, which, coming just in time for the end of the year, propelled the stock market to a sharp rise at the time.

The well-known financial blog Zerohedge points out that this is why the fate of capital markets—and of liquidity-sensitive assets such as Bitcoin, small-cap stocks, and virtually all non-AI assets—may now be in the hands of Chuck Schumer (Senate Democratic Leader). Once the Democrat yields and agrees to reopen the government, the repurchase market is expected to normalize rapidly, and all risk assets will see a rebound.

Of course, this is not a viable long-term solution: the massive US budget deficit means that the financial situation will deteriorate again, and the Federal Reserve will eventually have to intervene, which may involve truly large-scale asset purchases—as Bank of America has done. Just as Mark Cabana recently predicted.

(Article source: CLS)