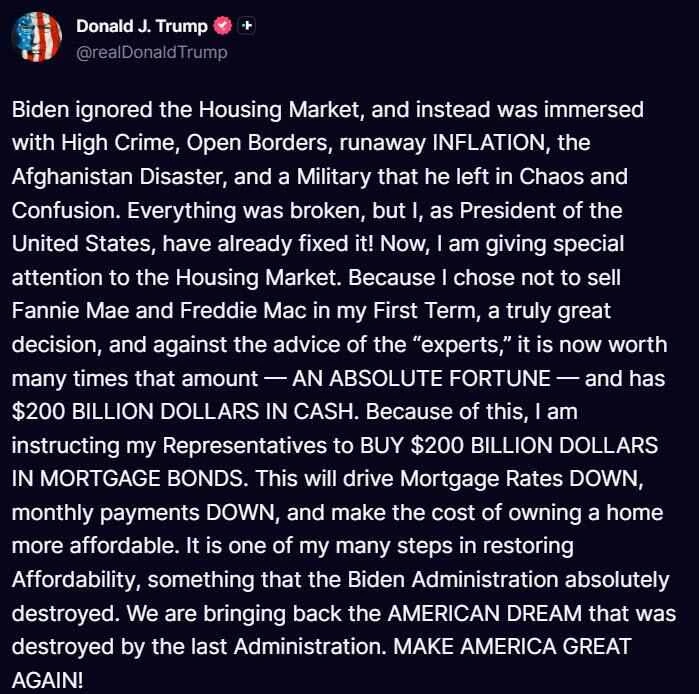

U.S. President Donald Trump said on Thursday that he is directing Fannie Mae and Freddie Mac to purchase $200 billion in mortgage-backed securities, a move he sees as the latest step to lower housing costs ahead of the November midterm elections.

Trump announced the move on social media on Thursday, saying it would "drive down mortgage rates, reduce monthly payments, and make homeownership more affordable."

He added that his decision not to sell Fannie Mae and Freddie Mac during his first term allowed the two companies to accumulate "$200 billion in cash," and that his current announcement of this decision is "based on this reason."

“This is one of many initiatives I’ve taken to restore housing affordability, and the Biden administration has completely undermined it,” Trump said.

Federal Housing Finance Agency Director Pulte subsequently stated that Fannie Mae and Freddie Mac would carry out President Trump's instructions.

Following this news, mortgage-backed securities (MBS) rebounded relative to U.S. Treasuries on Thursday, and mortgage-related stocks, including Rocket Cos. Inc. and LoanDepot, Inc., also rose.

Fannie Mae and Freddie Mac, two U.S. government-backed companies that received bailouts during the 2008 financial crisis, are continuing to increase their holdings of mortgage-backed securities. Latest data shows that in the five months ending last October, the two housing finance giants expanded their retained portfolios (i.e., the portion of bonds and loans not sold to investors) by more than 25%.

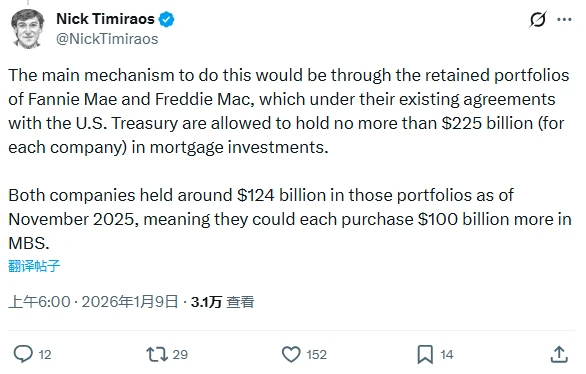

Nick Timiraos, a prominent journalist often referred to as the "new Fed's mouthpiece," stated that Trump has instructed his representatives to purchase $200 billion worth of mortgage-backed securities (MBS), primarily through the retained portfolios of Fannie Mae and Freddie Mac. Under their existing agreements with the U.S. Treasury, each company is limited to holding no more than $225 billion in mortgage-backed securities. As of November 2025, each company holds approximately $124 billion in these portfolios, meaning they could each purchase an additional $100 billion in MBS.

Trump's goal: to lower mortgage rates

Strategists point out that Trump's move is a relatively direct way to lower mortgage rates, as greater demand for MBS translates into narrower risk premiums, which in turn affect underlying mortgages.

“If the Trump administration allows Fannie Mae and Freddie Mac to expand their retained portfolios, there is no doubt that this will put downward pressure on mortgage rates—potentially at least 0.25 percentage points, or even more,” said David Dworkin, president and CEO of the National Housing Conference.

Freddie Mac said on Thursday that the average interest rate for a 30-year mortgage was 6.16% in the week ending January 8, near its lowest level since October 2024.

Citigroup estimated late last year that if the two government-backed companies were to add $250 billion to their portfolios, the bond risk premium could fall by about 0.25 percentage points, which could translate into a similar decrease in mortgage rates paid by consumers.

However, some analysts are skeptical about the actual effectiveness of the move. Neil Dutta, head of economics at Renaissance Macro Research, pointed out that mortgage spreads have already narrowed. "Therefore, I'm not sure how effective this move will be. Most of the room seems to have been fully utilized."

A series of policy measures have been introduced.

Federal Housing Finance Agency President Pulte said on Thursday, "The bond-buying program can be implemented quickly. We have the capacity to implement it, we have sufficient funds, and we will proceed in a very intelligent and large-scale manner."

Pulte said the bond-buying program, along with Trump's plan announced Wednesday to ban institutional investors from buying single-family homes, forms a policy "combination punch." Trump has indicated he plans to elaborate on the plan and other housing affordability proposals later this month at the World Economic Forum in Davos, Switzerland.

Previously, the president's advisory team had repeatedly warned that the cost of living issue had become a political burden for the Republican Party and could lead to the party losing control of Congress in the fall elections.

In an interview earlier Thursday, Pulte also said that Trump would decide within a month or two whether to proceed with the Fannie Mae and Freddie Mac IPOs.

However, Jaret Seiberg, managing director of TD Cowen, noted in a research report that the bond-buying program may mean that related IPO plans have been shelved. “We believe the president’s comments are detrimental to ending the administration of government-backed companies. Trump praised his decision not to take these companies public during his first term and suggested they could be used to improve housing affordability. This doesn’t sound like a president eager to push these companies to go public.”