This week, US financial The heated debate in the market regarding the extent of future interest rate cuts by the Federal Reserve is expected to intensify due to the release of a series of key economic data. For many market participants, this may also be the last "super week" of data releases in 2025…

With the long-delayed US monthly non-farm payrolls and inflation data set to be released in the coming week, these reports will undoubtedly fill the data gap caused by the US government shutdown, and more key employment data will be released in early January. These indicators will help answer a core question at the start of 2026: After three consecutive rate cuts, is the Federal Reserve nearing the end of its easing cycle, or does it need to take more aggressive rate-cutting actions?

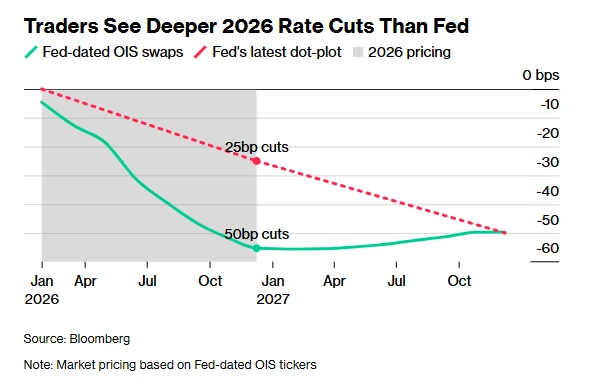

This is crucial for bond traders, who are currently betting that the Federal Reserve will cut interest rates twice next year to support the job market and outlook—despite persistently high inflation in the United States. This estimate is one more rate cut than suggested in the Fed's dot plot last week.

If these bets in the interest rate market are correct, it could pave the way for another strong rally in US Treasuries and even US stocks, with US Treasuries heading toward their best year since 2020.

George Catrambone, head of fixed income for the Americas at Deutsche Asset Management, said the single most important data point for interest rate direction next year may be the employment data released on Tuesday. "This is the only indicator I focus on; the direction of the labor market will determine the direction of interest rates."

Catrambone is one of the analysts who expect the Federal Reserve will have to cut interest rates significantly. Given the weak U.S. labor market indicators ahead of this week's non-farm payroll data release, he anticipates the Fed's rate cuts may be far greater than expected—he bought U.S. Treasuries last week when yields surged to multi-month highs.

Some Wall Street traders are currently building related option positions—these positions will be profitable if the market shifts to expect a rate cut by the Federal Reserve in the first quarter of next year.

It is worth noting that market pricing has not yet fully priced in the expectation that the Federal Reserve will cut interest rates again before the middle of next year, while the expected window for a second rate cut is in October next year.

Backlogged data becomes key

This has led industry insiders to continue to pay close attention to the upcoming release of some US macroeconomic data for November and October.

Following the Federal Reserve's policy meeting last week, the US November jobs report, to be released this Tuesday, is expected to further impact the outlook for borrowing costs in 2026. Media surveys indicate that non-farm payrolls are expected to increase by 50,000 in November. Previously delayed data showed that US jobs increased by 119,000 in September, exceeding expectations, but the unemployment rate rose to 4.4%, the highest level since 2021.

The report will also include backdated figures for October's nonfarm payrolls—data that was delayed due to the federal government shutdown. However, the U.S. Bureau of Labor Statistics had previously stated that the October unemployment rate data would be missing because the household survey for that month could not be conducted.

Macro strategist Ed Harrison said, "For the rally in U.S. Treasuries to continue, the jobs report on December 16 will be the next data hurdle. The market generally expects non-farm payrolls to increase by 50,000 in November. If the actual data is lower than expected, it may drive the bond market to continue its upward trend and bring forward the timing of the first fully priced-in rate cut from June next year to April next year."

Kevin Flanagan, head of fixed income strategy at WisdomTree, believes that "the threshold for the Fed to cut rates at its next meeting in January has been raised. People need to see clear evidence of an economic slowdown in the jobs report."

Flanagan stated that if the November non-farm payroll data remains at the (higher) level of September, it could trigger a sell-off in US Treasuries, pushing the 10-year Treasury yield up to 4.25%. He also believes that the Fed's rate-cutting cycle is nearing its end, citing his research that 3.5% is the so-called neutral interest rate—neither stimulating nor inhibiting the economy.

This view echoes, to some extent, Federal Reserve Chairman Jerome Powell's remarks last week, in which he stated that the policy rate is now within the "neutral" range estimated by Fed officials. Some believe this indicates limited room for further easing by the Fed. According to swap market data, traders expect the Fed to end this easing cycle by cutting rates to around 3.2%.

Besides the non-farm payroll data, the longest shutdown in US government history that occurred earlier in the fourth quarter also affected another closely watched economic indicator: the CPI. Industry experts currently expect the November CPI report, to be released on Thursday, to show that both the overall CPI and the core CPI (excluding food and energy prices) rose by 3% year-on-year, and 0.3% month-on-month. Currently, US inflation remains consistently above the Federal Reserve's official 2% target.

The U.S. Commerce Department will also release October retail sales data this Tuesday. Economists predict that core retail sales, excluding automobile and gasoline spending, will rise 0.2% month-over-month, indicating that consumer demand remains relatively strong at the beginning of the fourth quarter.

Of course, besides the flurry of economic data releases, another major event is brewing: as President Trump pressures for significant interest rate cuts, some investors have shifted their focus to Powell's successor after his term expires in May. Trump's selection process is now in its final stages.

Janet Rilling, head of the fixed income team at Allspring Global Investments, noted, "Regardless of whether the economy is overheating, the appointment of a new chairman means the Fed will adopt a more dovish stance." She added, "The job market could become a cover for policy adjustments. While we don't expect a significant rise in the unemployment rate, a slightly weaker job market could provide an excuse for further rate cuts in the future."

(Article source: CLS)