On Wall Street, as the new year approaches, a growing number of industry institutions seem to be embracing a theme: the tech giants that have fueled the bull market in recent years may no longer dominate the market next year…

Including Bank of America and Morgan Stanley Strategists at several Wall Street firms, including Nvidia, are currently advising clients to buy into less popular sectors—they are listing healthcare, industrials, and energy as their top investment targets for 2026, rather than Nvidia. and Amazon The "Big Seven".

For years, investing in tech giants has been a consistently wise choice in the US stock market—their strong balance sheets and substantial profits are convincing. However, the market is increasingly questioning whether this sector can continue to support its high valuations and the rise of artificial intelligence. Significant investment in technology – the sector has surged by approximately 300% since the start of the bull market three years ago.

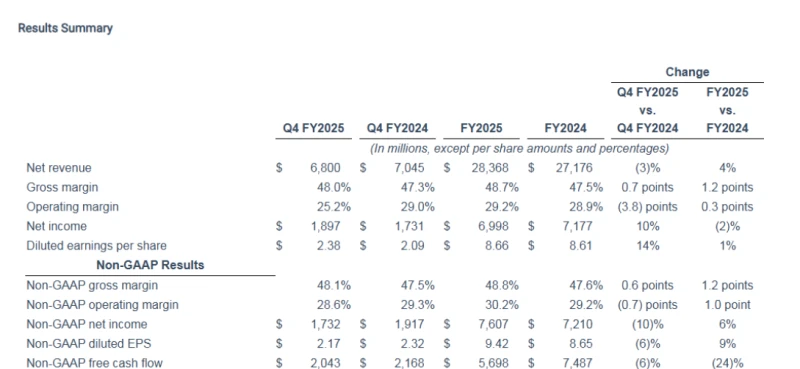

Last week, Oracle , considered a bellwether company in the AI field, Hebotong The financial results fell short of expectations, further exacerbating these concerns.

Concerns surrounding this hot AI deal come at a time of growing market optimism about the overall US economy in the new year. This backdrop could prompt investors to flock to lagging sectors within the S&P 500, at the cost of selling off mega-cap tech stocks…

Institutions widely predict a style shift in US stocks.

Craig Johnson, chief market technology analyst at Piper Sandler & Co., said, "I've heard that some people are pulling out of the 'Big Seven' deals and moving into other areas of the market. They're no longer just chasing Microsoft." Instead of investing in giants like Amazon , they have expanded their investment scope to a wider range of areas.

Signs of overvaluation have begun to dampen investor enthusiasm for tech giants. As traders position themselves to capitalize on anticipated economic growth next year, funds are shifting towards undervalued cyclical stocks, small-cap stocks, and economically sensitive sectors.

Market data shows that since US stocks hit their recent lows on November 20, the Russell 2000 small-cap index has risen 11%, while the Bloomberg Big Seven index has only risen half that amount. During the same period, the S&P 500 equal-weighted index has consistently outperformed its market capitalization-weighted counterpart—the equal-weighted index treats giants like Microsoft and small-cap stocks like Newell Brands "equally."

Jason De Sena Trennert, chairman of Strategas Asset Management, pointed out that the company currently prefers the S&P 500 equal-weighted index rather than the benchmark index, and expects a "major sector rotation" in 2026, with funds flowing into sectors that have lagged behind this year, such as financial stocks and consumer discretionary stocks.

Morgan Stanley's research team shares the same view, highlighting the sector rotation trend in its annual outlook report. Michael Wilson, Morgan Stanley's chief U.S. equity strategist and chief investment officer, stated, "We believe tech giants will continue to perform well, but will lag behind emerging sectors, particularly consumer discretionary (especially durable goods) and small-cap stocks."

Wilson, who accurately predicted the rebound after the April crash, pointed out that as the economy enters the "early stage of the cycle" after bottoming out in April, the market diffusion trend is expected to be supported. This environment often benefits lagging sectors, such as low-quality, more cyclical financial and industrial sectors.

Is the market poised for a "multi-pronged boom" next year?

Bank of America's chief strategist, Michael Hartnett, pointed out last Friday that the market is positioning itself for a "hot economy" strategy in 2026, rotating from large-cap stocks on Wall Street to mid-cap, small-cap, and micro-cap stocks on the Main Street.

Earlier last week, Ed Yardeni, a senior Wall Street strategist, also released a report at his eponymous firm, Yardeni Research, advising investors to underweight tech giants relative to other sectors of the S&P 500, anticipating a shift in earnings growth. He has consistently recommended overweighting information technology and communication services since 2010. The sector, but recently changed this strategy.

Fundamental data also supports this view. Goldman Sachs According to group data, as the profit contribution of the top seven companies in the S&P 500 index decreased from 50% to 46%, the profit growth rate of the remaining 493 companies in the S&P 500 index is expected to accelerate from 7% this year to 9% in 2026.

Michael Bailey, research director at FBB Capital Partners, noted that investors will expect to see evidence that these 493 companies have met or exceeded overall earnings expectations before becoming more optimistic. "If employment and inflation data remain unchanged, and the Fed continues its accommodative policy, they may see an upward trend next year," he added.

Last Wednesday, the Federal Reserve cut interest rates for the third consecutive meeting and reiterated its expectation of another rate cut next year, which added new momentum to the US stock market.

HSBC Holdings Chief cross-asset strategist Max Kettner points out that utilities The financial, healthcare, industrial, energy, and even consumer discretionary sectors have all seen steady growth this year, indicating that a broad-based market rally has taken shape.

Kettner stated, "For me, the focus is not on whether to buy tech stocks or other sectors, but on whether tech stocks can drive other sectors to rise together. I believe this trend will continue in the coming months."

(Article source: CLS)