①US Semiconductor Applied Materials, a leading equipment manufacturer The company released its Q4 FY2025 financial report. Although the data was better than expected, revenue from China was severely impacted by the tightening of US semiconductor export controls. ② The company expects Chinese customers to reduce procurement spending in 2026, despite the impact of artificial intelligence... The surge in investment may have offset some of the impact, but the share price still fell 3.25%.

After the market closed on Thursday Eastern Time, Applied Materials, a major U.S. semiconductor equipment company, released its fiscal fourth quarter earnings report for 2025.

Although the financial report itself showed better-than-expected results, the company stated that the tightening of US semiconductor export controls had severely impacted its revenue from China, causing investors to become increasingly concerned about the company's performance prospects.

Despite the company stating that strong demand for storage products related to the surge in AI investment may offset this impact to some extent, its shares still fell 3.25% in after-hours trading.

Applied Materials' revenue in China has been impacted.

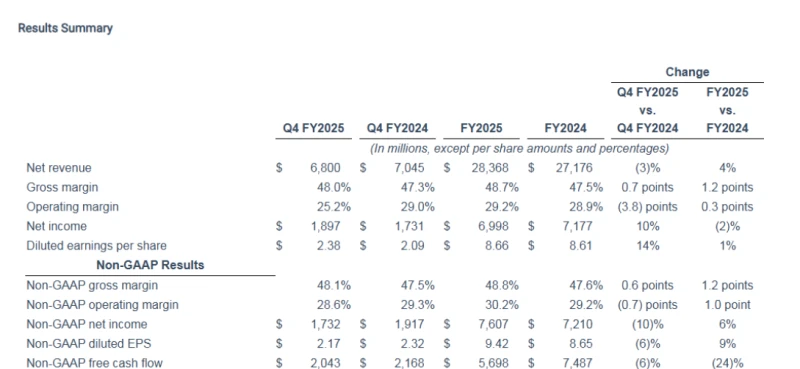

The financial report shows that the application company's performance in the fourth fiscal quarter ending October 31 was as follows:

Revenue: $6.8 billion, down 3% year-over-year, but higher than analysts’ expectations of $6.68 billion.

Non-GAAP earnings per share: $2.17, exceeding the expected $2.11.

The company projects revenue of $6.85 billion (plus or minus $500 million) for the quarter ending in January. Analysts, on average, expect revenue of $6.76 billion for the quarter, according to data collected by LSEG.

Excluding one-time items, the company expects earnings per share of $2.18, plus or minus 20 cents, higher than the expected $2.13.

The data above alone may not seem worrying. However, in the details of the financial statements, investors discovered that Applied Materials' largest market—China—has seen its share of revenue decline from nearly 40% in recent years to around 20%.

The Chinese market contributed $1.96 billion in revenue to Applied Materials in the fourth fiscal quarter, a year-on-year decline of 8.1% , mainly due to policy restrictions imposed by the Trump administration.

According to the China Economic Times, in late September this year, the U.S. Bureau of Industry and Security (BIS) issued an export control penetration rule, imposing additional export control sanctions on subsidiaries of companies listed on the U.S. "Entity List" and other entities that hold more than 50% of the shares.

In October, Applied Materials stated that it expected its revenue to decrease by $600 million in fiscal year 2026 due to pressure on its business from tightened U.S. semiconductor export controls. At the time, the company also announced it would lay off approximately 4% of its workforce, or about 1,400 jobs, to streamline operations.

In its after-hours earnings statement on Thursday, the company confirmed that its fiscal 2026 revenue would be $600 million lower, and complained that U.S. government actions were making it difficult to ship certain products and services to customers in China. However, these products will ship within the next three months (until January next year) and are already included in the company's earnings forecast.

The company anticipates that tightened U.S. export restrictions may dampen demand from Chinese customers, and that Chinese downstream manufacturers will further reduce their spending on the company's chip manufacturing equipment in 2026.

Chinese customers are turning to other companies.

Applied Materials CEO Gary Dickerson said that while other foreign competitors are still supplying products to Chinese companies under the restrictions imposed by the Trump administration, his company is unable to provide services to Chinese companies.

Dixon stated during the conference call:

“Non-US equipment companies are not subject to such restrictions, so restricted (Chinese) customers can purchase products from these (non-US) companies, even if they would otherwise prefer to purchase from Applied Materials.”

Due to tightened controls by the United States, Applied Materials is no longer able to supply memory chips to China. The company also has older-generation chip manufacturing equipment, but it expects the Trump administration will not impose significant restrictions on shipments to China in the future.

The company’s chief financial officer, Brice Hill, told investors that customer demand may pick up in the second half of next year amid the AI boom: “Our customers have given us feedback that spending on wafer fab equipment may accelerate in the second half of 2026.”

(Article source: CLS)