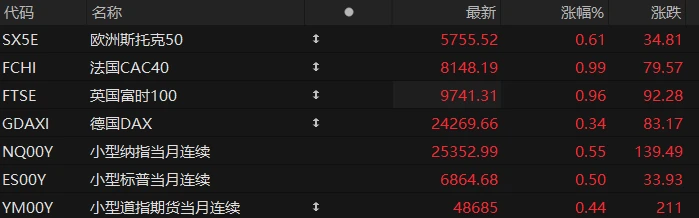

U.S. stock index futures rose across the board in pre-market trading on Monday, while major European indices also generally gained. As of press time, the Nasdaq... S&P 500 futures rose 0.55%, S&P 500 futures rose 0.50%, and Dow Jones futures rose 0.44%.

In terms of individual stocks, most star tech stocks rose in pre-market trading, with Tesla among them. Nvidia Micron Technology It rose by more than 1%.

Popular Chinese concept stocks showed mixed performance in pre-market trading, with Baidu... Alibaba fell nearly 2%. NIO fell more than 1%; XPeng Motors Slight increase.

Gold/USD rose for the fifth consecutive day, reaching $4340, while silver/USD rose more than 3%. Gold also rose in pre-market trading. AngloGold Ashanti and Goldfields... Cordellen Mining Harmony Gold rose more than 3%. It rose by more than 2%.

Following the Federal Reserve's 25-basis-point rate cut last week, market attention may shift to the selection of the person to succeed Powell as the next Fed chair. US President Trump believes either Kevin Hassett or Kevin Warsh will be appointed.

This week's economic calendar will continue to digest the delayed data accumulated due to the government shutdown, with the November jobs report scheduled for Tuesday and the November CPI data to be released on Thursday. On the earnings front, Micron Technology will release its quarterly results on Wednesday, while investors will see Accenture's earnings released on Thursday. Nike FedEx And the earnings report from Darden Restaurant (DRI.US). In addition, the Bank of England, the European Central Bank, and the Bank of Japan will all announce their interest rate decisions this week.

Hot News

Is the market underestimating the probability of a rate cut in January? This week's employment and CPI data will be key variables.

Powell's remarks after the December policy meeting were interpreted by the market as a hawkish signal. However, a recent report from UBS suggests that the market may have overreacted, and the upcoming employment and CPI data will provide key information for judging whether a rate cut will occur in January.

A recent report by UBS's Jonathan Pingle team noted that Powell's "cautious" stance on certain data primarily concerned the quality of household survey data affected by the government shutdown, rather than a rejection of all economic data. Previously, Powell explicitly stated at a press conference that the Federal Open Market Committee (FOMC) had not yet made any decisions regarding its January meeting, and emphasized that policymaking would depend on the data to be released.

The FOMC will release both the October and November non-farm payroll reports this Tuesday, a rare arrangement that will provide a more comprehensive assessment of the labor market. UBS expects non-farm payrolls to decline by 20,000 in October and increase by 45,000 in November, influenced by the federal government's Deferred Retirement Program (DRP). More importantly, the unemployment rate is likely to rise to 4.5% in November, continuing the labor market slowdown.

The November CPI data will be released on Thursday. However, due to data collection disruptions caused by the government shutdown, the CPI report may be subject to significant noise.

JPMorgan Chase 2026 Storage Market Outlook: Market Cap of Giants Approaching $1 Trillion This Year, $1.5 Trillion by 2027

In its latest research report, JPMorgan Chase pointed out that the current leading memory chip... The total market capitalization of manufacturers is approaching $1 trillion. Based on historical valuation averages, this figure is projected to surge to $1.5 trillion by 2027, meaning that leading manufacturers still have more than 50% upside potential.

On December 14, JPMorgan Chase stated in its latest report that the current cycle will be the longest and strongest storage growth cycle in history.

Investors are generally concerned that new capacity in 2027 will lead to an oversupply of DRAM. JPMorgan's data models suggest that this concern is unfounded—capacity squeeze from HBM and the structural demand for AI inference (inference consumes three times the memory of training) will cause DRAM bit supply growth to lag behind demand growth for the next two years.

The market is experiencing a "dual-track" pricing structure. Strong B2B (enterprise/AI) demand is supporting high prices, while B2C (consumer) faces cyclical pressures. However, overall, the upward trend in server-side demand will completely offset the downside risks on the consumer side.

Stop focusing on AI and tech giants in 2026! - Goldman Sachs Bank of America predicts an impending rotation in US stocks.

Investors have been focusing on artificial intelligence since the beginning of this year. (AI) and the big tech giants that drive the stock market rally. But as the year draws to a close, Goldman Sachs says that bigger opportunities next year may come from other sectors.

"From an industry perspective, we expect accelerated economic growth in 2026 to most significantly drive earnings per share growth in cyclical sectors, including industrials, materials, and consumer discretionary," the bank's analysts wrote in a recent report. They added that Goldman Sachs ' overall forecast also takes into account the easing of tariff pressures.

Goldman Sachs analysts predict that earnings per share (EPS) growth for real estate companies will rise from 5% this year to 15% next year, while EPS growth for consumer discretionary companies is expected to increase from 3% to 7%. Industrial stocks are also expected to rebound sharply, with EPS growth projected to accelerate from 4% to 15%.

In contrast, Goldman Sachs expects the earnings growth of information technology companies to slow from 26% in 2025 to 24% in 2026.

Bank of America Savita Subramanian, head of U.S. equities and quantitative strategy at Bank of America, also believes that AI- related stocks will face a "downturn" next year, with investors continuing to sell off.

Platinum prices have already surged by over 90% this year, and analysts expect them to rise another 30% next year.

This year is the year for precious metals It was a year of collective price surges, with platinum rising by as much as 93%, making it one of the most watched assets in the market.

Analysts generally believe that platinum's upward trend will continue. FXEmpire financial analyst Muhammad Umair stated that platinum prices broke through a multi-year downtrend this year, marking the beginning of a revaluation cycle, with funds shifting towards undervalued precious metals .

He predicts that platinum will surge to the $2,170-$2,300 range by 2026. This outlook is significantly higher than the expectations of other Wall Street institutions, many of which believe the median platinum price next year will be between $1,550 and $1,670 per ounce. As of press time, platinum futures prices are around $1,785 per ounce.

The gold-platinum ratio is also showing signs of a trend. After peaking at 3.59 in April, the ratio has plummeted to its current level of 2.47. If it falls further below 2.2, it could potentially drop to 1.8 to 2.0. This implies that platinum prices still have greater upside potential than gold prices.

However, some institutions have warned that with platinum prices currently near multi-year highs, investors should remain cautious, especially given the market's sensitivity to global economic fluctuations, and a technical correction is inevitable.

US Stocks Focus

True self-driving It's here! Musk: Tesla begins driverless Robotaxi road tests.

Last Sunday (December 14), an X user filmed a Tesla Model Y driving on the streets of Austin. The car appeared to be empty, with no safety supervisor present.

This video sparked controversy online, particularly regarding Tesla. The audience was extremely excited, with some even immediately opening ride-hailing apps to place orders to verify whether the vehicle was still equipped with a safety driver (the results showed that a safety driver was still present).

Tesla CEO Elon Musk responded later Sunday, saying the company is currently testing driverless taxis without human safety drivers, although it does not appear to be open to paying passengers yet.

According to data from Robotaxi Tracker, run by Austin-based autonomous driving industry observer Ethan McKenna, Tesla currently has 31 active Robotaxi vehicles in Austin, up from 29 in November.

In an October podcast, Musk revealed that Tesla aims to expand its fleet of driverless taxis in Austin to 500 vehicles by the end of the year.

TSMC Will Samsung's monopoly be challenged? Samsung is reportedly in talks with AMD about a possible 2nm chip collaboration.

Samsung is ramping up its efforts to find customers for its advanced chip manufacturing processes, following its partnership with Apple. After securing a substantial order from Tesla, it appears to be discussing the possibility of chip manufacturing with AMD.

Although TSMC remains the mainstream supplier of 2nm chips for the technology industry, competition in the chip industry is rapidly intensifying due to TSMC 's severely limited production capacity and the increasing acceptance of Samsung's 2nm technology and the rapid development of its foundry business.

Reports indicate that AMD is in talks with Samsung, a semiconductor foundry, regarding a collaboration on 2nm process technology, and may be working together to develop next-generation CPUs. This could be the EPYC Venice CPU, or possibly the Olympic Ridge consumer CPU, with an expected release date of the end of 2026.

The two companies plan to finalize the contract around January next year. AMD will then assess whether Samsung's process can meet the required performance levels, but industry insiders believe that Samsung is very likely to win the mass production contract.

According to insiders, if Samsung's upcoming prototypes meet AMD's quality requirements, it will greatly enhance Samsung's reputation, but be a heavy blow to TSMC. This not only means TSMC will lose a long-term customer, but also that its monopoly in cutting-edge logic processes will be truly challenged for the first time.

SpaceX reportedly begins selecting investment banks for what is touted as the "largest IPO in history."

According to market sources, executives at SpaceX, Elon Musk's rocket manufacturer, are beginning the process of selecting Wall Street banks. The company provides advisory services for its initial public offering (IPO).

Reports indicate that several investment banks are scheduled to conduct preliminary bidding this week, a process known in the industry as the "bake-off" stage. This refers to a process where companies planning an IPO invite multiple investment banks to participate in the bidding to select the most suitable partner to handle their IPO-related underwriting, advisory, and other matters.

This represents a significant step forward for SpaceX toward an IPO.

Last Tuesday, it was reported that SpaceX is seeking an IPO next year, aiming to raise well over $30 billion, potentially creating the largest IPO in history with a target valuation of approximately $1.5 trillion.

Although SpaceX has not officially announced its IPO, Musk's public statements and internal memos from company executives have sent clear signals of an IPO.

(Article source: Hafu Securities) )