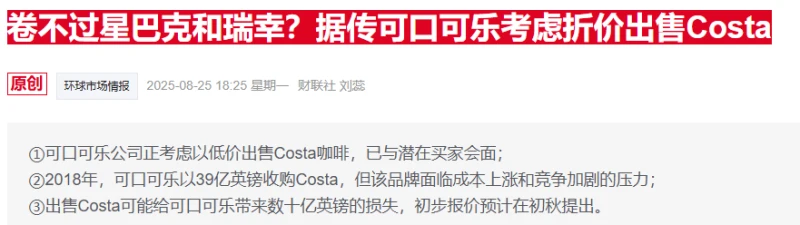

Coca Cola The proposed sale of Costa Coffee is at risk of falling through. In an effort to salvage the deal, Coca-Cola held final negotiations with private equity firm TDR Capital over the weekend.

Sources familiar with the matter revealed that following a board meeting in New York last week, Coca-Cola selected TDR Capital as its preferred bidder for the sale of Costa. Costa is the UK's largest coffee chain, while TDR Capital owns the British supermarket chain Asda.

However, a source familiar with the matter said that Coca-Cola and its financial advisor, Lazard, have encountered obstacles in negotiations with TDRs over price. The source indicated that Coca-Cola will decide this week whether to completely suspend the sale process.

One source said that the deal currently under discussion includes Coca-Cola retaining a minority stake in Costa, adding that the stake could be adjusted in favor of Coca-Cola to facilitate the deal.

Previous reports indicated that Coca-Cola hoped to sell Costa for around £2 billion – almost half of its acquisition price.

In 2018, Coca-Cola acquired Costa from Whitbread for £3.9 billion. However, the division has since struggled to compete with independent coffee shops and rivals such as Greggs.

At the same time, rising costs, from coffee beans to employee wages, have dragged the business into financial losses.

According to the latest financial data disclosed by Companies House, Costa achieved revenue of £1.2 billion in 2023, but recorded an annual loss of £13.8 million.

A source familiar with the matter said TDR is looking to acquire Costa's operations in the UK and other international markets. Other bidders include Special Situations, a subsidiary of Bain Capital, and Centurium Capital is also involved in the bidding.

Coca-Cola announced last week that its Chief Operating Officer, Henrique Braun, will succeed James Quincey as CEO, effective March 31, 2026.

In July of this year, James Kunjie told analysts that Costa "failed to deliver satisfactory results."

(Article source: CLS)