On Tuesday, Eastern Time, Ken Griffin, founder and CEO of Citadel, the world's largest hedge fund, called on Trump to "create distance" between the Federal Reserve and the White House, highlighting growing investor concerns that the US president will choose a close ally to serve as Fed chairman.

In a recent interview, when asked whether Kevin Hassett, director of the White House National Economic Council, should lead the Federal Reserve, he said, "The most important thing the president and the incoming Fed chairman can do... is to create distance between the White House and the Fed."

As of the beginning of this year, Griffin's hedge fund managed over $65 billion in assets. According to Institutional Investor magazine, since its inception in 1990, Citadel Investments had generated $74 billion in profits for investors by the end of last year, making it the "most profitable hedge fund in history." With its historical profits surpassing Bridgewater and the retirement of Ray Dalio, Griffin has become the top figure in the hedge fund industry.

Griffin, who voted for Trump in last year's US election, is a major donor to Republican politicians. However, he later criticized Trump's trade policies, saying they could damage America's "brand" and its government bond market.

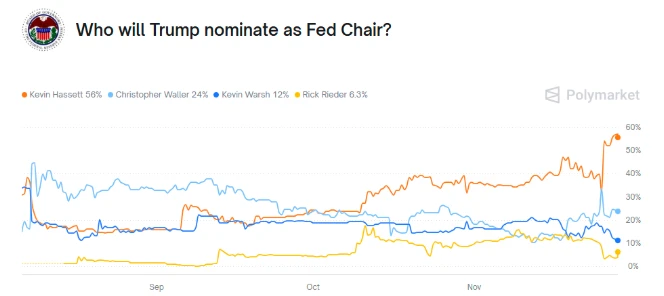

Griffin's remarks came as the race to succeed Powell reached its climax. Powell's term as Federal Reserve Chairman ends on May 15, 2026, and Trump recently stated that he has decided on who will succeed him and will announce the nomination early next year. Hassett and former Federal Reserve Governor Kevin Warsh are considered the most likely candidates to succeed Powell.

In addition to criticizing the Federal Reserve for not cutting interest rates enough, Trump recently reiterated his past stance that the Federal Reserve Chairman should consult the President on interest rate decisions.

“We don’t usually do that anymore. It used to be routine, but we should continue to do it now. My point is insightful and should be heard,” he said.

Hassett responded that if elected Federal Reserve Chairman, he would consider President Trump’s policy recommendations, but the central bank’s interest rate decisions would remain independent.

“The president has a very firm and well-founded view on what we should do. But ultimately, the Fed’s responsibility is to remain independent and work with the members of the Federal Reserve Board and the Federal Open Market Committee (FOMC) to reach a consensus on what interest rates should be at,” he added.

Griffin declined to endorse any candidate on Tuesday, saying he believed that adding his own choice to the discussion "would not help the current debate or decision."

"I hope the president will make decisions that can control U.S. inflation from the perspective of giving global markets, American investors, and consumers the greatest possible peace of mind," he added.

(Article source: CLS)