If White House National Economic Council Director Kevin Hassett is indeed nominated by Trump to be the next Federal Reserve Chairman, he may effectively serve as a "shadow Fed Chairman" for up to five months—and the market will undoubtedly be watching his every word closely!

Since Trump made it clear that he would fire current Federal Reserve Chairman Jerome Powell—or at least refuse his re-election—investors have been speculating about how the next Fed chairman would be chosen. Now, the countdown to the complete revelation of this suspense has undoubtedly begun:

Just before Thanksgiving, U.S. Treasury Secretary Bessant hinted that Trump might announce his nominee before Christmas, revealing that the candidates had been narrowed down to five. Hours later, industry media, citing sources, reported that Hassett had become the frontrunner…

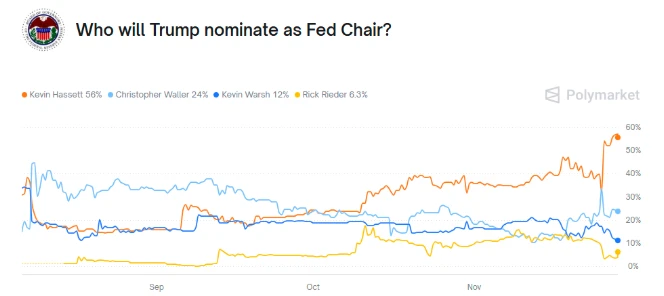

Betting markets such as Polymarket reacted immediately, with Hassett's probability of being elected the next Federal Reserve Chairman jumping to over 50%—far exceeding Fed Governor Waller's odds of about 22%, after the two had been neck and neck for a long time.

Even Nick Timiraos, a renowned journalist known as the "new Fed mouthpiece," wrote an article on Monday admitting that the selection process for the Fed chair appears to be nearing its end, with Trump leaning towards his longtime advisor, Hassett. Timiraos believes that if Hassett is ultimately nominated, it will be because he meets two key criteria set by Trump—loyalty and credibility in the markets…

However, with Hassett's victory in sight, many industry insiders are seeing this as a wake-up call for the politicization of the Federal Reserve.

Another of Trump's advisors, Stephen Milan, currently occupies one of the seven seats on the Federal Reserve Board of Governors; two governors appointed by Trump during his first term—Woller and Bowman—remain in office; and the legal proceedings surrounding Federal Reserve Governor Cook in January next year will likely free up another seat.

Furthermore, if Powell resigns completely (ending his term as chairman and resigning from his seat on the Federal Reserve Board of Governors), the governors appointed by Trump will hold a 5-2 majority of seats on the Federal Reserve Board of Governors.

At that time, the market's focus will likely shift not only to the direction of interest rates, but also to the extent to which the Federal Reserve Board will support Trump's desire to "lower interest rates even if inflation remains high and the economy continues to overheat."

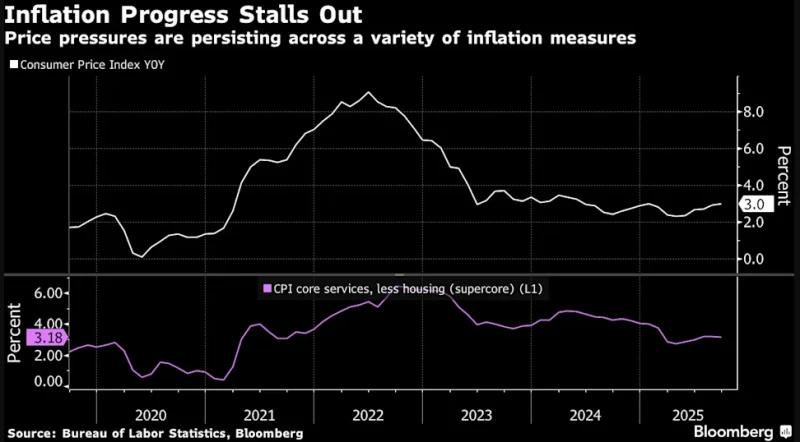

Milan is a staunch supporter of Trump's publicly called for a significant 2-3 percentage point rate cut. Since Trump returned to the White House, Waller and Bowman have also clearly shifted to a dovish stance, especially while other Fed officials remain wary of inflation—currently, the US inflation rate is still about 1 percentage point above the Fed's 2% target.

Will the loudest voice in the next five months come from the "shadow chairman"?

From a market perspective, Wall Street and the US housing market may cheer for this prospect of easing that could stimulate nominal growth. However, in the current climate of increasing caution regarding real returns in the fixed-income sector, the risk premium on US Treasuries, the steepening yield curve, and market inflation expectations will all be closely watched…

The most direct price reaction might be a renewed sell-off of the dollar. Since last week, the dollar may have begun to show signs of weakness reminiscent of early 2025.

Meanwhile, analysts point out that this also highlights the crucial importance of the five-month transition period during which Trump's chosen candidate serves as the "shadow Federal Reserve chairman"...

If Hassett is chosen, the market generally believes that this close ally of Trump will have a stronger political leaning than Waller—although both have backgrounds as central bank economists, Hassett comes directly from the executive branch, while Waller has been working at the Federal Reserve for the past five years.

As the transition period approaches, opinions from all sides will become a key indicator. The chair not only has voting seats on the Federal Open Market Committee (FOMC), but also bears the traditional responsibilities of a consensus builder and influential figure, and holds decisive voting power when opinions differ.

It's worth noting that Hassett's current position has kept him in a high-profile position throughout the year—last month alone, he gave at least six media interviews or formal speeches. His views can be summarized as follows:

Hassett believes there is no substantial reason to prevent interest rates from falling further;

He warned of “partisan politics” within the Federal Reserve and claimed that the central bank would not be “coerced” by politics.

He downplayed the price pressures caused by tariffs, calling them mostly one-off effects;

He also stated that a 50-year mortgage program is "under discussion"...

While Hassett staunchly defended the Federal Reserve's independence during Trump's first term, he has maintained his support for Trump this year, sharply criticizing the Fed and Powell. This summer and last month, he accused the Fed of not cutting interest rates more aggressively due to partisan bias, a claim refuted by almost all Fed policymakers.

Incidentally, Hassett's most famous achievement in the industry is perhaps his co-authored book, *Dow Jones 36,000*, written during the peak of the dot-com bubble in 1999. The book predicted that the stock market index would more than triple within five years and claimed that stocks were actually less risky than bonds. Ultimately, the Dow Jones did reach 36,000 points—but it took 21 years, during which time it plummeted by more than a third between its 2000 peak and its 2002 trough.

Overall, Hassett is considered a conservative economist with some bold ideas for "reforming" the Federal Reserve. However, compared to Miguel Milan, the Fed governor appointed by Trump this year and the "architect of the Mar-a-Lago agreement," Hassett hasn't made many other outrageous statements.

However , if Hassett is successfully approved to become the Federal Reserve Chairman this month, every public speech he makes could have a significant impact on the market. His views will undoubtedly be closely examined to determine their similarities and differences with Powell's – and if their views diverge, it could trigger significant market volatility.

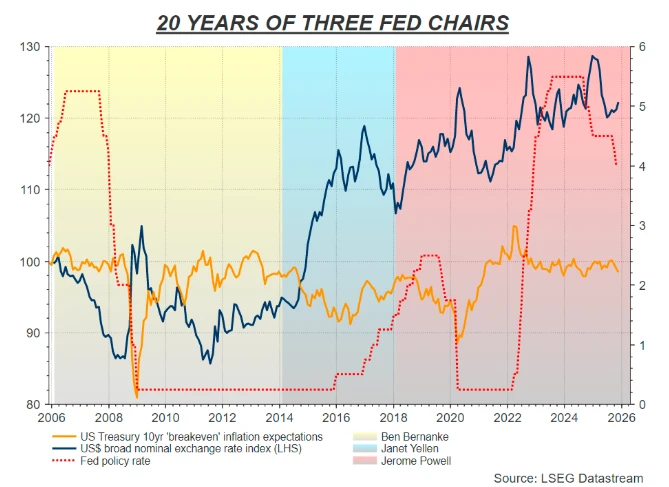

As Timiraos recently noted in his article this week, the current succession of Federal Reserve chairs is exhibiting an atypical pattern rarely seen in decades —since Alan Greenspan succeeded Paul Volcker in 1987, every newly appointed Federal Reserve chair (Bernanke, Yellen, Powell) has followed the same path—promising to maintain policy continuity to promote market stability.

This time, however, the candidates on the list had to distance themselves from the current chairman, Powell.

During the months that Hassett publicly campaigned for the position, he also attacked his future colleagues. If he does take office next May, he may have to maintain the loyalty of those who helped him get the nomination, while also proving his credibility to these colleagues and the market.

(Article source: CLS)