With the approval of my country's first batch of Level 3 autonomous driving vehicles, the autonomous driving industry chain has taken another crucial step towards large-scale deployment. Against this backdrop, the commercialization process and profitability of Robotaxi (autonomous taxis) are becoming a focus of continued industry attention.

On December 16th, at Pony.ai At the 2025 media briefing of Pony.ai (02026.HK), Wang Haojun , co-founder and CFO of Pony.ai, introduced that in terms of overall operation, the size of Pony.ai 's Robotaxi fleet has increased from more than 200 vehicles last year to nearly 1,000 vehicles by the end of this year, and is expected to reach 3,000 vehicles by the end of 2026, and is expected to reach 100,000 vehicles by 2030. This means that user acceptance has entered a new stage and will drive the accelerated growth of Robotaxi.

Industry experts believe that Robotaxi has now formed a closed loop in terms of business, and profitability may be just around the corner.

In November of this year, Pony.ai's seventh-generation Robotaxi began fully driverless operations in Beijing, Guangzhou, and Shenzhen. Commercial operation. According to information obtained by reporters from Cailian Press from the company, over 600 seventh-generation Robotaxi units have rolled off the production line. Based on the Guangzhou operating area alone, the daily operating data for the past two weeks since the start of commercial operation has shown that the Robotaxi unit economy (UE) has turned positive at the single-city level, with an average of 23 orders per day.

It is understood that a key factor in the expansion of the Robotaxi fleet and its eventual profitability lies in cost reduction.

"Currently, there is still room for further cost reduction," said Wang Haojun. He noted that the BOM (Bill of Materials) cost of the seventh-generation Robotaxi's autonomous driving kit has decreased by 70% compared to the previous generation. The BOM cost of the seventh-generation autonomous driving kit, which is expected to be mass-produced in 2026, is projected to be 20% lower than this year's standard.

Besides hardware costs, operating costs are also a key variable determining the cost per vehicle. This includes the expenses for personnel involved in remote assistance (decision support and passenger demand processing) and ground support. "Currently, our actual personnel-to-vehicle ratio is 1:20 (i.e., 1 person supports 20 vehicles), and we are working towards optimizing it to 1:30. We expect to reach this ratio by the end of this year, which will further reduce the cost of remote assistance personnel per vehicle," said Wang Haojun.

Regarding overseas expansion, Wang Haojun mentioned, "The 'asset-light model' accelerates scale expansion. We plan to use this model to increase sales volume in overseas markets, rather than having all vehicles on our asset list." The company has done a lot of preliminary work for global market development, successively obtaining Robotaxi/autonomous driving test permits in Luxembourg, the UAE, Qatar, South Korea, Singapore, and other places. They have also found important partners with both resources and experience in these markets, and they intend to become Robotaxi operators when the local demonstration operations truly open up in the future.

When asked by a reporter from Cailian Press about the pace of Robotaxi rollout in overseas markets, Wang Haojun said that he expects the total number of Robotaxi vehicles overseas to be a few hundred next year.

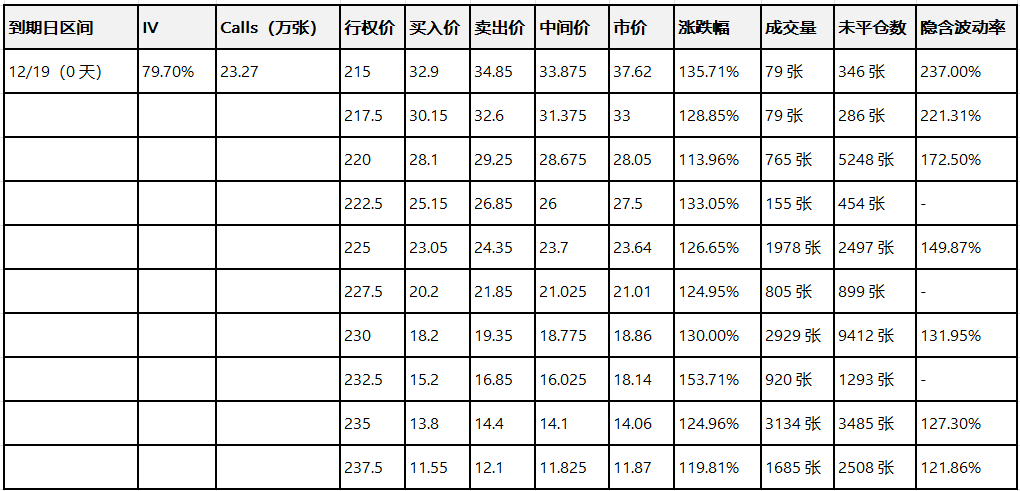

In the capital markets, Pony.ai completed its dual listing on the US and Hong Kong stock exchanges in November of this year. Possibly spurred by news of the breakthrough in L3-level access, Pony.ai-W and Hesai... Hong Kong-listed intelligent driving concept stocks such as W (02525.HK) and RoboSense (02498.HK) continued their upward trend today.

The financial report shows that in the third quarter of this year, Pony.ai's Robotaxi business achieved revenue of 47.7 million yuan, a year-on-year increase of 89.5%. Among them, revenue from passenger fares increased by more than 200% year-on-year.

(Article source: CLS)