The following are the latest ratings and target prices for US stocks from various brokerage firms:

CITIC Securities We give Oklo Inc-A (OKLO.N) an "Overweight" rating:

The growing demand for electricity driven by AI and the US raising its nuclear power target to 400GW have propelled the small modular reactor (SMR) industry to a turning point. Oklo, a technology leader, employs sodium-cooled fast reactor technology and holds 14GW of potential orders. Its innovative business model has shortened the deployment cycle to 24 months. Its first reactor, Aurora-INL, has completed the preliminary NRC review process and possesses long-term development potential.

Guolian Minsheng Maintaining Oracle (ORCL.N) Overweight rating:

FY26Q2 total revenue was $16.1 billion, up 13% year-over-year, with cloud revenue at $8 billion, up 33% year-over-year. IaaS revenue grew 66% year-over-year, and GPU-related revenue surged 177%. RPO reached $523 billion, up 433% year-over-year, driven by improved order diversification. Although gross margin was under pressure and FCF was negative in the short term, AI-driven accelerated delivery of OCI computing power and steady growth in SaaS businesses such as Fusion and NetSuite suggest promising long-term growth prospects.

CITIC Securities maintains its buy rating on Robinhood Markets Inc-A (HOOD.O):

Market concerns exist regarding high valuations and volatility, but the company is expected to benefit from product line expansion in 2026, driving growth in overseas, high-net-worth, and institutional businesses. The market is projected to contribute hundreds of millions of dollars in new revenue, and the Super App strategy and innovation flywheel support the long-term high valuation, demonstrating strong medium- to long-term growth potential.

CITIC Securities maintains its buy rating on Snowflake Inc (SNOW.N) with a target price of $315.

The company's Q2 results were impressive, with continued growth in the number and retention rate of major customers. AI ARR exceeded $100 million, indicating smooth progress. Although the full-year guidance was lower than expected due to a higher base from one-off cloud migration revenue in the previous quarter, the penetration of new businesses and the solid AI-driven logic suggest promising long-term growth.

Industrial Securities Give to O'Reilly (ORLY.O) Buy rating:

The company is a leading US auto parts retailer and distributor, benefiting from a dual-market strategy and an efficient supply chain, resulting in superior operational efficiency. Continued mergers and acquisitions are driving steady store growth, and net profit is projected to increase steadily from fiscal years 2025 to 2027, with an EPS CAGR of 23.0%. Coupled with active share buybacks and cancellations, shareholder returns are substantial, and long-term growth is promising.

CITIC Securities Give Baozun e-commerce (BZUN.O) Overweight rating:

The company's brand management business performed well, with revenue increasing by 19.8% year-on-year in Q3 2025. The number of offline stores expanded to 171, and the rejuvenation of GAP products yielded significant results, with losses narrowing by 33%. The e-commerce business structure was optimized, with strong growth in categories such as beauty and luxury goods, resulting in a return to profitability after adjustments. Adjusted net profit is projected to be RMB 0.27/1.35/2.27 billion in 2025-2027, with a gradually declining PE ratio, demonstrating strong growth potential.

BOCOM International maintains Broadcom (AVGO.O) Buy rating, target price $460:

FY4Q25 results exceeded expectations, AI semiconductors Revenue reached $6.44 billion, doubling year-over-year. The backlog of orders for the next six quarters is $73 billion, coupled with additional orders from Anthropic, driving AI revenue to be revised upwards to $46.3 billion/$75.4 billion (FY26E/FY27E). EPS forecasts are raised to $9.69/$13.13, maintaining a PE ratio of 35x, and the target price is raised to $460.

Guolian Minsheng maintains its buy rating on Broadcom (AVGO.O):

FY25Q4 revenue reached $18 billion and net profit reached $9.71 billion, both exceeding expectations. AI semiconductor revenue reached $6.5 billion, a year-on-year increase of 74%, and the AI order backlog exceeded $73 billion. FY26Q1 guidance indicates that AI revenue is expected to reach $8.2 billion, doubling year-on-year. Although gross margin is under short-term pressure, mainly due to the upgrade of the system-level sales model, long-term growth momentum is strong, benefiting from the dominant position of ASIC and the continuously expanding AI order backlog.

First Shanghai maintains its buy rating on Broadcom (AVGO.O) with a target price of $420.

The company's Q4 2025 results exceeded expectations, with AI revenue surging 75.7% and order backlog reaching $73 billion, demonstrating the synergistic effect with VMware. Benefiting from strong demand for ASIC chips and increased capital expenditure by cloud providers, AI revenue is projected to grow by 157% year-on-year in 2026. A target price of $420 is offered based on DCF valuation, reflecting long-term growth potential.

First Shanghai maintains its Buy rating on lululemon athletica inc (LULU.O) with a target price of $240.60.

Q3 results exceeded expectations, with revenue in China growing by 46% and global same-store sales turning positive, although a decline in North America dragged down the overall performance. Accelerated product iteration, SKU localization, and shortened R&D cycles contributed to the demand recovery. 2026 is a crucial year for strategic adjustments, with a new CEO leading the transformation. The target price is based on a PE ratio of 19, reflecting recovery expectations. Current valuation has upside potential.

First Shanghai maintains Tesla (TSLA.O) Buy rating:

Tesla's Robotaxi has completed driverless road tests; FSD V14.3 is coming soon, featuring enhanced learning and inference capabilities. The AI5 chip has seen significant performance improvements and is expected to enter mass production in 2027. The Shanghai factory has reached a production capacity of 4 million vehicles, and energy storage... With the expansion of the supercharging ecosystem, Starlink has integrated patent disclosures, promoted intelligentization and infrastructure in synergy, and demonstrated significant long-term competitiveness.

Huatong Securities Maintain Microsoft (MSFT.O) Buy rating:

The company's Q1 revenue increased by 43% year-on-year, with intelligent cloud revenue reaching $26.8 billion and Azure growth of 33%. Cash flow is healthy, and shareholder returns reached $9.7 billion. Revenue is projected to continue double-digit growth from 2025 to 2027, with an operating profit margin remaining stable at 45.0%. While investment in AI infrastructure may suppress short-term profits, it lays the foundation for long-term competitiveness, and high growth expectations support the valuation.

CITIC Securities maintains WeRide (WRD.O) Buy rating:

In Q3 2025, revenue reached RMB 171 million, a year-on-year increase of 144.3%, with gross margin improving to 32.93% and losses significantly narrowing. Robotaxi revenue accounted for 20.7% of total revenue, and the company's global footprint expanded to over 30 cities in 11 countries. It obtained a fully autonomous driving license in Switzerland and L4 commercial operation qualification in Abu Dhabi. Benefiting from policy liberalization and a comprehensive product portfolio, the company possesses significant advantages in large-scale operations, and long-term growth is promising.

Huatai Securities Maintain Pony.ai (PONY.O) Buy rating, target price $25:

The company's Q3 2025 revenue increased by 72% year-on-year, and the UE of its Guangzhou-based bike-sharing service turned positive, validating the viability of the Robotaxi business model. Global expansion accelerated, with operations in 8 countries and the expansion of asset-light partnerships. The Hong Kong IPO raised over US$800 million, providing ample cash reserves. The 2026 revenue forecast was revised upwards to US$116 million, and based on a 4.4x EV/Sales DCF exit multiple, the target price was raised to US$25.

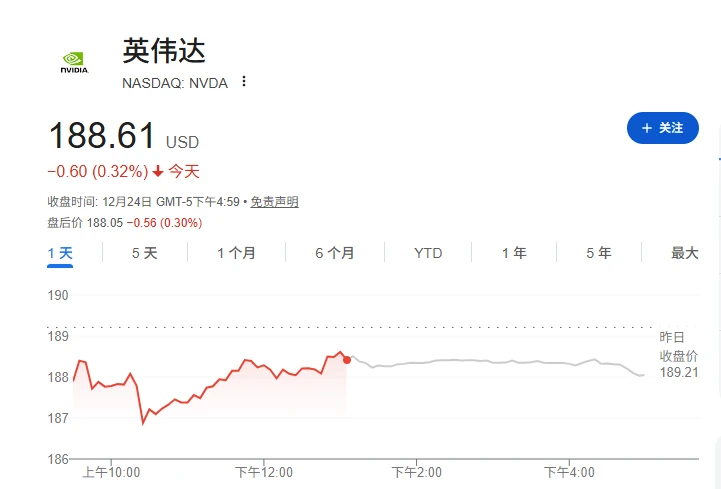

Huatong Securities maintains Nvidia's (NVDA.O) Buy rating:

The company's revenue for Q3 of fiscal year 2026 was $57.006 billion, a year-on-year increase of 62.49%, and net profit was $31.91 billion, a year-on-year increase of 65.26%. Demand for the Blackwell architecture was strong, and the AI ecosystem continued to expand. Despite weak sales in China in H20 and pressure on gross margins, long-term order visibility is high, particularly in data centers. A solid dominant position supports expectations for future growth.

(Article source: CLS)