① Google DeepMind CEO Demis Hassabis warned of a “bubble” in the AI funding frenzy, especially among highly valued early-stage startups; ② Hassabis emphasized that some AI startups are “basically not even operational yet” but have “jumped on to get valuations of hundreds of billions of dollars,” a situation that may be unsustainable.

Demis Hassabis, CEO of DeepMind, Google's AI research firm, recently warned that in today's artificial intelligence... There may be a "bubble" in the (AI) funding frenzy, especially among early-stage startups that are being funded at high valuations.

In a recent podcast episode, he bluntly warned that some of these AI startups appear unsustainable. Hassabis emphasized that some startups "haven't even started operating yet" but "have already received valuations of hundreds of billions of dollars."

“It’s going to be interesting to see how this situation can continue. You know, my guesses probably won’t hold up, at least not overall,” he added.

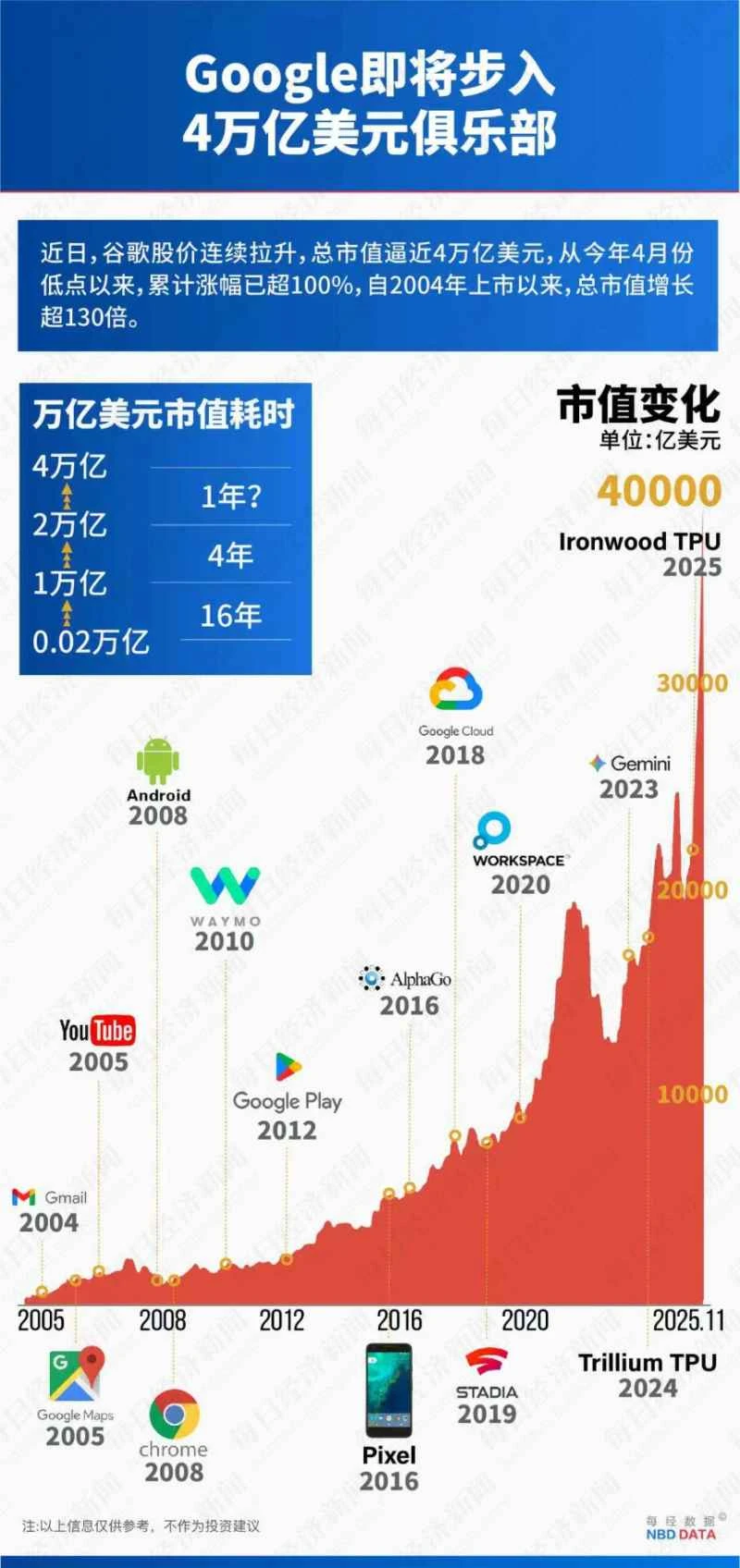

Hassabis distinguished between the exorbitant seed funding rounds and the multi-billion dollar investments by large tech companies in AI infrastructure. He stated that there is "a lot of real business value" behind the valuations of large tech companies.

He added that artificial intelligence is "overhyped in the short term" but "still not being given enough attention in the medium to long term."

Hassabis also stated that "overcorrection" is inevitable for any major technological change, such as artificial intelligence, especially when people quickly go from skepticism to fascination.

“When we founded DeepMind, nobody believed in it. But fast forward 10, 15 years, and now, it’s clear that it seems to be the only topic of conversation among business people,” he added. “This volatility tends to push valuations too far and too fast. It’s almost an overreaction to an underreaction.”

Finally, Hassabis emphasized that he is not worried about whether there is an AI bubble, and he is focused solely on his work. Google DeepMind specializes in building AI models for Google products (including Gemini) and leads the company's cutting-edge AI research.

AI startups are valued at extremely high levels.Hassabis made these remarks as valuations for artificial intelligence startups continue to soar. Young founders—some of whom have just graduated—are reportedly raising millions of dollars for their AI startups. In fact, many have even dropped out of school to ride the AI wave.

Earlier this year, Stanford University dropout Carina Hong raised $64 million for her AI startup, Axiom Math. She even recruited top AI talent from Meta and Google Brain.

This has attracted the attention of many investment heavyweights. Howard Marks, a Wall Street value investing guru, also warned that investors are flocking to artificial intelligence startups with virtually no track record. Marks is the co-founder of Oaktree Capital Management, a firm known for investing in distressed credit and high-yield bonds.

The billionaire asked, "Would you like to start a startup that currently has no revenue or profit, but could potentially become a top company if successful?"

"Or you might want to invest in an existing, successful tech company that's already making a lot of money, where AI might just bring some progress but not have a real impact? That's a choice," he added.

(Article source: CLS)