Speaking of Nvidia Stocks like these are often associated with "overvaluation." Add to that the current understanding of artificial intelligence... Amidst a chorus of warnings about an (AI) bubble, it seems unlikely anyone would believe the stock is still undervalued. But according to Bernstein analyst Stacy Rasgon, that is indeed the case.

He pointed out that considering Nvidia 's historical valuations and investments in artificial intelligence , the company's stock price is still undervalued. Despite delivering impressive results, its stock price gains have been modest, indicating that its upside potential has not yet been fully realized. Historically, investors who enter the market at such a discount level have often reaped substantial returns in the following year.

Their conclusion was: "Therefore, 2026 will be an interesting year for Nvidia 's new investors."

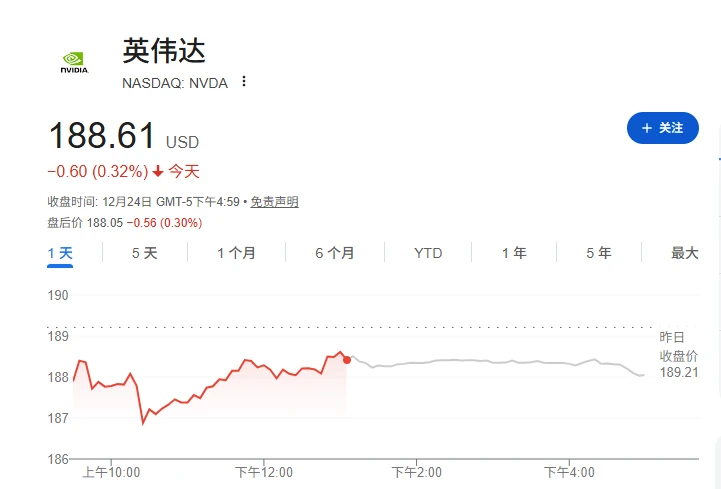

As we all know, Nvidia is one of the biggest beneficiaries of the AI boom. The past three years have been a pivotal period for Nvidia's stock price and market capitalization, witnessing significant increases. Following rises of 242.63% and 171.05% in 2023 and 2024 respectively, it has risen 36.37% so far in 2025. Compared to the impressive performance of the previous two years, Nvidia seems to be struggling this year. Investors are now most concerned about the stock's future direction: has it peaked, or is it just a temporary pause?

After analyzing a range of data, Bernstein concluded that the stock is "still undervalued." According to Rasgun, one reason is its relative valuation compared to the Philadelphia Semiconductor Index. The performance of the industry index (SOX). Year-to-date, the SOX is up about 43%, while Nvidia is up only 36%. This suggests that although Nvidia is considered an industry leader, its stock performance has not been better than its peers.

Bernstein analysts also noted an interesting statistic regarding Nvidia. The company's stock is currently trading at a 13% discount to the SOX. In the past 10 years, there have only been 13 days with a discount exceeding this level. Rasgun believes they have discovered a unique valuation statistic, and given how rare this situation is, it is difficult to refute.

In conclusion, the current stock price offers an excellent entry point. The analyst points out that anyone who bought Nvidia at this price level has achieved an average annual return of over 150%, with no pullbacks. Its forward P/E ratio of 25 is also in line with Nasdaq... The forward P/E ratio of 25.1 is in line with expectations. All of this suggests that Nvidia is poised for a strong performance in 2026.

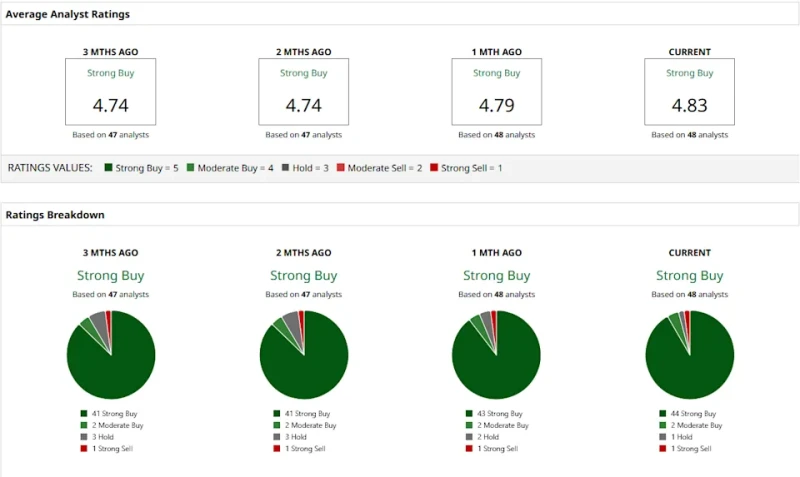

It's also worth noting that Nvidia's stock remains highly sought after on Wall Street. Of the 48 analysts researching the stock, 44 have given it an "overweight" rating. The highest price target is $352, implying the stock could potentially double from current levels.

(Article source: CLS)