Last weekend, Michael Burry, a well-known short-selling investor known as "The Big Short," posted a series of messages on social media, responding to his critics while targeting the hottest sector in the current stock market: technology .

Burry was instrumental in accurately shorting mortgage-backed securities before the 2008 financial crisis. His fame grew, with Michael Lewis's book "The Big Short" and the Oscar-winning film "The Big Short" both documenting this deal.

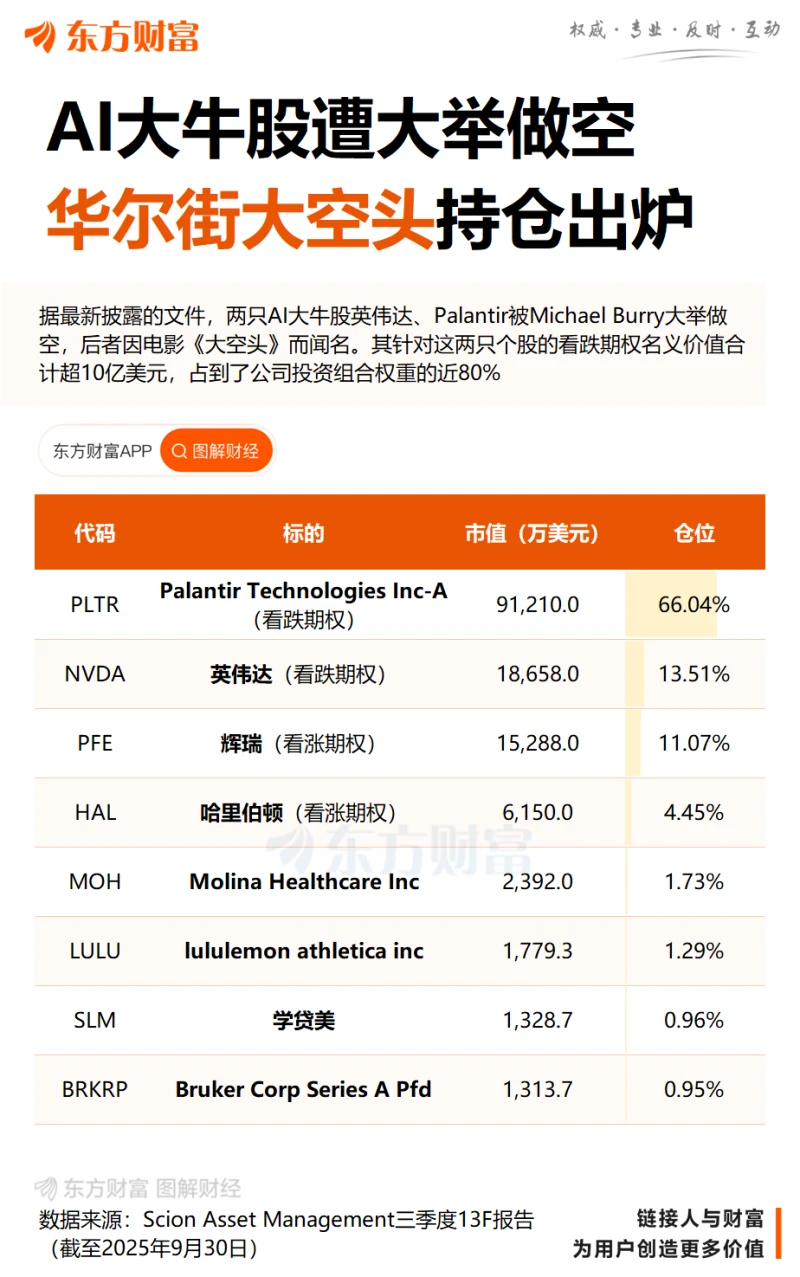

In late October of this year, Burry returned to the public eye after several years of silence. Since then, he has repeatedly warned of the risks of a stock market bubble and disclosed his short-selling of Nvidia. New positions in AI stocks.

In his latest X post, Burry reiterated that the hottest trades in the stock market are brewing a crisis and are targeting top players in the AI field .

“OpenAI is the next Netscape, doomed to fail, and the company is losing a lot of cash,” Burry wrote on X late Friday in response to a post by Salesforce CEO Marc Benioff about large language models.

Netscape was once one of the world's most valuable internet companies, rising rapidly in the mid-1990s with its Netscape Navigator browser, at one point holding nearly 90% of the browser market share.

However, the company began to decline rapidly in the late 1990s, mainly due to Microsoft. By bundling Internet Explorer (IE) with the Windows system, Netscape launched a "browser war," severely squeezing its survival space and causing its market share to plummet. In 1998, Netscape was acquired by America Online, marking the loss of its independent operating capabilities. The company was dissolved in 2003, and in 2008, its browser ceased all technical support, officially exiting the market. It became a classic example of a company's decline during the dot-com bubble era.

" Microsoft is trying to prolong its (OpenAI) life while keeping related businesses off its balance sheet and continuing to extract its intellectual property. " "So why is OpenAI still able to secure funding? The entire industry actually needs a $500 billion IPO feast, and the sooner the better," Burry said.

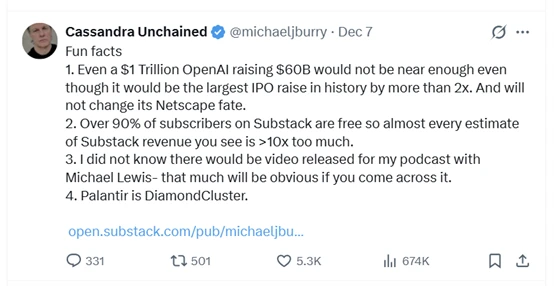

Last Saturday, Burry added in another post that even if OpenAI raised $60 billion, it would be "far from enough" to fill its funding gap .

In late October, news broke that OpenAI was preparing for its initial public offering (IPO), which could value the company at up to $1 trillion. This would be the largest IPO in history. Industry insiders say OpenAI is considering filing for listing with securities regulators as early as the second half of 2026, with initial discussions suggesting a fundraising target of at least $60 billion.

Before launching his attack on OpenAI, Burry had previously criticized another AI giant, Nvidia . Last month, Burry publicly announced his short-selling of Nvidia and launched a scathing attack on the company, prompting it to send a memo to Wall Street analysts in defense of itself.

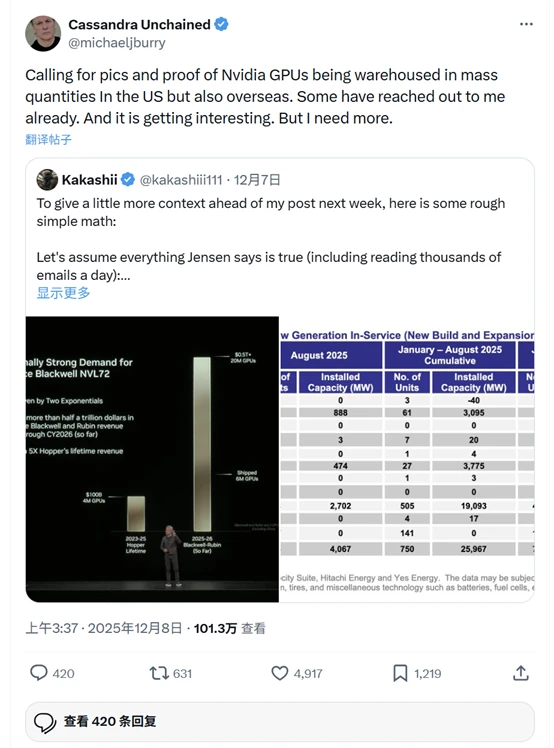

"I welcome any evidence that Nvidia graphics processing units (GPUs) are being stockpiled on a large scale in the U.S. and overseas. I've already been contacted, and things are getting interesting. But I need more evidence," Burry posted again last Sunday afternoon.

Burry also fiercely countered his critics, defending his bearish views on the market.

In his post last Sunday, he included links to several news articles, including his prediction of a meme stock crash and his reminder to his followers in 2021 to "prepare for inflation." The following year, the US stock market experienced a significant correction, and the US inflation rate surged to a peak of around 9%.

Burry also shared a screenshot of a post he made on X in March 2023. At that time, he predicted that regional banks... The crisis "may be resolved quickly." He criticized journalists who had questioned his views, saying that history has proven his judgment correct.

Dongcai Illustrated Guide: Some Useful Tips

(Article source: CLS)