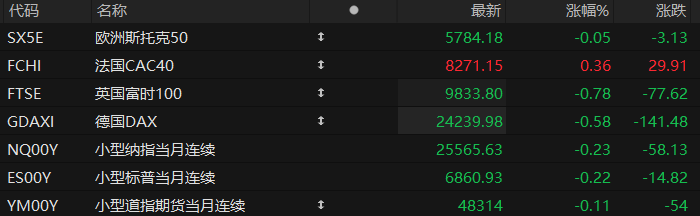

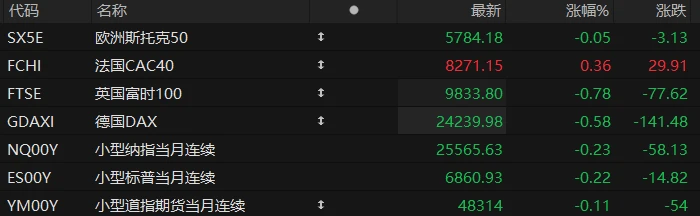

U.S. stock index futures fell across the board in pre-market trading on Thursday, while most major European indices also declined. As of press time, the Nasdaq... S&P 500 futures fell 0.23%, S&P 500 futures fell 0.22%, and Dow Jones futures fell 0.11%.

In terms of individual stocks, Chinese concept stocks generally rose in pre-market trading, with Alibaba among them. Bilibili rose more than 4% in pre-market trading. JD.com Earnings exceeded expectations, and the stock price rose by more than 2% in pre-market trading.

Several high-performing stocks rose in pre-market trading, with Cisco among them. Canadian Solar surges 7% pre-market! Latest quarterly results exceed expectations. The stock rose more than 12% in pre-market trading after Q3 revenue exceeded market expectations.

The U.S. dollar spot index fell 0.1%, and the yield on the 10-year U.S. Treasury note rose two basis points to 4.09%. Bitcoin rose 1% to $102,895.

Spot gold broke through $4,232 per ounce for the first time since October 21, up 0.93% on the day.

On November 12 local time, US President Trump signed a temporary federal government funding bill passed by both houses of Congress at the White House, ending the longest federal government shutdown in history, which lasted 43 days.

Earlier that day, the U.S. House of Representatives passed a temporary federal funding bill that had previously been passed by the Senate. The House ultimately passed the bill with 222 votes in favor and 209 against. The bill will provide continuous funding for the federal government, ensuring that most government agencies have operating funds until January 30, 2026.

However, it may take several days for the U.S. federal government to fully resume normal operations, and some agencies may even need a week or longer. The payroll system needs to be updated to pay back wages incurred during the shutdown. The backlog of appropriations, loan applications, and customer service cases, which has been stalled for 43 days, also needs to be expedited.

Hot News

The AI boom will continue to drive the expansion of the "commodity bull market"! Goldman Sachs A former executive predicts four major "beneficiaries".

With artificial intelligence The AI boom is driving the growth of data centers. Amid the construction boom, veteran commodities analyst Jeff Currie recently stated that he expects commodities to benefit significantly.

In a recent interview, Currie specifically pointed out four sectors that he believes could participate in what is being called an expanding commodity bull market: natural gas. Base metals, precious metals And crude oil. He explained that this is largely because they are raw materials that constrain the construction of data centers .

Currie is currently the Chief Energy Path Strategy Officer at Carlyle Group, a leading U.S. private equity firm. Previously, he served as Global Head of Commodities Research at Goldman Sachs, where he helped build the bank's commodities business. During his nearly three decades at Goldman Sachs, he became one of Wall Street's leading commodities market strategists.

Currie also stated that he believes some investments in the field of artificial intelligence have been misled. He said the market needs to invest in the inputs required for data centers , such as metals and natural gas , to obtain these resources. He added that much of the capital expenditure specifically allocated to artificial intelligence ultimately flows into commodities.

Will gold rise another $500? The appointment or removal of Federal Reserve Governor Cook may be a key factor.

Gold is awaiting the next driving factor for its rise, and analysts point out that the US Supreme Court's debate over whether Federal Reserve Governor Cook can continue in his position could determine the near-term direction of gold prices.

The U.S. Supreme Court announced Wednesday that it will hold oral arguments on January 21 to discuss whether President Trump has the right to fire Cook. Markets believe the outcome will determine the future independence of the Federal Reserve and is a significant factor driving gold prices to record highs.

In a report on Wednesday, StoneX's head of market analysis, Rhona O'Connell, noted that the gold market will be closely watching this process. If the ruling is favorable to Trump, gold prices could rise by $500 per ounce due to reduced Federal Reserve independence. This would be a positive, but a weaker dollar could have further implications. Conversely, if the court rules in favor of Cook, the opposite would be true.

The "big short" announces the closure of its fund and discloses its short selling of Nvidia. Palantir details

Michael Burry, who gained market attention for publicly challenging the valuation of a leading US AI stock, announced hours ago that his Scion fund had withdrawn from the US securities market . The Transaction Commission revoked the registration .

The reason Berry attracted so much attention was because he successfully bet on the bursting of the US subprime mortgage bubble in 2008. His story was even made into the Oscar-winning film "The Big Short," making him one of the representative figures of that market catastrophe.

In the past two weeks, his Scion fund first released its 13F form ahead of schedule, showing that it held put options on Palantir and Nvidia, two leading AI software and hardware stocks, respectively . Then, it repeatedly spoke out on social media, emphasizing that the market was in a bubble and accusing tech giants of secretly increasing the depreciation period of computing chips to reduce the impact of large-scale investments on their profit and loss statements.

There are different opinions among people with different positions (and holdings) as to why Berry closed the fund.

EndGame Macro, a macro strategy analysis team, interprets Berry's posts as a clear attempt to portray himself as the man who sat before a pile of subprime mortgage product brochures in 2005. Back then, he saw institutions packaging substandard collateral into AAA-rated structured products; now, he sees trillion-dollar market capitalizations supported by capital expenditures and accounting choices. Therefore, his current "exit" is most likely due to a desire to avoid another agonizing struggle at the end of a frenzied bubble—given the significant discrepancy between fund managers' judgments and market realities, the most honest course of action for a trustee is to return the money.

US Stocks Focus

Alibaba shares surged over 4% amid rumors that the company is preparing for a "1000 Questions for Consumers" campaign.

As of press time, Alibaba, a Chinese technology company, saw its shares rise over 4% in pre-market trading. According to the Science and Technology Innovation Board Daily, Alibaba has secretly launched the "Qianwen" project, developing a personal AI assistant app based on the Qwen model, directly competing with ChatGPT. An international version of the Qianwen app, targeting the global market, is also under development, aiming to leverage the overseas influence of the Qwen model to directly compete with ChatGPT for overseas users.

This is another significant move in Alibaba's AI strategy, following the announcement earlier this year of a 380 billion yuan investment in AI infrastructure. Previously, Alibaba had focused heavily on the B2B AI market, providing model API services to various industries through Alibaba Cloud. Based on Qwen's excellent performance and international influence, Alibaba's management believes the time is ripe to launch a major C2C campaign.

Green electricity reigns supreme in the AI era! Google and Total sign 15-year power purchase agreement.

Total Energy of France has signed a 15-year power purchase agreement (PPA) with Google to acquire solar power from Total's Montpellier, Ohio solar power plant . The power plant generates a total of 1.5 terawatt-hours (TWh) of renewable energy. This provides a template for the technology industry in its search for clean, long-term energy supplies.

Total Energy stated that the solar facility is nearing full completion, has been connected to the PJM grid (the largest power grid in the United States), and will power Google's data center in Ohio. This agreement aligns perfectly with Google's strategy of adding new carbon-free power generation facilities to its operating power grid, rather than solely relying on existing renewable energy capacity. The company is also advancing its 24/7 carbon-free energy goal, aiming to power all its global operations with carbon-free energy at all times by 2030.

Will Conkling, Google’s head of clean energy and power, said the partnership will enhance Ohio’s digital and economic infrastructure; while Stéphane Michel, president of Total Energy’s gas , renewable energy and power business, emphasized the company’s profitability targets for its power business, saying, “This agreement demonstrates our ability to meet the growing energy needs of large technology companies while strongly supporting the continued expansion of the company’s renewable energy portfolio.”

Disney Mixed results: Streaming and theme parks lead the way for growth, while big-budget film spending drags down the new fiscal quarter.

Disney (DIS.US) reported fourth-quarter profits that exceeded market expectations, driven by strong performance in its streaming and theme park businesses. The media giant also announced a 50% increase in its dividend and doubled the size of its share buyback program for fiscal year 2026. However, the company's stock price fell in pre-market trading as several big-budget films, including the upcoming Avatar, are expected to impact its first-quarter results.

Data shows that for the fourth quarter of fiscal year 2025, ending in September, Disney's adjusted earnings per share were $1.11, a 3% decrease from the same period last year, but 6 cents higher than the average analyst expectation. Revenue was $22.5 billion, roughly flat year-over-year, slightly below analysts' expectations of $22.75 billion.

Looking at the breakdown, the Experiences segment, which includes theme parks, saw operating profit of $1.88 billion, a 13% year-over-year increase, partly driven by the expansion of the U.S. cruise business and the growth of Disneyland Paris.

Because this year's films failed to replicate the success of last year's "Inside Out 2" and "Deadpool & Wolverine," the entertainment division's operating profit plummeted by more than a third to $691 million. Traditional television profits fell 21% to $391 million. Streaming profits, however, surged 39% to $352 million, with Disney+ and Hulu adding a combined 12.5 million subscribers this quarter, bringing their total subscriber count to over 196 million.

(Article source: Hafu Securities )