① With billions of dollars "voting with their feet" this year, US investors seem to have gradually become "enamored" with China's vision of technological self-reliance, and this enthusiasm is expected to continue into the new year; ② According to data compiled by the industry, since 2025, major US-listed ETFs that focus on Chinese technology stocks have attracted a large inflow of funds, while funds that focus on non-technology sectors have experienced outflows.

With billions of dollars "voting with their feet" this year, American investors seem to have become increasingly "enamored" with China's vision of technological self-reliance, and this enthusiasm is expected to continue into the new year.

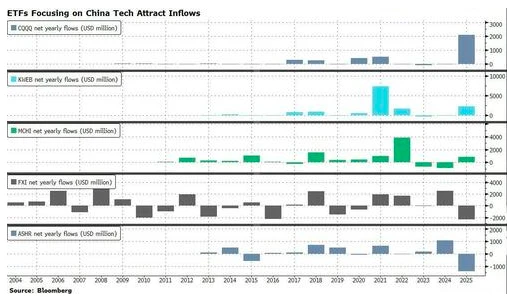

According to data compiled by the industry, since 2025, major US-listed ETFs that focus on Chinese technology stocks have attracted a large inflow of funds, while funds that focus on non-technology sectors have experienced outflows.

Based on assets under management, the KraneShares China Overseas Internet ETF (KWEB), the largest Chinese stock ETF listed in the US, has attracted $2.3 billion this year and is on track for its best annual performance since 2021.

Invesco, ranked fourth in terms of asset size The China Technology ETF (CQQQ) also recorded a $2.1 billion in inflow, and is on track for its best annual performance ever.

iShares MSCI China The ETF (MCHI) attracted $871 million in new funds, potentially ending two consecutive years of outflows.

In stark contrast, the iShares China Large-Cap ETF (FXI), which focuses on traditional sectors, has seen net outflows of $2.3 billion so far this year; Deutsche Bank During the same period, its Xtrackers Harvest CSI 300 ETF (ASHR) also experienced a $1.4 billion outflow of funds.

Rene Reyna, Head of Thematic and Specialized ETF Strategy at Invesco , believes that the launch of DeepSeek earlier this year and the trade frictions initiated by Trump were likely key factors driving inflows into Chinese technology ETFs. He noted that there were peaks in inflows into CQQQ in April and August, "which coincides with the Liberation Day tariffs and the tariff suspension following the US-China Stockholm Trade Negotiations."

He added that DeepSeek's R1 model also "demonstrates that China has become a leader in artificial intelligence. " “A true competitor in the field,” “Investor interest in this topic should continue until 2026.”

Neil Shearing, chief economist at Capital Economics, also pointed out that " most developed economies are struggling to keep up with the US in the AI race, but 2025 is also the year China will close some of the gap. " He added that stock investors seem to be betting that China will "more broadly surpass the US in cutting-edge technology fields."

Citigroup The bank's economists hold a similar view. In a report released last Friday, they wrote that China is rapidly catching up with the technological forefront in both models and hardware.

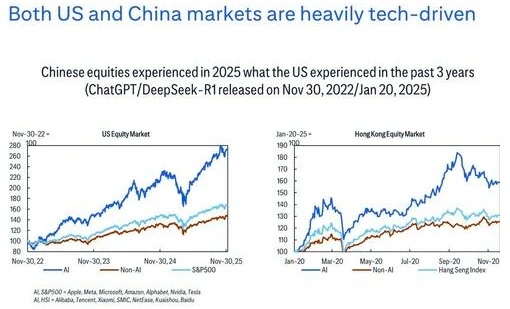

This prominent US investment bank, comparing the launch of ChatGPT in November 2022 with the release of DeepSeek-R1 in January of this year, concluded that " what the Chinese stock market will experience in 2025 is exactly what the US market has experienced over the past three years. "

Betting on Chinese AI

It's clear that despite the increasingly fierce competition between China and the US in the field of artificial intelligence, US investors are still vying to continuously invest in Chinese companies involved in this area. According to fund managers, Chinese venture capital firms are raising dollar funds for AI investment, while US endowment funds, which have avoided Chinese assets for years, are considering returning to the Chinese market.

Nomura Securities (Japan) Shi Jialong, head of Chinese internet equity research, pointed out, "The Chinese market is huge, and we will see a continued inflow of funds from American investors."

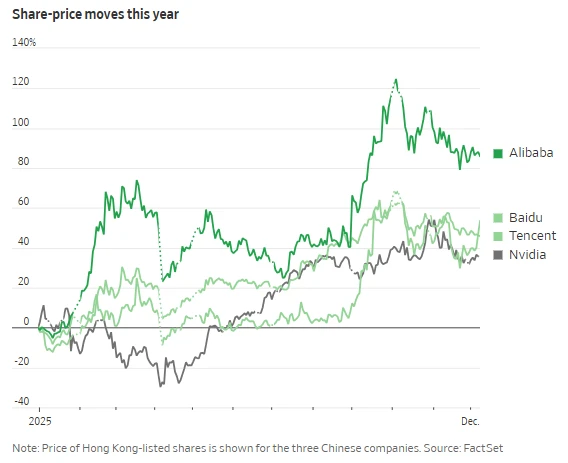

Earlier this year, US hedge fund manager David Tepper publicly expressed optimism about Chinese companies. According to securities filings, Alibaba... In November of this year, it was the largest component of the publicly traded portfolio disclosed by Tepper's fund company Appaloosa, accounting for 16% of its approximately $7 billion publicly traded equity investments.

According to data provider LSEG, Pioneer in the United States Group, BlackRock And Fidelity The funds they manage have all increased their holdings of Alibaba 's Hong Kong-listed shares this year. Similarly, Chinese tech companies Tencent and Baidu, which also utilize large-scale language models—a core technology in generative artificial intelligence—are also involved. The stock price has also risen by nearly 50% this year.

London-based investment firm Ruffer believes Chinese tech giants still have room to grow, as their price-to-earnings ratios are significantly lower than those of their US counterparts, such as Google's parent company, Alphabet. Ruffer manages a £19 billion (approximately $25 billion) portfolio, which has risen nearly 11% so far this year. Gemma Cairns-Smith, an investment expert at the firm, says this growth is partly due to Alibaba —which accounts for 1.5% of her total portfolio.

“China is a major player in the field of artificial intelligence,” Cairns-Smith noted. “Chinese companies are valued at a significant discount compared to their American counterparts, and investors risk missing out on a great opportunity.”

Brendan Ahern, chief investment officer of Krane Funds Advisors LLC, which manages KWEB, points out that the ETF's constituent companies have engaged in share buybacks, have very attractive valuations, and have low investor allocations. "Combined with the geopolitical realignment between the US and China and policy support, Chinese stocks may see a sustained revaluation in 2026."

(Article source: CLS)