The financial reports of chip giants have released significant positive signals.

Fueled by positive earnings, the largest U.S. memory chip company saw gains in pre-market trading on Thursday. Manufacturer – Micron Technology The stock price surged, rising over 10%. The latest financial report shows that in the field of artificial intelligence... (AI) Data Center Amid surging demand and a continued tightening of memory chip supply, Micron Technology 's performance and guidance both significantly exceeded market expectations.

Wall Street analysts say Micron Technology 's earnings report was "explosive," with its guidance far exceeding expectations. Besides Nvidia... This could be related to the US semiconductor industry . The largest upward revision in revenue and net profit guidance in the industry's history, with room for further improvement in the coming quarters.

Chip giants surge

On December 18, Beijing time, Micron Technology's stock price surged by more than 10% in pre-market trading on the US stock market.

In terms of news, Micron Technology's latest fiscal first quarter results for fiscal year 2026 show that, benefiting from tight supply and sharp price increases in memory chips , as well as rapid growth in demand for AI data centers , the company's performance and guidance both significantly exceeded analysts' expectations.

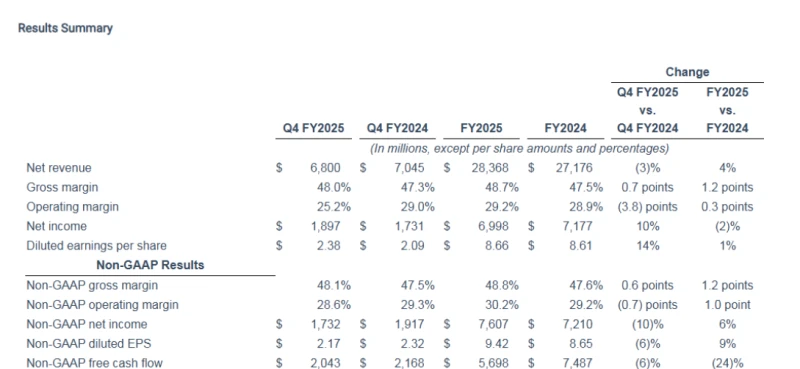

Specifically, Micron Technology reported adjusted revenue of $13.64 billion for its first fiscal quarter, a 57% year-over-year increase, exceeding analysts' expectations of $12.95 billion; adjusted net income was $5.482 billion, a 58% year-over-year increase; and adjusted earnings per share were $4.78, exceeding analysts' expectations of $3.95.

By segment, Micron Technology's cloud storage segment achieved sales of $5.28 billion in the first fiscal quarter, more than doubling year-over-year; the data center segment achieved sales of $2.38 billion, up 4% year-over-year; the mobile and client segment contributed $4.255 billion in revenue; and the automotive and embedded segment contributed $1.72 billion in revenue.

In terms of earnings guidance, Micron Technology expects second-quarter revenue to be $18.7 billion, plus or minus $400 million, far exceeding analysts' expectations of $14.38 billion. Meanwhile, the company anticipates its non-GAAP gross margin to jump to around 68%, significantly higher than analysts' expectations of 55%, marking a historic leap in the company's profitability.

In addition, optimistic comments from Micron Technology executives during the earnings call also ignited bullish sentiment in the market.

Sanjay Mehrotra, Chairman, President and CEO of Micron Technology, stated that Micron achieved record revenue and significant margin expansion across the company as a whole and across all business units. The company expects its performance to continue strengthening throughout fiscal year 2026. With its leading technological capabilities, differentiated product portfolio, and strong operational execution, Micron has become an indispensable key player in the AI ecosystem and continues to invest to meet customers' growing demand for storage and memory.

Sanjay Mehrotra further stated, "Over the past few months, our customers' AI data center construction plans have driven a sharp increase in forecasts for memory and storage demand. We believe that the total supply across the industry will be far below demand for the foreseeable future."

Mehrotra revealed that the company's HBM4 memory project is progressing smoothly, with yield improvements occurring faster than when HBM3 first started production. Production is expected to increase starting in the second quarter. Even with manufacturing facilities operating at full capacity, Micron still faces potentially greater demand that it may be unable to meet.

Micron Technology announced that it will increase its net capital expenditure for fiscal year 2026 from $18 billion to approximately $20 billion in response to the market’s high attention to its capital expenditure (Capex) plan.

Wall Street Commentary: "Explosive"

Morgan Stanley In a recent report, Joseph Moore's analysis team pointed out that Micron Technology's earnings per share (EPS) guidance for the next quarter is about 75% higher than the market consensus, with a median non-GAAP EPS guidance of $8.42, while the market had previously expected only $4.78. The analysts stated that, apart from Nvidia , this could be the largest upward revision of revenue and net profit guidance in the history of the US semiconductor industry.

Barclays Tom O'Malley's team emphasized in their report that this was an "explosive quarter." While the market had anticipated this due to recent price movements, the magnitude of the exceedance was still astonishing. Guidance indicates a gross margin of 68%, with room for further improvement in the coming quarters. This suggests a continuing improvement in the pricing environment, supported by long-term agreements.

In addition, the average selling price (ASP) of DRAM (Dynamic Random Access Memory) and NAND (Non-volatile Flash Memory) continues to rise due to tight supply. Barclays model shows that Micron Technology's average selling price (ASP) of DRAM will increase by 30% quarter-on-quarter and NAND will increase by 40% quarter-on-quarter in the next quarter.

Barclays added that Micron Technology's management expects the potential market size for HBM to grow at a compound annual growth rate (CAGR) of approximately 40%, reaching $100 billion by 2028. Micron is working to improve its supply capacity, but this supply shortage will negatively impact consumer markets such as PCs, as capacity is prioritized for high-margin AI and data center sectors.

Barclays has given Micron Technology an "overweight" rating and raised its price target from $240 to $275. Their optimistic view is based on structural changes in the storage industry, believing that Micron will continue to benefit from its improved operating model until supply shortages ease.

But Goldman Sachs We maintain our "Neutral" rating on Micron Technology and raise our price target from $205 to $235.

Goldman Sachs ' core concern lies in the pricing environment of 2026. The bank's analysts believe the current risk-reward ratio is relatively balanced. However, HBM prices may face a pullback risk in 2026 as more suppliers (such as Samsung) validate and release capacity. Goldman Sachs stated that it would only consider a more constructive stance on the stock if it sees the entire industry maintain disciplined supply growth in 2027.

(Source: Securities Times)