On Thursday, local time, the U.S. Treasury Department released its highly anticipated October 2025 International Capital Flows (TIC) report. During this month of the longest government shutdown in history, the actions of America's overseas creditors were revealed...

A TIC report shows that foreign investors' holdings of U.S. Treasury bonds declined for the second consecutive month in October, as the longest government shutdown in U.S. history led to a deterioration in bond market sentiment.

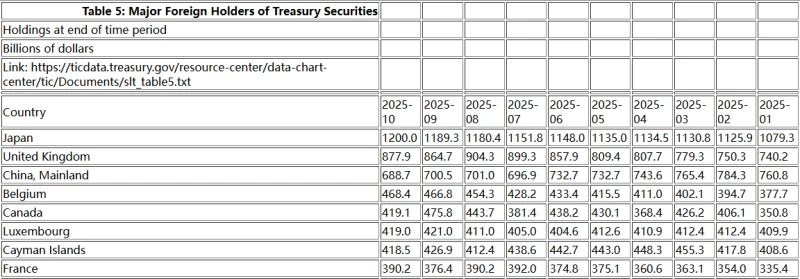

Data shows that foreign investors' holdings of U.S. Treasury bonds fell to $9.243 trillion in October, down from $9.248 trillion in the previous month. However, compared to the same period last year, foreign investors' holdings of U.S. Treasury bonds still increased by 6.3% in October. This figure previously peaked at $9.262 trillion in August. The figure reflects both net selling and changes in the valuation of U.S. Treasury bonds.

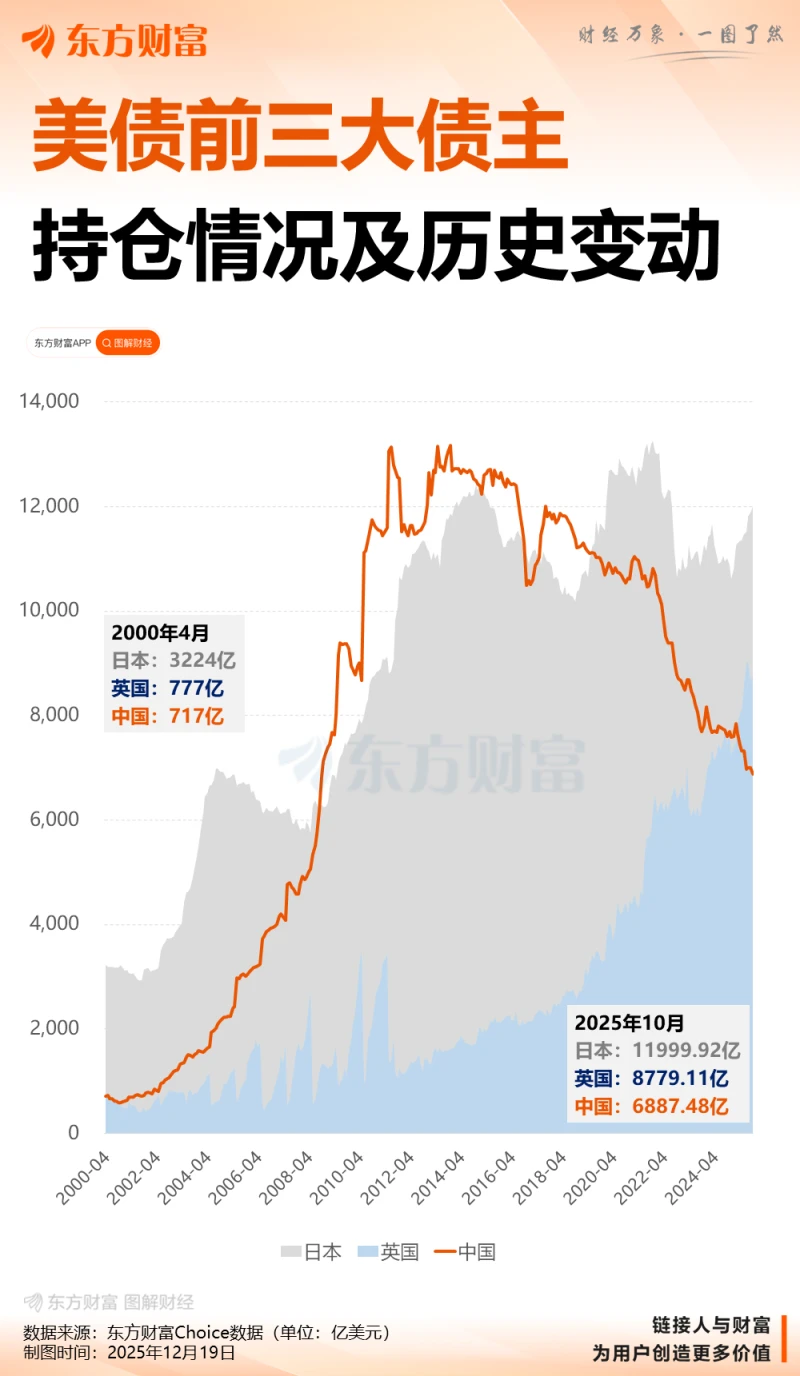

As the third largest foreign holder of U.S. Treasury bonds, China's holdings of U.S. Treasury bonds decreased by $11.8 billion in October compared to September, falling to $688.7 billion—the lowest level since October 2008 ($684.1 billion).

This marks the second time since July that China's holdings of US Treasury bonds have fallen below the $700 billion mark. Since the beginning of the year, China's holdings have decreased by more than 9%.

Since its holdings peaked at over $1.3 trillion in 2011, China has been gradually reducing its holdings of U.S. Treasury bonds and shifting towards other reserve assets such as gold.

Data from the People's Bank of China shows that as of the end of October, my country's gold reserves stood at 74.09 million ounces, an increase of 30,000 ounces from 74.06 million ounces at the end of September. This marks the 12th consecutive month that the central bank has increased its gold holdings.

The U.S. federal government began shutting down on October 1st, and this 43-day shutdown set a new record for the longest in U.S. history. Analysts point out that this event may have weakened market confidence. During this period, the U.S. debt continued to climb, while hundreds of thousands of federal employees lost their salaries, severely disrupting the economy.

A list of other U.S. overseas "creditors"

Overall, among the top eight foreign holders of U.S. creditors in October, four reduced their holdings—China, Canada, Luxembourg, and the Cayman Islands; while four increased their holdings—Japan, the United Kingdom, Belgium, and France.

Japan remains the largest foreign holder of U.S. Treasury bonds, with its holdings reaching $1.2 trillion in October, a new high since July 2022. Japan's holdings of U.S. Treasury bonds have now increased for ten consecutive months.

The UK, which surpassed China this year to become the second-largest foreign holder of US debt, increased its holdings of US Treasury bonds to $877.9 billion in October, up from $864.7 billion in September.

Canada was the most notable contributor to the reduction in its holdings of US Treasury bonds that month. Canada's holdings of US Treasury bonds plummeted by $56.7 billion in October, to $419.1 billion. This neighboring country's holdings of US Treasury bonds have fluctuated dramatically this year—monthly changes often exceeding $50 billion.

Dongcai Illustrated Guide: Some Useful Tips

(Article source: CLS)