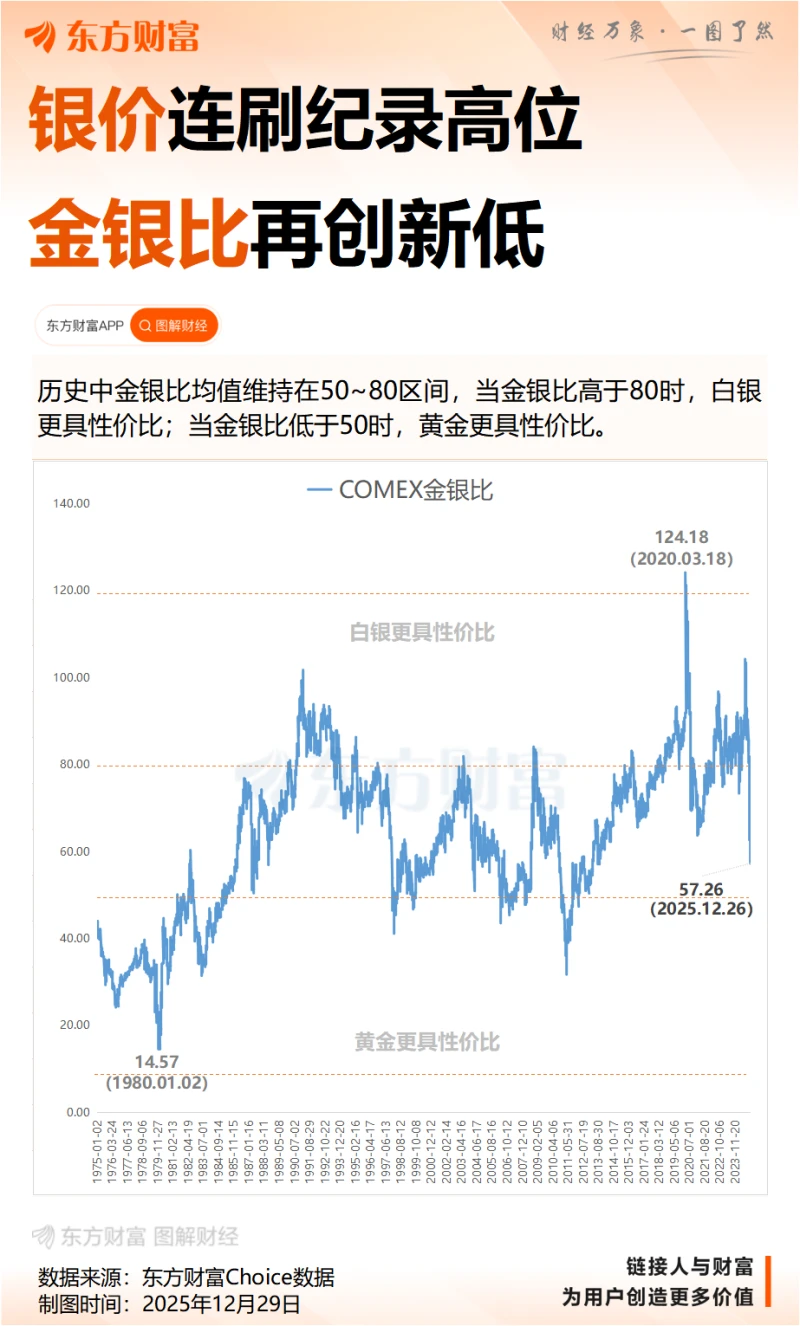

Since the beginning of this year, silver prices have followed gold prices in a steady climb, driven by increased purchases by global central banks, inflows into exchange-traded funds (ETFs), and three consecutive interest rate cuts by the Federal Reserve. Last week, benefiting from escalating geopolitical tensions, a weaker dollar, and insufficient market liquidity on the day after Christmas, COMEX silver futures recorded their biggest single-day gain in more than three years since October 2022 on Friday, with a weekly increase of nearly 18%.

After spot silver prices approached $80/ounce last Friday, they briefly rose above $83/ounce during Monday's Asia-Pacific trading session, setting a new record high. However, they later plunged from their highs, briefly falling below $75, with a daily range of $9. As of around 2:30 PM, silver prices were trading around $79. Even so, silver is still considered poised for an annual gain of over 160%, which, if realized, would be its best annual performance since 1979.

However, following today's rollercoaster market movements, concerns about the potential for speculation and high leverage in silver have intensified. After raising silver margin requirements by 10% on December 12th, the Chicago Mercantile Exchange (CME) announced a further increase in margin requirements for futures contracts across multiple metals, including gold, silver, and lithium, after the market closes on December 29th. This means that the initial margin for silver futures contracts expiring in March 2026 will be raised to $25,000. Historically, similar actions have triggered sharp drops in silver prices.

Structural supply and demand imbalance

Escalating geopolitical risks boosted demand for safe-haven assets, and market expectations of further interest rate cuts by the Federal Reserve in 2026 also benefited silver prices. Last Friday, gold and silver hit new highs against the backdrop of heightened geopolitical risks in the Middle East, Eastern Europe, and Latin America. The Bloomberg Dollar Spot Index, a key indicator of dollar strength, fell 0.8% last week, its largest weekly decline since June. A weaker dollar typically also benefits precious metals. favorable.

However, geopolitical risks and a weakening dollar were only part of the driving force; this rally was primarily driven by strong industrial demand and tight supply. ING (IG) market analyst Tony Sycamore said: "The main driver of this round of silver's rally is..." A severe structural supply-demand imbalance has triggered a scramble for physical silver. Buyers are now even willing to pay a 7% premium for immediate delivery compared to waiting another year. Data shows that global silver demand has reached 1.24 billion ounces, while supply is only 1.01 billion ounces.

Meanwhile, retail investors' large-scale investment in various silver investment products, including physical silver bars, silver ETFs, and silver derivatives, has further boosted trading volume and exacerbated market volatility. Data shows that the trading volume of options contracts for the world's largest silver ETF, iShares Silver Trust, has recently approached the high levels seen during the retail trading frenzy on Reddit in 2021. However, while silver prices have soared, market speculation has also significantly intensified. The trading volume of options contracts related to iShares Silver Trust, the world's largest silver ETF, has recently surged, reaching its highest level since the 2021 Reddit retail trading boom.

Brent Donnelly, president of market research firm Spectra Markets, stated that the current market rally, driven by both retail investor sentiment and industrial themes, is exposing the silver market to increasing volatility risks. Silver prices often exhibit characteristics of sharp rises and falls, with rapid increases frequently followed by significant corrections.

Concerns about CME triggering speculation and high leverage risks

However, it is precisely this increasingly volatile market that has led market analysts to warn of the speculative and high-leverage risks associated with silver. Previously, when faced with the question of whether to invest in gold or silver, several analysts told First Financial Daily that while silver, like gold, possesses certain safe-haven attributes, it also has industrial applications, making its inflation-hedging and safe-haven capabilities less effective than gold. More importantly, the silver market is much smaller than the gold market; the same negative events and capital flows are enough to cause much more dramatic price fluctuations in silver. This high volatility, while presenting trading opportunities, also harbors significant risks.

For example, the London silver market already exhibits significant leverage. According to an analysis by commodities expert David Jensen, the number of paper silver certificates circulating in the London market far exceeds the physical silver inventory available for delivery. This high leverage means that once physical withdrawal demand becomes a trend, it could put enormous pressure on the limited physical inventory, quickly triggering a wave of liquidations in the market.

Meanwhile, price discrepancies in global markets will further amplify the likelihood of such a wave of liquidations. There is an "extreme" price difference between silver futures on the Shanghai Futures Exchange (SHFE) and the New York Mercantile Exchange (COMEX). This arbitrage opportunity incentivizes traders to ship silver from London, where inventories are relatively plentiful, further depleting London's already strained physical silver reserves.

Skarram stated, "There is no doubt that the silver market is experiencing the biggest bubble in a generation. The development of new mines takes up to 10 years, and capital is being drawn into the silver bubble like moths to a flame. We have no idea when the bubble will burst."

More importantly, as market speculation intensified, the CME raised silver margin requirements by 10% on December 12. On December 26 (Beijing time), the Shanghai Futures Exchange also issued a notice adjusting the daily price limits for gold and silver futures contracts to 15% and correspondingly raising trading margin ratios. This means that following the margin increase on December 10, the restriction on intraday opening positions on December 22, and the adjustment of transaction fees, the Shanghai Futures Exchange has introduced its third round of risk control measures for silver futures within a month.

Historically, the 2011 silver crash and the 1980 Hunt brothers' failed margin call were both related to the fact that exchanges began to restrict leverage at that time.

Advisorpedia analyst Michael P. Lebowitz warns that the current silver price movement bears a striking resemblance to the events leading up to the bursting of the bubble in 2011. Following the 2008 financial crisis, the Federal Reserve implemented quantitative easing, causing real yields to fall into negative territory. Silver, as a high-beta currency hedge, surged from $8.50 to $50 within two years, a 500% increase. However, in 2011, the CME raised silver margin requirements five times in nine days, forcing massive deleveraging in the futures market and causing silver prices to plummet by nearly 30% within weeks. Subsequently, with the end of quantitative easing and the recovery of real interest rates, silver entered a prolonged bear market.

Besides the risks of speculation and high leverage, soaring and volatile silver prices are also detrimental to industrial development. On the 27th, Musk stated bluntly on social media platform X that soaring silver prices are "not good for industrial development" because "silver is needed in many industrial processes." Due to the lack of effective substitutes in many industrial applications, industrial buyers are less sensitive to price fluctuations but extremely vulnerable to supply shortages. Musk stated that the sharp fluctuations in silver prices also pose a serious challenge to industries that rely on these key raw materials.

Dongcai Illustrated Guide: Some Useful Tips

(Article source: CBN)