① In summary, UBS offers four recommendations for trading next year: ② Trading Recommendation 1: Regional Banks ETF (KRE) – The purest form of market breadth expansion trading; ③ Trading Recommendation 2: Positive outlook on the consumer sector; ④ Trading Recommendation 3: US real estate sector – a key issue in the midterm elections; ⑤ Trading Recommendation 4: Mid-cap stocks are entering a new era.

As the eventful year of 2025 draws to a close, a new research report released this week by UBS's trading department will give investors a preview of 2026.

UBS first outlined its market strategy for 2026—it expects US stocks to have a bumpy upward trend with more pullbacks than usual, but investors should take advantage of these pullbacks to increase their holdings in select sectors that benefit from the accelerated economic recovery and the expansion of market breadth.

Meanwhile, UBS also discussed two key factors in its report that have influenced market performance this year and will remain a focus next year: first, developments related to US President Trump, especially the midterm elections; and second, artificial intelligence . Related transactions.

In summary, UBS offers four recommendations for trading next year:

Trading Recommendation 1: Regional Banks ETF (KRE) – The purest form of market breadth expansion trading;

Trading Recommendation 2: Maintain a positive outlook on the consumer sector;

Trading Recommendation 3: US Real Estate Sector – A Key Issue in the Midterm Elections

Trading Recommendation 4: Mid-cap stocks are about to enter a new era

The following are the main points of the UBS research report:

US stocks are expected to rise amid a bumpy road next year.

UBS's bottom-up approach—which aggregates earnings forecasts from each company to calculate the index target—projects a 16% increase to 7,900 points for the S&P 500 by the end of 2026. In contrast, top-down strategists, who use macroeconomic models to predict the index , have an average target price of 7,500 points, implying a 10% upside next year .

UBS points out that current market expectations are optimistic, positioning is bullish, and valuations are high, meaning the market has limited room to absorb negative news, thus the probability of a significant pullback is higher than usual. However, given the continued strong earnings performance in the artificial intelligence sector and the dominant upside risks to nominal growth, these pullbacks should be viewed as buying opportunities.

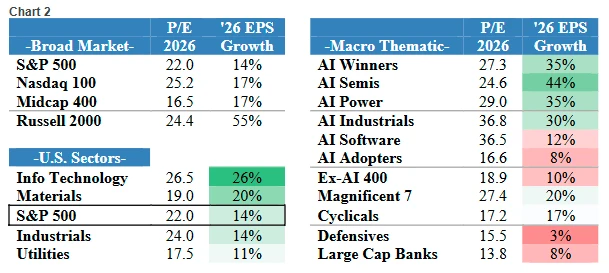

Profit growth momentum will spread

While technology sector earnings are still expected to outperform non-technology sectors, the gap is likely to narrow significantly. (Nasdaq ) The index's 2026 earnings per share growth forecast is 17%, only 3 percentage points higher than the S&P 500's consensus forecast of 14%. Last year, the gap was as large as 14 percentage points. Even the UBS-compiled non- AI 400 index basket (ticker symbol: UBXXX400) is expected to see 10% earnings growth next year. However, UBS believes this broad-based earnings growth is not yet reflected in current market positioning.

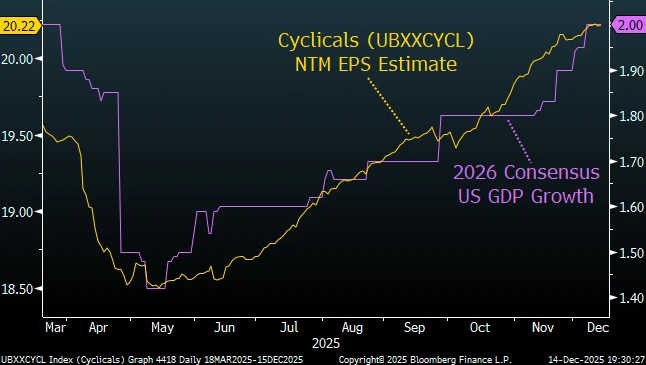

Economic growth has upward momentum in 2026.

Since the beginning of this year, earnings expectations for cyclical stock baskets have risen in tandem with expectations for US GDP growth. The market generally expects US real GDP to grow by 2.0% and inflation to be 2.9% by 2026. Can the US economy achieve even higher growth next year? Considering the following factors, the possibility of upward growth does exist: (1) tariff-related disruptions have passed their most severe stage; (2) the Fed's interest rate cuts are gradually being transmitted to the real economy; (3) the lagged benefits of the Big and Beautiful Act will gradually emerge; and (4) many traditional non-AI sectors have a low starting point for growth. The upside risks suggest that it is wise to moderately allocate assets that benefit from accelerated economic recovery and increased market participation.

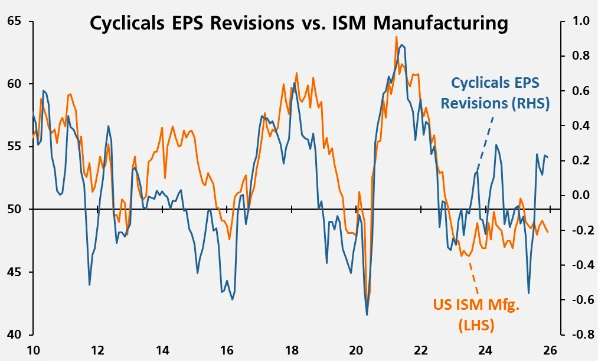

Key points to watch in the first quarter of next year

An accelerating economic recovery means that market breadth will extend to previously lagging cyclical sectors. UBS points out that people will certainly pay attention to macroeconomic data, such as the ISM Manufacturing Purchasing Managers' Index, which has been stagnant for three years. However, to confirm an economic recovery, earnings revisions in cyclical sectors must continue to rise and provide support; otherwise, this could just be another false start to a recovery.

The Republican Party is expected to face a tough challenge in next year's midterm elections.

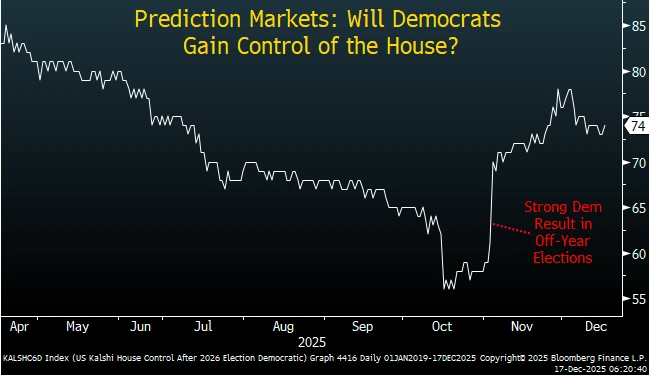

The US midterm elections will influence markets for much of next year. Betting market data shows a 33% chance of Democrats controlling the Senate, but a 74% chance of controlling the House. This latter probability has fluctuated wildly over the past six months—reaching as high as 85% and as low as around 55%. This means anything is possible, but Trump and the Republicans will face a formidable challenge in maintaining complete control of Congress. They must contend with the incumbent party's poor historical record in midterm elections and the declining approval ratings of Trump.

Election cycles put pressure on the stock market.

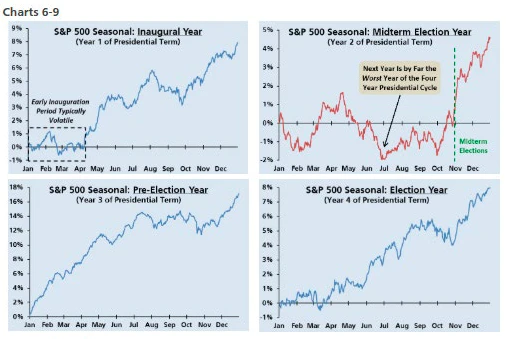

Historical data shows that ruling parties often find themselves at a disadvantage in midterm elections, especially in the House of Representatives elections. Since the American Civil War, the ruling party has lost its majority in 35 out of 39 midterm elections. This may stem from the uncertainty of midterm elections or the lingering effects of a president's first year in office, but whatever the reason, it is detrimental to stock market returns.

Undoubtedly, midterm election years are the worst-performing years for the stock market in the four-year election cycle. While the stock market typically trends upward in the other three years, it generally declines until the end of autumn during midterm election years. However, once the midterm elections in November have passed and political uncertainty decreases, the stock market often begins to rise before the end of the year.

Cost of living will be a primary issue.

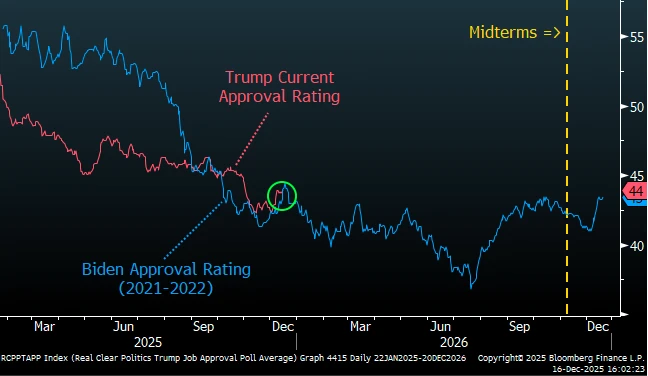

Trump's approval rating is currently at the same level as Biden's before the 2022 midterm elections. The primary reason for Trump's declining approval rating is inflation. His net approval rating on inflation governance has hit its lowest point this year, at -27%. To reverse the situation before the midterm elections, Trump may need to focus on addressing the cost of living crisis. UBS is uncertain whether this will be successful, but understanding the impact of this dynamic on the market is crucial.

The plight of the US housing market is more severe than that during the global financial crisis.

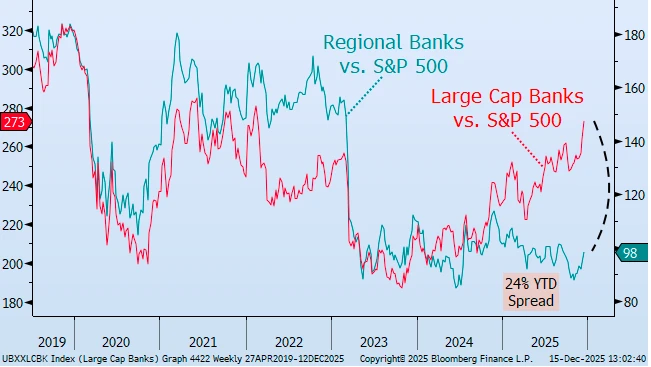

This year, the Trump administration's actions have had a significant impact on the stock market—affecting sectors from those impacted by tariffs (ticker symbol: UBXXTTL), large banks (ticker symbol: UBXXLCBK), to rare earths (ticker symbol: UBXXRARE). Next year, UBS believes the policy focus may shift towards the consumer sector. Stimulus checks appear to be a recurring theme; a more accommodative policy from the Federal Reserve could also provide support.

The housing market is a prominent area of consumer dissatisfaction. A University of Michigan study on "Is now a good time to buy or sell a home?"... A joint survey of homebuyers and sellers indicates that market confidence is currently at a historic low—even lower than during the worst of the global financial crisis. The US housing market is stagnating.

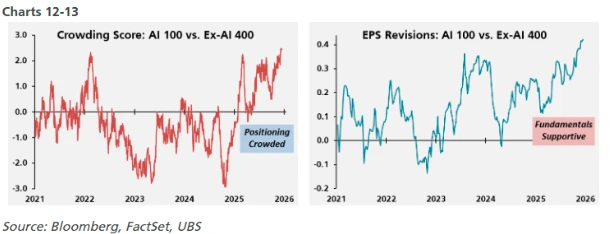

AI holdings are at a high level, but fundamentals still provide support.

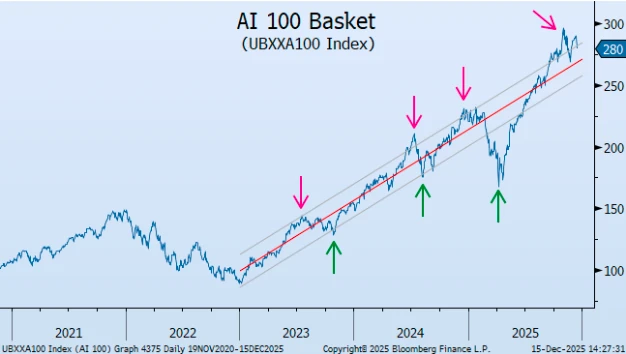

Currently, there are two types of AI-related trades: "AI-enabled" and "AI-productivity." Over the past three years, AI-enabled stocks have been the core of the market, driving the stock market rally. Despite market concerns about funds rotating from the AI sector to other areas, AI holdings remain at peak levels. The crowding score gap between UBS's AI 100 index basket (ticker symbol: UBXXA100) and the non-AI 400 index basket, representing the rest of the market, has reached an all-time high.

While this may be worrying, it is worth noting that earnings revisions still favor the artificial intelligence sector rather than non-AI sectors.

Why UBS remains unconcerned about the artificial intelligence sector

How should one trade artificial intelligence (AI) stocks? As mentioned at the beginning of this article, optimistic expectations, long positions, and high valuations mean the market has limited room to absorb negative news. This is particularly evident in AI-related trading. UBS's broadest indicator for measuring the AI sector—the AI 100 Index—is currently still at the top of its trading range.

However, as shown in Figure 13 on the right above, the earnings revisions that drove these stocks higher from the outset remain strong. In conclusion, the artificial intelligence sector will remain an important part of any industry portfolio, but it should no longer be the sole holding. New funds should be allocated to other areas, especially those benefiting from increased market participation and exhibiting significant portfolio asymmetry.

Four Trading Recommendations

Trading Recommendation 1: Regional Bank ETF (KRE) – The Purest Market Breadth Expansion Trade

UBS points out that we are in the midst of another wave of “market breadth expansion” trading. Will this time be different? For this trend to continue, we need to see: (1) strong but not overheated data; (2) stable or improving credit conditions; (3) a steepening yield curve; (4) AI-related trading paused but not ended; and (5) a rapid recovery in momentum in cyclical sectors. This is perfectly consistent with the list of drivers for the regional banking sector, making it the purest and most leveraged sector to benefit from market breadth expansion. In addition, regional banking ETFs are currently 17% below their post-COVID-19 highs and have underperformed the large banking sector by 24 percentage points this year.

Trading Recommendation 2: Positive Outlook for the Consumer Sector

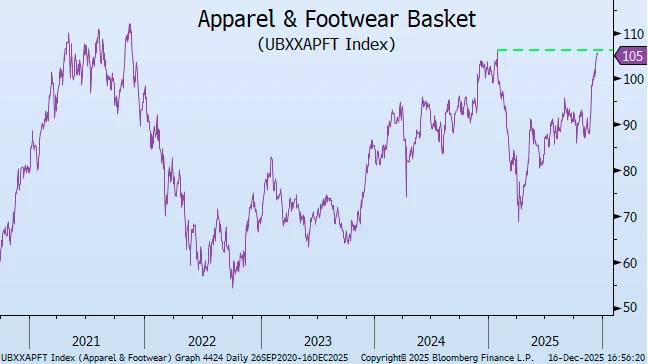

Similar to KRE, the consumer sector is unlikely to be excluded if market breadth expands. However, the consumer sector possesses several unique characteristics that warrant inclusion on next year's watchlist. First, tariffs have had a particularly severe impact on the consumer sector this year, but the worst may be over. Furthermore, if the Supreme Court removes tariffs related to the IEEE PA Act, it will directly benefit these stocks. From the end of the first quarter to the second quarter of next year, with a surge in consumption driven by Big and Beautiful Act tax rebates and the immediate adjustment of tax withholding policies starting January 1st, we should see positive changes in the consumer sector. If the Trump administration addresses the cost of living crisis that has been plaguing households, the consumer sector will also benefit.

Recommended Stock: While most consumer themes will benefit from improved consumer sentiment, no sector boasts superior earnings momentum compared to the Apparel & Footwear sector (ticker symbol: UBXXAPFT). In fact, it ranks first in earnings revision momentum among a basket of 150 themes. These upward earnings revisions explain and justify the sector's recent 20% gain. In ETF form, the Retail Select Sector SPDR Fund (XRT) is the closest liquidity alternative.

Timing for entry: As mentioned at the beginning, UBS believes that many market breadth expansion trades will present buying opportunities on pullbacks, and the consumer sector, which has risen sharply over the past four weeks, is expected to offer more attractive entry points as we enter the first quarter of next year.

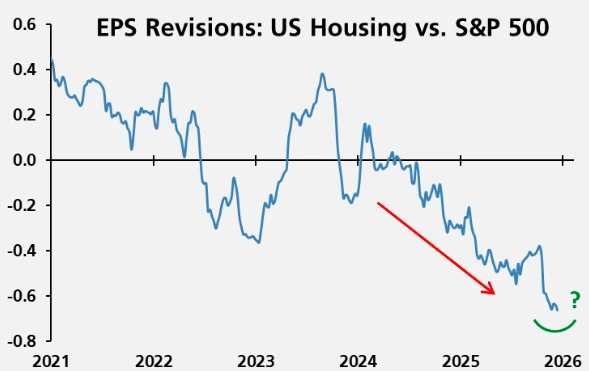

Trading Recommendation 3: US Real Estate Sector – A Key Issue in the Midterm Elections

It's important to clarify that the fundamentals of the US housing market remain poor. Homebuilders' earnings revisions rank at the bottom among more than 150 thematic baskets. Lower mortgage rates remain a key missing factor for a trend reversal—this would certainly be true in normal times, but not now. With the cost of living crisis at the heart of the midterm elections, the Trump administration appears to be focusing on the housing market. They are constantly introducing new measures to revitalize it—from 50-year mortgages to government-supported business reforms. Sluggish earnings revisions coupled with federal government support may be enough to reverse the trend of the US Housing Index Basket (ticker symbol: UBXXHOME), which is ETF-based as the Residential Construction and Renovation ETF (XHB). Given the speculative nature of this trade, UBS recommends waiting for yields to recover before gradually building a position.

Trading Recommendation 4: A New Era for Mid-Cap Stocks

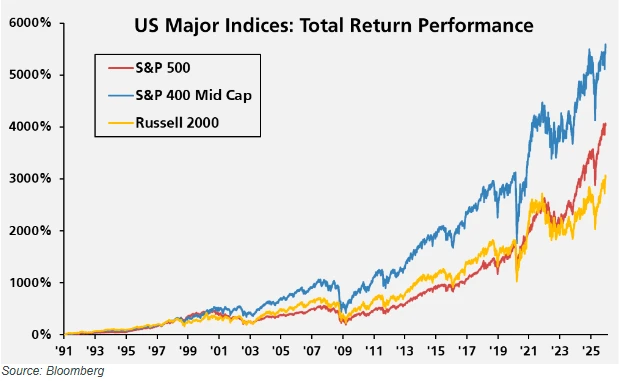

UBS points out that this deal is not suitable for all investors, but similar to the three deals mentioned above, mid-cap stocks will benefit if market participation increases. Historically, S&P... The CSI 400 Mid-Cap Index is often overlooked, sandwiched between the S&P 500 and the Russell 2000 Small-Cap Index. Despite mid-cap stocks outperforming large-cap and small-cap stocks in the long run, this neglect persists.

If you're looking to allocate long-term funds to the U.S. stock market but are concerned about the valuation and concentration risks of the S&P 500 and believe the Russell 2000 is more of a market betting on Fed rate cuts, then mid-cap stocks—or the S&P 400 Mid-Cap ETF (MDY) in ETF form—would be an ideal choice.

In terms of valuation, compared to the S&P 500's P/E ratio of 22 and the Russell 2000's P/E ratio of 24, mid-cap stocks' P/E ratio of 16.5 also offers a valuation advantage. The valuation of mid-cap stocks relative to the S&P 500 has only reached such a low level since the dot-com bubble.

(Article source: CLS)