U.S. Treasury prices fell across the board on Wednesday (November 5) as the U.S. Treasury hinted at future expansion of long-term debt issuance, while the resilience of the U.S. economy further reduced the likelihood of a Federal Reserve rate cut in December.

Market data shows that yields on U.S. Treasury bonds of various maturities generally rose by 5-8 basis points overnight. Specifically, the 2-year Treasury yield rose 5.99 basis points to 3.630%, the 5-year Treasury yield rose 7.30 basis points to 3.764%, the 10-year Treasury yield rose 7.78 basis points to 4.159%, and the 30-year Treasury yield rose 7.31 basis points to 4.737%.

In its quarterly refinancing statement released that day, the U.S. Treasury Department announced that it expects to maintain the auction size of medium- and long-term fixed-rate and floating-rate Treasury bonds unchanged for "at least the next few quarters," a wording consistent with previous quarterly statements.

However, the Treasury Department added in its latest statement that, looking ahead, it has begun preliminary consideration of increasing the size of future auctions of interest-bearing and floating-rate Treasury bonds, with a focus on assessing long-term demand trends and the potential costs and risks of different issuance structures.

After the U.S. government signaled that it would expand the scale of the auction, U.S. Treasury prices fell sharply during the session, while yields rose rapidly.

Although traders had anticipated that the U.S. Treasury would at some point begin paving the way for increased issuance of long-term bonds—given the government’s continued historically large fiscal deficits that have increased the overall debt burden—Wednesday’s statement was still clearly unexpected.

U.S. Treasury Secretary Bessant had previously stated his preference for avoiding locking in higher borrowing costs when Treasury prices were low—meaning a greater reliance on short-term bond financing. This led some Wall Street firms to postpone their predictions on when to increase long-term bond issuance. However, according to Wednesday's statement, Bessant may now be planning a shift in policy as early as 2026.

Wells Fargo Strategist Angelo Manolatos said, "The interest rate market may have reacted to the Treasury's additional guidance that it is considering increasing the issuance of medium- and long-term coupon bonds in the future. This guidance essentially rules out the possibility of a reduction in issuance and has raised market concerns that the Treasury may increase the size of bond issuance as early as November 2026."

TD Securities Interest rate strategist Jan Nevruzi, when discussing the refinancing announcement, also noted that "the announcement was somewhat hawkish compared to market expectations."

He stated, "We do not agree with the claim that they will reduce the auction size, but there were indeed rumors about it before... In fact, they have completely reversed course and are initially considering increasing the auction size of future interest-bearing and floating-rate government bonds."

Economic data further reduced expectations of interest rate cuts.

In addition to the U.S. Treasury's quarterly refinancing statement, a series of better-than-expected U.S. economic data released on Wednesday also put pressure on U.S. Treasuries.

The ADP employment report, often referred to as the "mini-nonfarm payrolls," released Wednesday showed that the U.S. private sector added 42,000 jobs in October, exceeding the 22,000 forecast by economists surveyed by the media. The September job losses were also revised to a decrease of 29,000, better than the initial report for the previous month.

With the official non-farm payroll data from the U.S. Department of Labor currently unavailable due to the government shutdown, investors and Federal Reserve policymakers are now relying more heavily on alternative data sources such as ADP.

"This jobs report should alleviate the Federal Reserve's concerns about a deteriorating labor market," said Florian Ielpo, head of the macro multi-asset team at Lombard Odier Asset Management. He expects U.S. Treasury yields to "linger" in the 4.00% to 4.25% range.

Data released by the Institute for Supply Management (ISM) on the same day also showed that its non-manufacturing purchasing managers' index (PMI) rose to 52.4 in October, up from 50.0 in September and stronger than economists' previous forecast of 50.8. The service sector accounts for more than two-thirds of U.S. economic activity.

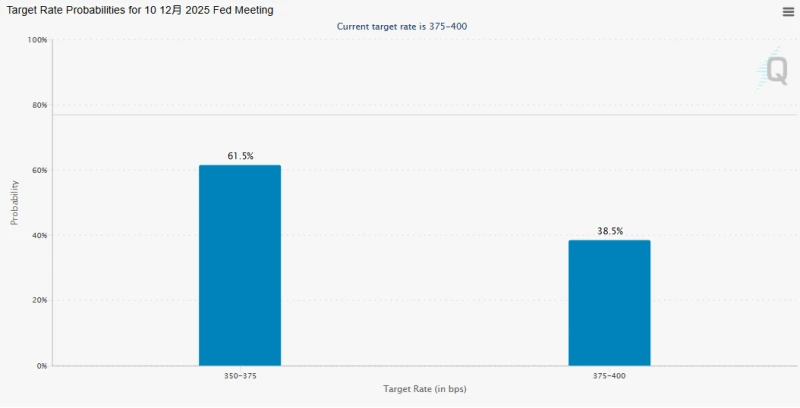

The aforementioned strong signs in the U.S. economy have further weakened market expectations that Federal Reserve policymakers will cut interest rates for the third consecutive time at their December meeting. The CME Group's FedWatch Tool shows that interest rate futures traders now expect a 61% probability of a 25-basis-point rate cut at the Fed's next policy meeting in December, down from about 70% before the data release.

In a report, Matthew Martin, a senior economist at Oxford Economics, stated, "We believe that the Fed's two consecutive rate cuts have provided sufficient support for the labor market, and therefore we will keep rates unchanged at the next two meetings."

Meanwhile, as the U.S. Supreme Court began hearing the legality of Trump's comprehensive tariff policy on Wednesday, the U.S. Treasury market also faces the risk of further sell-offs. The tariff policy previously boosted U.S. federal government revenue, helping to reduce the deficit for the fiscal year ending September 30. However, if the Supreme Court rules that Trump's tariffs are illegal, the prospect of reduced tariff revenue could lead to a widening of the U.S. government budget deficit and ultimately a surge in U.S. Treasury supply.

“The oral arguments held by the Supreme Court today serve as a reminder that this issue remains, and its impact is almost always either/or,” said Art Hogan, chief market strategist at B. Riley Wealth.

John Brady, managing director of RJ O'Brien, pointed out: "If the tariff policy is overturned, 10-year and 30-year US Treasury bonds will be very likely to experience a sharp decline. At that time, the market will face a fiscal deficit situation that is far less ideal than it is now."

(Article source: CLS)