① Bank of America The bank predicts that commodities will be the best investment choice in 2026, as tax cuts and interest rate reductions will stimulate a new round of economic growth, and commodities are expected to perform well; ② The bank believes that commodities will yield considerable returns in 2025, as metals and energy commodities are key drivers of AI data centers. Key investment focus.

According to Bank of America , commodities will be the hottest and best investment option in 2026.

In a recent report, the team led by strategist Michael Hartnett stated that the corners of the market—often overshadowed by more glamorous risk assets such as stocks and cryptocurrencies—present the best "run-it-hot" trades investors may have to look forward to in 2026, as a series of economic tailwinds will allow commodities to continue to outperform.

The core logic of the "Run it hot" strategy is that tax cuts and interest rate reductions will work together to "heat up" the economy, thereby stimulating a new wave of growth, and the US economy will perform strongly. Even if there are some negative data, the powerful policy toolbox is enough to smooth out short-term fluctuations.

Bank of America predicts that the economy in 2026 will be characterized by strong growth, fiscal and monetary stimulus, and potentially worsening inflation.

“We believe that going long on commodities is the best ‘striking while the iron is hot’ trade in 2026, and the long-underestimated oil/energy sector is undoubtedly the best ‘striking while the iron is hot’ contrarian trade,” the team wrote.

Bank of America went on to point out that commodities are expected to yield substantial returns by 2025, primarily because metals and energy commodities are driven by artificial intelligence. (AI) Key investment focus in the data center boom.

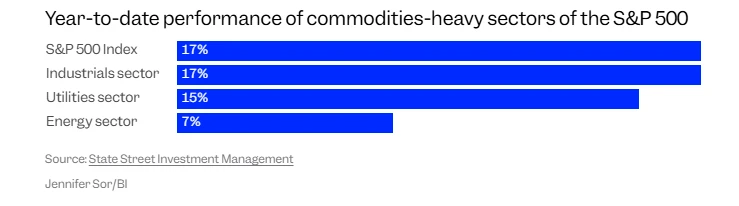

Vanguard Commodity Strategy Fund, a well-known mutual fund that tracks commodity investments, has risen 17% year-to-date, outperforming the S&P 500. The S&P 500 index.

Meanwhile, commodity-heavy industrial stocks in the benchmark index have also risen 17% since January. Utilities have also performed well this year. Stocks in the blue and energy sectors rose by 15% and 7%, respectively.

Here are some reasons why Bank of America believes this momentum can continue:

Trump's economic policies. Strategists believe the president's economic agenda appears poised to stimulate further economic growth in the coming year, a factor that could support commodity investment.

Increased attractiveness. Bank of America stated that excessive fiscal spending in recent years has enabled commodities to outperform other investments traditionally considered safe-haven assets, such as bonds.

Globalization is crumbling. World trade is becoming more fragmented due to factors such as geopolitical conflicts, supply chain problems, and trade barriers like tariffs. Theoretically, this should boost commodities, as they are frequently transported and used as raw materials for various goods.

Inflation. Higher inflation expectations could lead to higher prices for commodities such as gold. Gold has risen 60% this year and is on track for its best performance since the 1970s, mainly because investors view it as a safe-haven asset and an inflation hedge.

Strategists wrote, "Soon, all commodity charts will show gold's trajectory."

(Article source: CLS)