Earlier this year, when the idea of a "currency devaluation trade" first emerged in the market, Robin J. Brooks, former chief economist of the Institute of International Finance and now a senior fellow at the Brookings Institution, held several meetings to discuss whether such trades actually existed.

This week, after gold, silver, platinum, and palladium all surged again, he argued in his latest column published on Tuesday that this question no longer needs to be discussed!

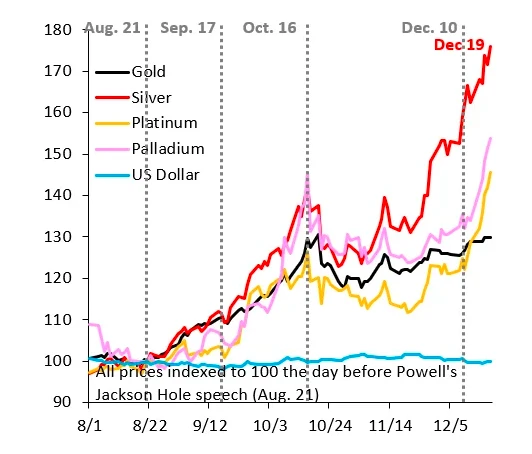

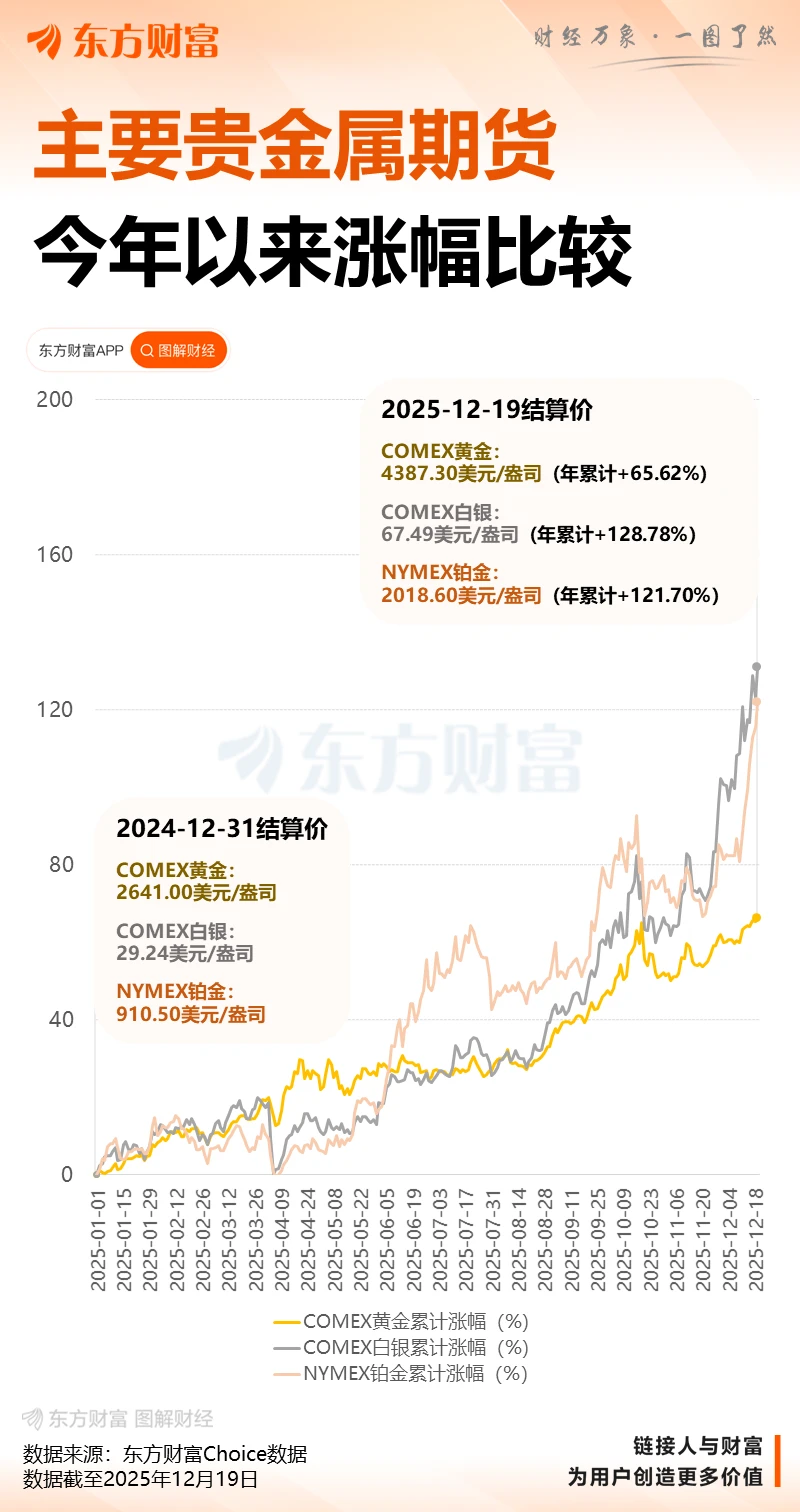

As shown in the chart below, since the Jackson Hole Economic Symposium hosted by the Federal Reserve in August of this year, silver prices have surged by 76%, palladium by 65%, and platinum by a staggering 45% in just four months, triggering a surge in precious metal prices . Gold, which had been surging recently, has lagged behind – with a gain of "only" 30%.

Note: Red represents silver, purple represents palladium, orange represents platinum, black represents gold, and blue represents US dollars.

Brooks points out the following facts that we currently know:

First, this round of price increases was clearly triggered by the Federal Reserve's easing policies and related concerns about debt monetization. After all, Fed Chairman Powell's dovish speech in Jackson Hole on August 22 and the Fed's latest interest rate cut this month were both important catalysts for the rise in precious metals .

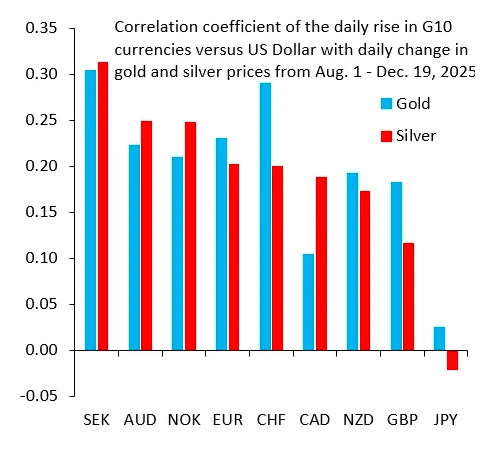

Secondly, this round of market activity is not limited to the precious metals sector. The currencies of countries with low public debt levels, such as Switzerland and Sweden, are showing an increasingly close correlation with gold and silver price movements.

The chart below, provided by Brooks, shows the daily changes in G10 currencies against the US dollar and their correlation with the prices of gold (blue) and silver (red). It's noteworthy that the Swedish krona—a traditionally volatile currency lacking safe-haven appeal—is changing its character due to currency devaluation trading.

Note: The horizontal axis represents the Swedish Krona, Australian Dollar, Norwegian Krone, Euro, Swiss Franc, Canadian Dollar, New Zealand Dollar, British Pound, and Japanese Yen, respectively; the vertical axis represents the correlation.

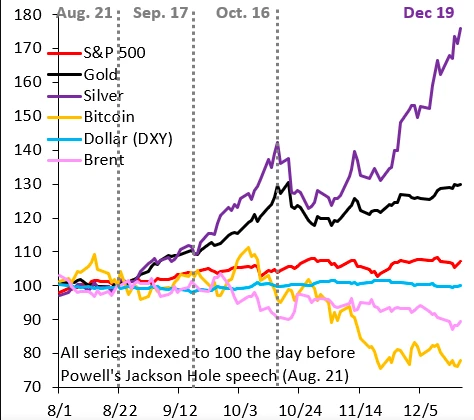

Third, the US dollar appears immune to currency devaluation transactions—it remained stable during the period of the precious metals frenzy—but this is not the true story.

The chart below shows Brooks' preferred method for tracking global market dynamics. The blue line clearly demonstrates that the US dollar remained rock solid during the precious metals bull market.

However, as Brooks recently noted, this resilience of the dollar is partly superficial—the apparent strength of the dollar is due to the sharp depreciation of the yen. It can be preliminarily concluded that the currency devaluation trades that triggered the surge in precious metal prices are not only related to the United States, but also reflect widespread concerns about the monetization of debt in other G10 countries.

Of course, Brooks also mentioned that this does not mean there are no puzzling aspects behind the recent surge in precious metal prices.

Two main questions are: ① If currency devaluation is indeed occurring, why hasn't the US break-even inflation rate risen significantly? ② If the market is concerned about debt monetization, why haven't long-term Treasury yields risen further?

Brooks argues that the latter question has a good explanation: the existence of many countries with poor fiscal conditions makes the US relatively well-performing. The former question is more difficult to explain. But as he stated in an article a month ago, there are no transitive conditions in the market that guarantee consistency between different things. In Brooks' view, the lack of volatility in the break-even inflation rate—especially given increasingly poor data quality—does not negate the authenticity of currency devaluation trades.

Earlier this year, Cailian Press reported that when gold prices broke through the $4,000 mark in October, reaching a then-historical high, a major debate about "currency devaluation" swept through global markets. Those who believed in this argument were massively withdrawing from sovereign bonds and their denominated currencies, fearing that as governments avoided their massive debt burdens and even continued to expand bond issuance, the value of these assets would be eroded in the long term.

In Western history, the term "debasement" can be traced back to the era when rulers such as Nero and Henry VIII diluted gold and silver coins with cheap metals like copper. In ancient China, Wang Mang's reforms can be considered the most chaotic and frequent case of currency debasement in Chinese monetary history.

Many suspect the world is currently experiencing a modern version of “bad money” devaluation, especially given the multiple factors behind the surge in gold prices. Furthermore, since the global financial crisis, premature warnings of an impending debt crisis have been intermittent.

Coincidentally, renowned Wall Street forecaster Peter Schiff also stated on social media on Tuesday that the US federal government debt, just two months after surpassing $38 trillion, has reached $38.5 trillion—and is currently growing at a rate of $3 trillion per year. Trump claims that the record debt was accumulated during a period of economic prosperity. But what will happen once the economy collapses? The surge in gold prices is foreshadowing an impending debt crisis.

Dongcai Illustrated Guide: Some Useful Tips

(Article source: CLS)