U.S. Treasury prices rose broadly on Tuesday, pushing the 10-year Treasury yield below 4% for the first time in a month, after reports that White House National Economic Council Director Kevin Hassett was emerging as the frontrunner to become the next Federal Reserve chairman.

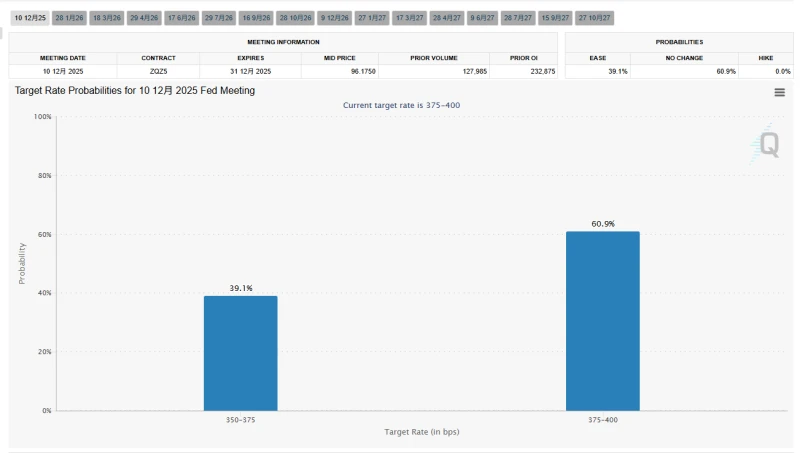

Traders subsequently increased their bets on significant interest rate cuts over the next year, reflecting the market's widespread belief that Hassett will implement the aggressive rate-cutting policies that US President Trump has been calling for.

Market data shows that yields on US Treasury bonds across all maturities declined overnight. The benchmark 10-year Treasury yield fell 3.07 basis points to 3.996%, a new low since the Federal Reserve's October decision. For other maturities, the 2-year Treasury yield fell 3.62 basis points to 3.459%, the 5-year Treasury yield fell 2.79 basis points to 3.564%, and the 30-year Treasury yield fell 2.05 basis points to 4.650%.

According to sources familiar with the matter, as the selection process for the next Federal Reserve chairman enters its final weeks, White House National Economic Council Director Kevin Hassett is being seen as the frontrunner by Trump's advisors and allies.

The aforementioned sources revealed that if Hassett is appointed, Trump will be able to place a close ally he knows and trusts within the Federal Reserve. Hassett is seen as bringing Trump's interest rate-cutting philosophy to the Fed, a position Trump has long sought to maintain.

However, sources also indicated that, as is well known, Trump frequently makes unexpected personnel and policy decisions, meaning that the nominations are not considered final until they are officially announced. White House Press Secretary Carolyn Levitt stated in a statement, "Nobody really knows what President Trump will do until he takes action. Stay tuned!"

Historically, the selection of the Federal Reserve Chairman and Governors has been the most direct way for a president to influence central bank policy. During his first term, Trump nominated current Chairman Powell. However, Powell failed to push for interest rate cuts as Trump desired, a fact Trump has long regretted.

Markets suspect the Fed will "plummet" once Powell's term ends.

Hassett is considered to share Trump's economic views, including the belief that interest rates need to be further lowered. In a media interview on November 20, he even threatened that if he were to become Federal Reserve Chairman, he would "cut rates immediately" because "the data shows we should." Hassett has also criticized the Federal Reserve for failing to control inflation after the pandemic.

U.S. Treasury prices surged during the session, buoyed by news that Hassett was a leading candidate for the next Federal Reserve chair, with the 10-year Treasury yield falling below 4% for the first time in a month. Meanwhile, the dollar briefly fell to an intraday low before gradually recovering its losses.

Mizuho Securities Jordan Rochester, head of macro strategy at the London office, said the market has concluded that the dollar will weaken, short-term interest rates will decrease from the May meeting next year, and the yield curve will steepen.

Hassett is a credible economist by background, having previously served as a senior economist at the Federal Reserve, but some may argue that his close ties to Trump make him vulnerable to manipulation.

On Tuesday, Miguel Milan, Trump's newly appointed Federal Reserve governor this year, reiterated his view that the US economy needs significant interest rate cuts, further reinforcing market expectations of a substantial decline in interest rates. The Federal Reserve typically adjusts interest rates in 25-basis-point increments, but occasionally makes adjustments of 50 basis points or more.

David Robin, interest rate strategist at TJM Institutional Services, noted, "With Hassett's addition, the Federal Reserve Board of Governors will likely have two voting members (appointed during Trump's second term), and the Fed may be more aggressive in advocating for a 50-basis-point rate cut starting next June. Unless there is strong opposition, the Fed Chair usually gets his way."

"Hassett's addition will increase the probability that the first or first two interest rate actions after Powell's departure will result in a 50 basis point cut," he added.

Powell's term will end next May. Currently, Hassett is leading the selection process for Powell's successor, and Trump is expected to announce his decision before December 25th. There are currently five candidates vying for the position. Besides Hassett, these include former Federal Reserve Governor Warsh, current Federal Reserve Governors Waller and Bowman, and BlackRock. Executive Rick Rieder.

It's worth noting that in his latest speech on Tuesday, Bessant made no secret of his intention to reform the Federal Reserve. Bessant stated that the core issue of his interview was simplifying the Fed's operations, noting that the Fed had become overly complex in its management of the money market.

Dongcai Illustrated Guide: Some Useful Tips

(Article source: CLS)