As 2025 draws to a close, if we were to take stock of the most "magical" performing assets of the past year, the 30-year US Treasury bond would certainly deserve a place...

Admittedly, its gains are far less impressive than those of AI concept stocks or gold and silver. In fact, the price of 30-year US Treasury bonds has not even risen this year.

But perhaps its "miracle" lies precisely in this—given the turmoil it has experienced over the past 12 months, it should have suffered a devastating blow. Yet, as of this writing, it is heading towards a year-end performance almost on par with the beginning of the year, which alone is remarkable.

Let's start by considering these questions:

If you were to go back to January 1st of this year and be told that gold would surge nearly 70%, breaking through $4,400 per ounce, that Wall Street would experience its biggest tech boom in a quarter of a century, and that financial conditions would be the loosest in three years, you would probably quickly conjure up a scenario of rising long-term bond yields (and falling prices)...

What if you were also told that U.S. inflation would continue to exceed the target level for the next year, the dollar would plummet by nearly 10%, the term premium of U.S. Treasury bonds would rise to its highest level in more than a decade, and the once-sacred concept of central bank independence would be nearly destroyed by the Trump administration’s continued attacks on the Federal Reserve?

If that's not enough, what if we add Trump's "Big and Beautiful Act," which will push up the budget deficit by trillions of dollars over the next decade, fueling a "dollar devaluation" trade? Does that make you think long-term US Treasury yields are about to skyrocket?

But back in reality, you'll find that the yield on 30-year Treasury bonds remained around 4.8% a year later, basically the same as at the beginning of the year.

The US Treasury yield curve has indeed become steeper—the 2-year/30-year spread is the steepest in four years, but this is almost entirely due to changes at the short end.

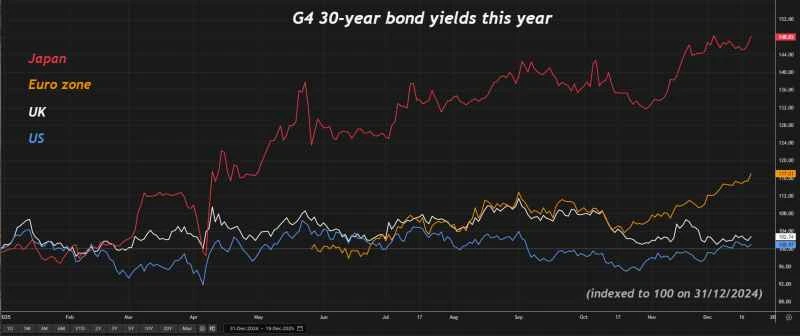

Compared to similar international bonds, US long-term bonds have performed remarkably well this year, although a 10% depreciation of the dollar has slightly dimmed their performance after currency adjustments. The yield on German 30-year government bonds recently reached its highest level since 2011, rising nearly 100 basis points this year; while the yield on Japanese 30-year government bonds also hit a record high, similarly rising by more than 100 basis points this year.

Of course, the flat yield at the end of the year compared to the beginning of the year doesn't mean there was no market movement; the 30-year Treasury yield did indeed fluctuate during this period. The Federal Reserve cut interest rates by a total of 75 basis points this year, which should have lowered Treasury yields—the 10-year Treasury yield did indeed fall by nearly 50 basis points throughout the year. However, it's also worth noting that when inflation is persistently and significantly higher than the target level, interest rate cuts often limit the downside potential of ultra-long-term Treasury yields.

Where does resilience come from?

So what is the reason for the relatively strong performance of 30-year US Treasury bonds?

In response, some industry insiders said that despite the drastic fluctuations in the macroeconomy, a 5% yield is still quite attractive to many investors for bonds, which are still considered to be among the safest and most liquid long-term assets in the world.

Funds from pension funds, mutual funds and insurance Demand from "real money" buyers such as corporations has remained strong, as these buyers need to match long-term liabilities with long-term assets.

This demand ensured that the 12 auctions of 30-year Treasury bonds conducted by the U.S. Treasury this year were generally completed smoothly without any major surprises.

This year, the U.S. Treasury has auctioned a total of $276 billion in 30-year Treasury bonds, once a month. The average bid-to-cover ratio for the 12 auctions was 2.37. According to Exante Data, this bid-to-cover ratio is roughly in line with the average of 2.38 for the past 50 auctions dating back to November 2021.

Domestic institutional investors in the United States absorbed approximately 70%-75% of the auctioned bonds, while foreign investors increased their purchases in the second half of the year, with their share exceeding 15% for the first time in November, reaching a new high since the beginning of last year. On the other hand, in these auctions, the U.S. Treasury paid yields lower than the pre-sale market level only three times, while paying yields higher in six instances. This indicates that investors generally demanded a premium when purchasing at auctions.

However, it is foreseeable that despite the relatively strong performance of US long-term bonds this year, they will still face serious challenges next year.

The global fixed income duration market environment remains challenging – risk premiums, inflation risk, and debt supply are all rising, and concerns about artificial intelligence are growing. Concerns about productivity prospects persist, and worries about the Federal Reserve's independence are intensifying.

Therefore, 30-year bonds may face similar challenges next year as they did in 2025—and this time the challenges may be even more severe, and whether they can still "dance on the edge of the cliff" as they have this year is a big question mark.

(Article source: CLS)