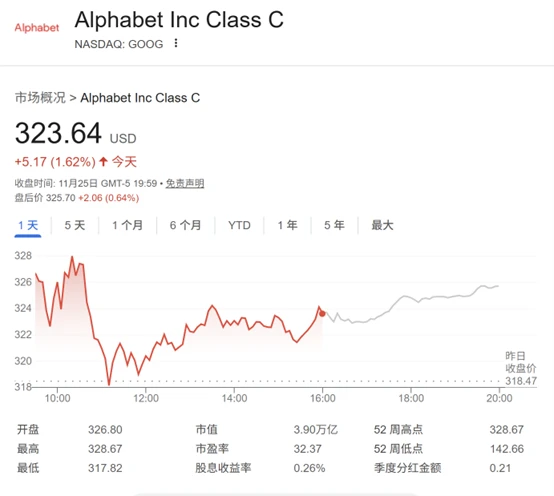

Amid lingering concerns about an "AI bubble," Alphabet, Google's parent company, has become the most dazzling player in the US tech sector, thanks to its globally stunning Gemini 3 models and full-stack AI capabilities, with its stock price soaring recently.

On Tuesday, Alphabet's stock price rose further, bringing its market capitalization just one step away from joining the $4 trillion club. Alphabet's stock has risen approximately 20% this month and has gained about 70% year-to-date, making it the top performer among the "Big Seven" US tech stocks.

Alphabet is clearly already incredibly popular, and a top tech investor recently added fuel to the fire.

If you had to choose one of the "Big Seven" US tech stocks that underpin the entire market, which one would you choose?

Gene Munster, a tech venture capitalist and founder of Deepwater Asset Management, gives the answer: Alphabet—at least for the next year.

Munster believes that the power structure of Silicon Valley is being reshaped, and Google is undoubtedly the leader in artificial intelligence. One of the most dominant companies in the technology field.

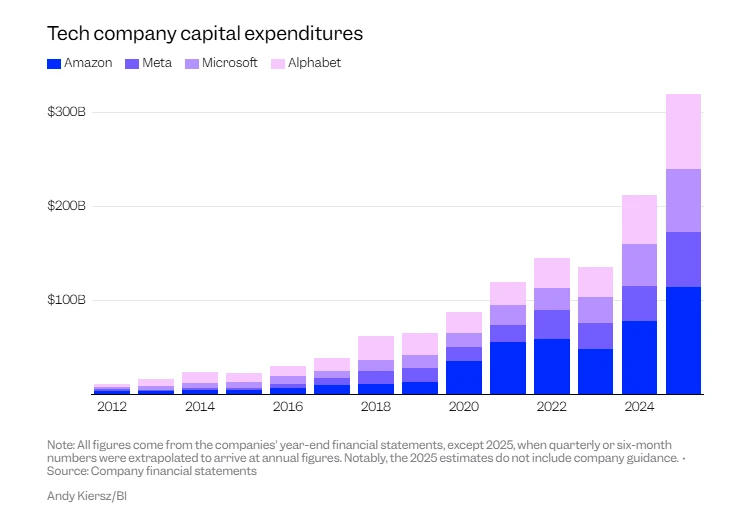

The fund manager's bullish logic revolves around Google's recent breakthroughs in artificial intelligence : On Tuesday, news broke that Google's Tensor Processing Unit (TPU) could be deployed in Meta's data centers as early as 2027. Providing computing power support caused Alphabet's stock price to rise that day, while Nvidia's... The stock price has pulled back. Currently, Meta's AI infrastructure primarily relies on Nvidia 's graphics processing units (GPUs).

Munster believes this is highly bullish for Alphabet stock, both in the long and short term. He points out that there were widespread concerns that Google would be unable to establish itself in the generative AI market, but the company's recent progress has overturned that view.

“This shows that, from the perspective of large language models, Google does indeed have the strength to compete head-on with OpenAI. What’s even more encouraging for investors is that the company’s competitive culture has been reactivated,” Munster said in an interview.

He added, chatbots The market presents a significant opportunity for Google—currently, only about 20% of Google users regularly use the Gemini AI tool. Google's recent updates to its AI platform have received high praise from leading figures in the tech industry; for example, Salesforce CEO Marc Benioff publicly praised Gemini as superior to ChatGPT.

Google's price-to-earnings ratio based on projected earnings over the next 12 months is approximately 28. Munster points out that this is similar to the other seven giants, and Google's new positioning—comprising both chip manufacturing and AI chatbots —justifies a higher valuation multiple .

In his view, although ChatGPT has brought a disruptive impact to the digital search ecosystem, Google’s core advantage has always been its user reach—reaching more users than any other platform.

(Article source: CLS)