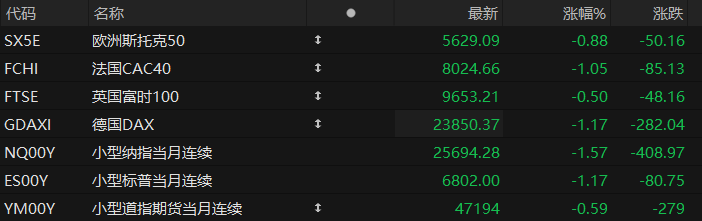

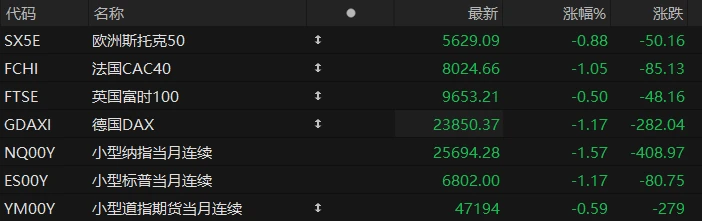

U.S. stock futures fell across the board in pre-market trading on Tuesday, while major European indices also declined. As of press time, the Nasdaq... S&P 500 futures fell 1.57%, S&P 500 futures fell 1.17%, and Dow Jones futures fell 0.59%.

In terms of individual stocks, major US tech stocks collectively weakened in pre-market trading, with Google and Nvidia among the losers. Nearly 2% drop, Meta and Amazon Microsoft fell more than 1%. , apple It fell by nearly 1%.

Tesla Stocks fell nearly 3% after Norway’s sovereign wealth fund rejected Musk’s trillion-dollar compensation package.

Palantir shares fell nearly 8% in pre-market trading, despite a 63% year-over-year increase in Q3 revenue, but the market continues to question its high valuation.

Popular Chinese concept stocks generally weakened in pre-market trading, with Bilibili among them. Alibaba fell more than 4%. JD.com NIO fell more than 3%. Li Auto shares fell nearly 3%. XPeng Motors It fell by more than 2%; only Baidu. It bucked the trend and rose by more than 2%.

Several CEOs from Wall Street asset management firms said that investors should prepare for a healthy stock market pullback of more than 10% within 12 or 24 months, and that such a correction could be a positive development rather than a pessimistic signal of the start of a bear market.

Mike Gitlin, president and CEO of Capital Group, said that corporate earnings were indeed very strong, but "the challenging thing is that valuations are really too high."

Morgan Stanley CEO Ted Pick and Goldman Sachs David Solomon expressed a similar view. They also believe that a significant sell-off is likely in the near future, noting that pullbacks are a normal feature of market cycles.

Hot News

The US stock market's bull run has been abruptly warned! Extreme bullish sentiment is flashing warning lights, and liquidity is showing signs of danger.

Amid the frenzied upward momentum of the US stock market, Ed Yardeni, one of Wall Street's most optimistic analysts, suddenly warned that the extreme bullish sentiment in the US stock market may be flashing warning lights. He warned that once market sentiment and technical indicators show signs of fatigue, the S&P 500 index may fall by 5% from its peak by the end of December.

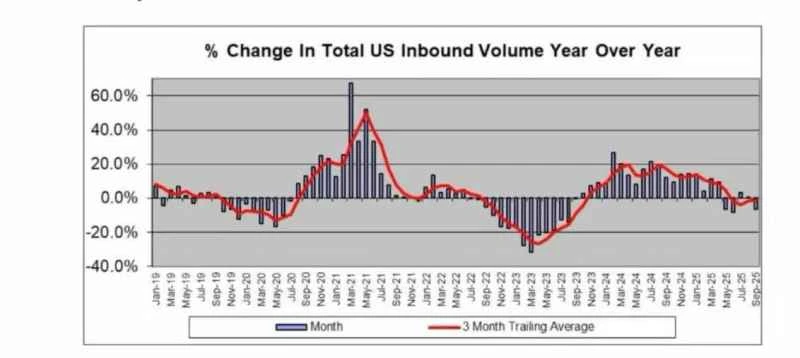

At the same time, dangerous signs are emerging in US market liquidity. Several key indicators in the US money market suggest that US financial... Systemic liquidity is approaching dangerous levels. The Secured Overnight Financing Rate (SOFR) surged 18 basis points to 4.22% on October 31, marking its largest increase in a year. The Federal Reserve's primary liquidity support tool—the Standing Repurchase Facility (SRF)—saw its usage reach a record high.

The core reason for the liquidity crunch is that the US government shutdown forced the Treasury to increase its cash balance from $300 billion to $1 trillion over the past three months, draining market liquidity. Federal Reserve reserves fell to $2.85 trillion, the lowest level since early 2021, and foreign commercial banks... Cash assets plummeted by more than $300 billion in four months.

Analysts believe that, in effect, the government shutdown was equivalent to multiple rounds of interest rate hikes, as the $700 billion in liquidity it withdrew from the market had a tightening effect comparable to a significant monetary policy tightening. The Federal Reserve's continued quantitative tightening in November further exacerbated the already fragile liquidity situation, making the Fed's decision to postpone ending quantitative tightening until December potentially another policy mistake.

Following his warning of an AI bubble, "Big Short" Burry revealed that he significantly shorted Nvidia and Palantir in Q3.

According to U.S. Securities and Exchange Commission The U.S. Securities and Exchange Commission (SEC) disclosed that Scion Asset Management, the asset management firm of "big short" investor Michael Burry, filed its third-quarter holdings report (13F, a document required by the SEC for institutional investors to disclose their shareholdings) for the period ending September 30, 2025. This filing revealed its investment in artificial intelligence . Large short positions in popular stocks Nvidia (NVDA.US) and Palantir (PLTR.US) have attracted widespread market attention. This is not the first time Burry has shorted Nvidia; he almost liquidated all his holdings of listed stocks in the first quarter of this year, and also established new short positions in Nvidia and Chinese concept stocks before US President Trump's trade war stirred up global markets.

This prominent investor had previously signaled caution regarding the artificial intelligence boom driving this year's market rebound, and this latest move further confirms his view. According to its 13F filing, the company disclosed holding put options on 1 million shares of Nvidia and 5 million shares of Palantir, representing 80% of the fund's portfolio. Year-to-date, Nvidia's stock price has risen 54%, while Palantir's has surged over 173%. As of press time, Nvidia's pre-market stock price was down 1.9%; even after Palantir reported strong third-quarter results and raised its full-year guidance, its pre-market stock price was still down 7.2%.

The truth behind the embarrassing rise in US stocks: Besides the seven giants, 493 other stocks are "deeply mired in trouble".

Beneath the surface of the US stock market's apparent prosperity lies an awkward structural divergence: the S&P 500's gains are almost entirely reliant on the seven tech giants, while the remaining 493 component stocks have lagged far behind. However, Wall Street strategists believe that as long as the earnings growth momentum of large tech companies remains strong, there is no reason to defy this trend.

On November 4th, it was reported that data compiled by Bloomberg showed that the "Big Seven" tech companies ( Apple , Nvidia, Microsoft , Amazon , Tesla , Meta, and Alphabet) are expected to see a 27% profit growth rate in the third quarter, roughly double the previous forecast, becoming a key force supporting the market. In contrast, excluding these seven companies, the profit growth of S&P 500 components plummeted from 13% to 8.8%.

Meanwhile, according to Jefferies data, the S&P 500 equal-weighted index—a measure of the performance of common stocks in a benchmark index—is trading at a discount of more than 25% relative to the S&P 500. However, Wall Street strategists generally believe that as long as the profit-generating machines of large technology companies continue to operate, there is no reason to defy this trend.

The report points out that despite concerns about a bubble arising from market concentration, investors' optimism about artificial intelligence technology and the continued strong profitability of tech giants have led most Wall Street figures to continue betting on a few winners rather than waiting for market breadth to improve.

US Stocks Focus

Tesla's shareholder meeting is approaching, and major shareholders have already explicitly opposed Musk's trillion-dollar compensation plan.

One of the world's largest sovereign wealth funds, the Norwegian Government Pension Fund Global, stated on Tuesday (November 4th) that it will invest in Tesla this week. At the annual shareholders' meeting, they voted against Elon Musk's "trillion-dollar compensation plan".

Tesla will hold its annual shareholder meeting on November 6, where it will announce the voting results of several proposals, including Elon Musk's compensation plan. According to this plan, if Musk is able to increase Tesla 's valuation to $8.5 trillion over the next 10 years, nearly eight times its current valuation, he will receive an additional 12% of Tesla's stock. At this level, the proposed award would be worth slightly more than $1 trillion. This plan is arguably the largest compensation plan in history; however, it also includes a clause that if the company's market capitalization fails to increase significantly, the CEO will receive "no money."

However, according to corporate compensation, company valuation, and robots Experts on technology and automotive industry trends say that Musk could still earn billions of dollars even if he doesn't achieve many of the aforementioned goals, which has drawn opposition from many critics.

To date, the Norwegian sovereign wealth fund is the only external investor in Tesla that has explicitly stated its intention to vote.

With the shareholders' meeting approaching, Tesla's board of directors is actively seeking shareholder approval for its proposed compensation plan. Last week, board chairman Robyn Denholm warned that if Musk's compensation package is rejected, he might leave the company, and the company may be prepared to appoint a new CEO from within.

OpenAI deal helps Amazon AWS regain growth momentum. Analysts say the deal is helping the company.

Analysts point out that with Amazon's $38 billion cloud computing deal with OpenAI on Monday... The agreement signifies a major renewed recognition for the e-commerce giant's cloud business.

For a long time, Amazon's cloud computing business AWS (Amazon Web Services) has led the industry, but in recent years, Microsoft and Google's parent company Alphabet have won a number of large contracts with their artificial intelligence (AI)-driven cloud services, which has gradually weakened Amazon's leading advantage.

According to data from Synergy Research Group, as of September this year, Amazon's share of the global cloud market had fallen to 29%, down from 34% in the months leading up to the release of ChatGPT in 2022. Due to its delayed release of a flagship large-scale language model and the lack of a consumer-facing chatbot like OpenAI's ChatGPT, Amazon was once considered a laggard in the AI race by investors.

However, Amazon has recently significantly increased its investment in AI. Last month, the company inaugurated an $11 billion AI data center in Indiana. "Project Rainier" utilizes Amazon's self-developed Trainium chip to train models for AI startup Anthropic. Analysts point out that this significant collaboration agreement between Amazon and OpenAI, coupled with Amazon's recent strong quarterly results, indicates that AWS is regaining growth momentum.

Pfizer Q3 results exceeded expectations, and the company raised its full-year profit guidance again, aiming to boost its weight loss drug business. Company Metsera

Pfizer (PFE.US) reported better-than-expected third-quarter results for 2025 and raised its full-year earnings guidance. The company stated that ongoing cost-cutting measures helped offset pressure from slowing sales growth, which also provided financial support for its bid to acquire weight-loss drug startup Metsera.

Financial reports show that Pfizer's Q3 revenue fell 6% year-on-year to $16.654 billion, better than analysts' consensus estimate of $16.5 billion; adjusted net profit was $4.949 billion, down 18% year-on-year; adjusted earnings per share were $0.87, better than analysts' consensus estimate of $0.64.

Looking ahead, Pfizer expects full-year revenue for 2025 to be between $61 billion and $64 billion. The company also expects adjusted earnings per share for the full year to be between $3.00 and $3.15, up from its previous forecast of $2.90 to $3.10. This is the second time this year that Pfizer has raised its full-year earnings forecast.

(Article source: Hafu Securities )