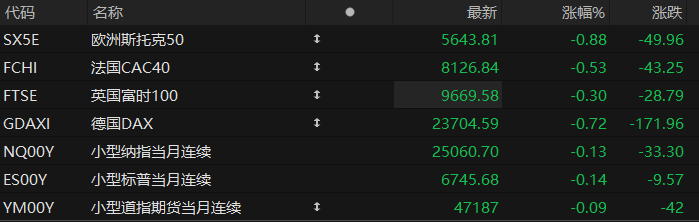

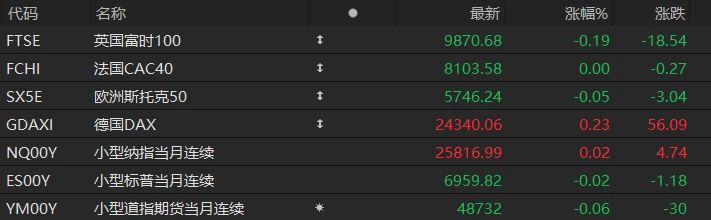

U.S. stock index futures traded in a narrow range in pre-market trading on Wednesday, while most major European indices declined. As of press time, the Nasdaq... S&P 500 futures rose 0.02%, S&P 500 futures fell 0.02%, and Dow Jones futures fell 0.06%.

In terms of individual stocks, the performance of star tech stocks diverged, with Micron Technology... TSMC Google rose about 0.5%, Intel... Nvidia shares fell more than 2%. Oracle bone script It fell by about 0.3%.

The number of Americans filing for unemployment benefits for the week ending December 20 was 214,000, compared with expectations of 224,000 and the previous week's figure of 224,000.

Due to the Christmas holiday in the United States, the US stock market closed three hours early on Wednesday, December 24th; trading in US Treasury futures contracts on the CME Group ended early at 03:30 Beijing time on the 25th, and trading in CME precious metals futures also ended early. Trading in energy and foreign exchange futures contracts ended early at 02:45 Beijing time on the 25th, while trading in stock index futures contracts ended early at 02:15 Beijing time on the 25th. ( Intercontinental Exchange) Trading in ICE Brent crude oil futures contracts ended early at 03:00 Beijing time on the 25th.

On Thursday, December 25th, US stock markets were closed. Trading in US Treasury futures contracts on the CME Group was suspended for the entire day, as were trading in precious metals , crude oil, foreign exchange, and stock index futures contracts on the CME Group. Trading in Brent crude oil futures contracts on the Intercontinental Exchange (ICE) was also suspended for the entire day.

Hot News

After four consecutive days of gains, US stocks are heading into Christmas Eve. Will Santa Claus arrive tonight?

Every Christmas, investors pray for the same thing: that Santa Claus will bring them a rise in the stock market, which is known in the investment world as the "Santa Claus rally".

The "Santa Claus rally" refers to the five trading days between the end of the year and the beginning of the new year, during which the US stock market is likely to rise. This year's "Santa Claus rally" window begins tonight, December 24th.

Since the beginning of the year, the US stock market has generally performed strongly, rebounding continuously from its April lows, with the S&P 500 index constantly hitting new highs. Although the US stock market experienced significant volatility in December, in recent days, as Micron Technology's earnings report stabilized investor confidence in the AI industry, US tech stocks regained their upward momentum, and the S&P 500 index once again reached a new high.

Many investment professionals on Wall Street say they expect U.S. stocks to continue rising during the Christmas holidays to end the year smoothly and get off to a good start in 2026.

Louis Navellier, chairman and chief investment officer of Navellier & Associates investment firm, believes that the current state of the US stock market has paved the way for a "Santa Claus rally." He points out that artificial intelligence... Trading concerns are easing, and many sectors of the market are performing strongly.

The Fed's "2025 Memoir": Maintaining Independence Under Trump's Pressure, What's Next After a 75 Basis Point Rate Cut?

In 2025, the Federal Reserve delivered a controversial yet resilient performance amidst a complex economic and political environment. That year, the Fed's monetary policy stance shifted from combating inflation to stabilizing growth, while the debate over its independence became a recurring theme throughout the year. Interest rates were cut three times, in September, October, and December, lowering the federal funds rate range to between 3.75% and 4.00%.

The most compelling drama of the year has undoubtedly been the power struggle between Trump and the Federal Reserve, or more accurately, between Trump and Chairman Powell. Trump and his senior advisors have been urging Powell to lower interest rates quickly and significantly, but the results have clearly been disappointing. Trump has repeatedly criticized Powell publicly and even threatened to fire him. Meanwhile, Powell's term as Federal Reserve Chairman will end on May 15, 2026, meaning the Fed will face its first leadership change in eight years next year.

News about his successor selection dominated headlines at the end of the year. Not long ago, Trump stated that he had decided who would replace Powell and would announce the nomination early next year. White House National Economic Council Director Kevin Hassett and former Federal Reserve Governor Kevin Warsh were considered the most likely candidates to succeed Powell. On December 23, local time, Trump once again conveyed a clear message to the market: I only want an "obedient" Federal Reserve Chairman.

Looking ahead to 2026, the prevailing opinion among Federal Reserve officials in the latest dot plot is that they expect only one more rate cut. Despite a cooling labor market, they do not view this weakness as an emergency. On the Wall Street investment banking front, JPMorgan Chase... The Federal Reserve is expected to cut interest rates only once next year, in January; UBS Global Wealth Management also predicts that the Fed will cut rates only once next year, in the first quarter. Goldman Sachs... Wells Fargo and Barclays Strategists at Standard Chartered Bank believe the Federal Reserve will cut interest rates twice next year, with March and June being the most likely months. and HSBC Securities All agree that the Federal Reserve will not cut interest rates next year.

Behind the historic bull market in silver, what should we be most wary of right now?

The parabolic rise in silver prices over the past few weeks has been remarkable – with spot silver prices breaking through $72 on Wednesday, silver has more than doubled this year and is more than three times higher than the low of $17 in 2022.

Historically, the current surge in silver prices is almost identical to previous historic jumps, and this bull market is even more intense.

The turmoil of the 2008 financial crisis began to ease in 2009, and silver prices embarked on a 500% surge, rising from $8.50 to $50.00 in two years. The Federal Reserve's excessive monetary response to the crisis, coupled with rampant speculation, created a perfect storm for the silver market. At the time, the Chicago Mercantile Exchange (CME) raised silver margin requirements five times in just nine days, forcing deleveraging in the futures market and causing silver prices to plummet by nearly 30% within weeks.

Currently, the silver-to-crude oil ratio (green line) has climbed to its highest level since at least 1990. The chart shows that similar surges have occurred multiple times in the past. If this is also a short-term spike, it means that crude oil prices are about to rise sharply, or silver is about to experience a sharp correction. When silver prices exhibit a parabolic upward trend, it may trigger proactive intervention from regulators and exchanges. Such actions are often unpredictable and occur extremely quickly.

US Stocks Focus

JPMorgan Chase : iPhone 17 delivery cycles have shortened significantly, and demand has cooled noticeably.

As the year draws to a close, JPMorgan analysts have observed that Apple... Delivery times for the iPhone 17 series are starting to shorten, indicating that market demand for the new iPhone has clearly cooled down.

In a report, JPMorgan analyst Samik Chatterjee stated that iPhone supply is beginning to catch up with demand, leading to "shorter lead times for the iPhone 17 series" in recent weeks.

The iPhone 17 was officially released on September 10th this year, and it has now entered its 14th week. In the first month after its release, the average delivery time reached 24 days, which is significantly longer than the initial delivery time of the iPhone 16 last year.

Chatterjee observed that the shipping time for the entire iPhone 17 series has been shortened by 3 days compared to the previous period, with the current average delivery time being only about 3 days, which is comparable to the level of the iPhone 16 series at the same time last year.

Chatterjee points out that, based on their past observations, Apple's new iPhones typically reach a "supply-demand balance" by the end of the year, and the iPhone 17 series seems to follow this trend. Previously, due to strong demand, the delivery time for the iPhone 17 series in the quarter following its release was extended, but the gap is now narrowing.

Sanofi Acquired Denavi Pharmaceuticals for $2.2 billion Expanding the vaccine business

Sanofi has agreed to acquire Denavitas Pharmaceuticals for approximately $2.2 billion, aiming to expand its current influenza product portfolio . A vaccine product line with vaccine business at its core.

According to a statement released by Sanofi on Wednesday, it will acquire Dadnavia Pharmaceuticals, headquartered in Emeryville, California, for $15.50 per share in cash. This offer represents a 39% premium over Dadnavia's closing price on Tuesday.

Through this acquisition, the French pharmaceutical giant will gain access to a hepatitis B vaccine already marketed in the United States, and an experimental shingles vaccine currently in early human trials. Sanofi stated that this move will strengthen its market position in the adult vaccination sector.

Currently, Sanofi's vaccine portfolio covers multiple indications, including influenza , respiratory syncytial virus, meningitis, and pertussis.

Meta faces antitrust pressure in Italy; WhatsApp terms may be restricted.

On Wednesday, Italy's antitrust authority (AGCM) ordered Meta to suspend certain contractual terms that could restrict competitors' AI chatbots . Excluded from WhatsApp.

The agency is currently investigating the U.S. tech giant for allegedly abusing its market dominance. A Meta spokesperson called the decision "fundamentally flawed" and stated that the emergence of AI chatbots "puts our systems under pressures that were not designed to withstand."

The spokesperson added, "We will appeal." This is one of a series of recent actions by European regulators against large technology companies. The EU is currently attempting to strike a balance between supporting the technology sector and curbing its growing influence.

(Article source: Hafu Securities )