I. Overview of US Stock Index Options

Trading volume in the US stock index options market is currently declining, and the put/call ratio is also decreasing.

The volume distribution of S&P 500 index options expiring today shows a divergence between call and put order distributions, with the peak for put orders at 6885 points and the peak for call orders at 6920 points.

Nasdaq contracts expiring today 100 Index Options Trading Volume Distribution: Call single peak at 25800, Put single peak at 25500.

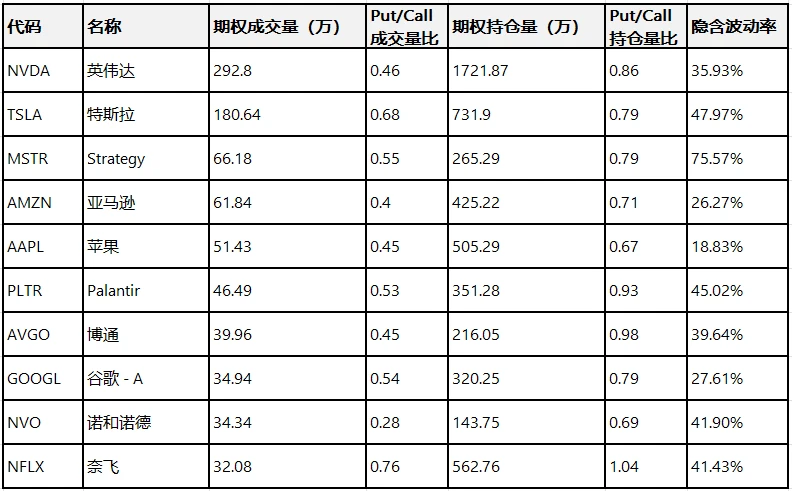

II. US Stock Options Trading Volume Ranking

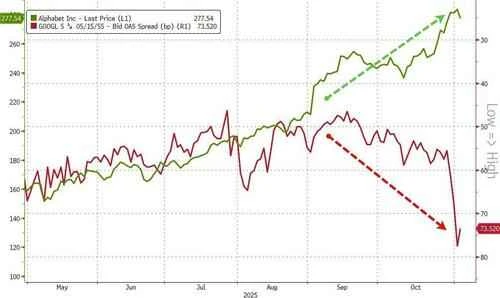

1. Novo Nordisk The stock rose 7.30% in the previous trading day, with the put/call ratio remaining relatively flat the day before, and trading volume increasing significantly.

Looking at the call orders expiring this Friday, the highest increase was over 8 times.

Observing the large order fluctuations in options trading, it was found that there was a divergence of opinion among major investors regarding whether to buy or sell before the market closed.

The U.S. Food and Drug Administration (FDA) recently approved Novo Nordisk's weight-loss drug. This gives the company a competitive edge in the rapidly evolving obesity treatment market. This approval puts Novo Nordisk at the forefront of the race to develop potent oral weight-loss drugs .

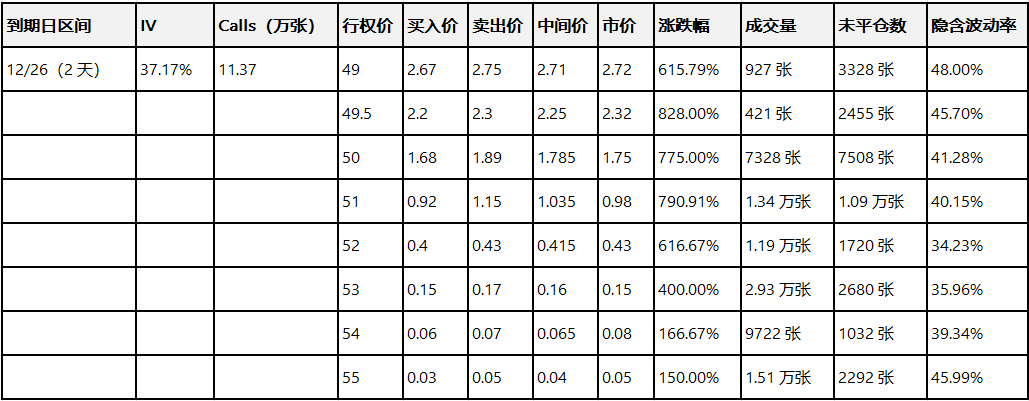

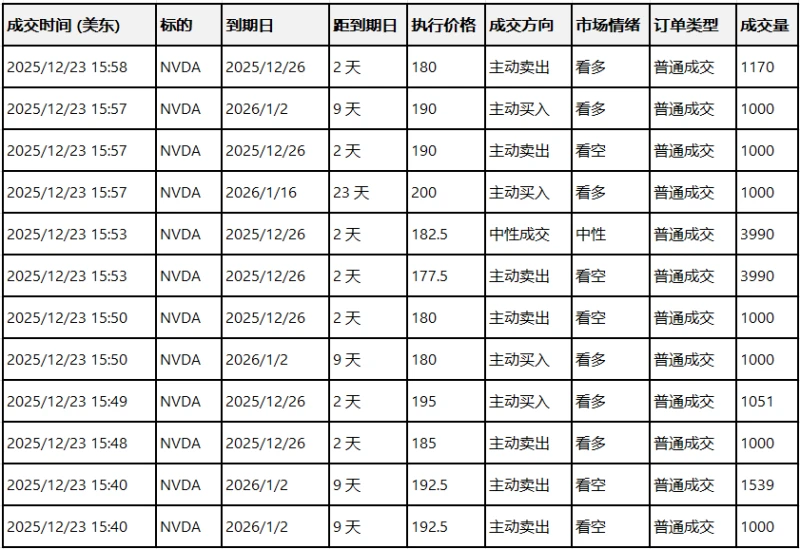

2. Nvidia The stock rose 3.01% in the previous trading day, with the put/call ratio declining and trading volume increasing the day before.

Looking at the call orders expiring this Friday, the highest increase was over 4 times.

Observing the large orders with unusual activity in options trading, it was found that large investors were mostly bullish before the market closed.

Top 10 US Stock Options Trading Volume Ranking

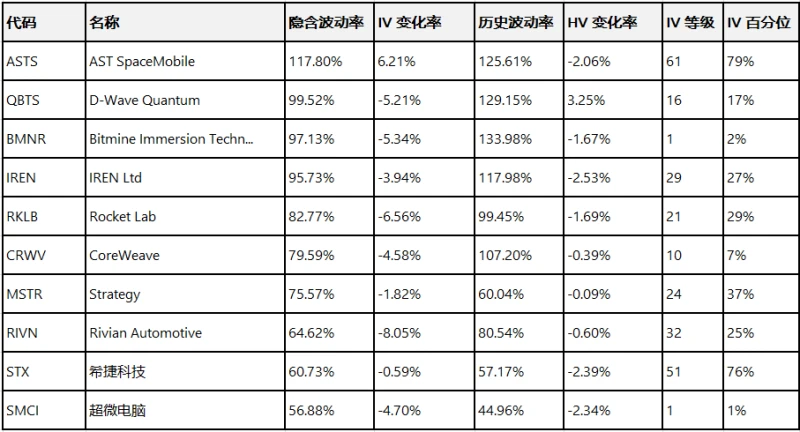

Top 10 most volatile US stock options (underlying asset market capitalization > $10 billion and option trading volume > 100,000 contracts)

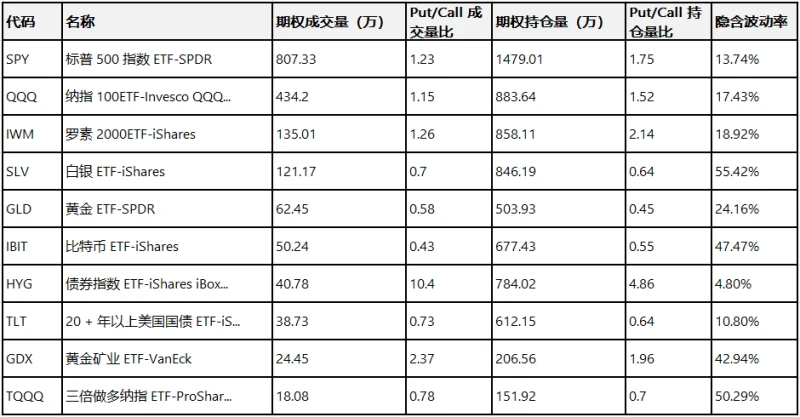

III. Top Ten US Stock ETF Options Trading Volume Ranking

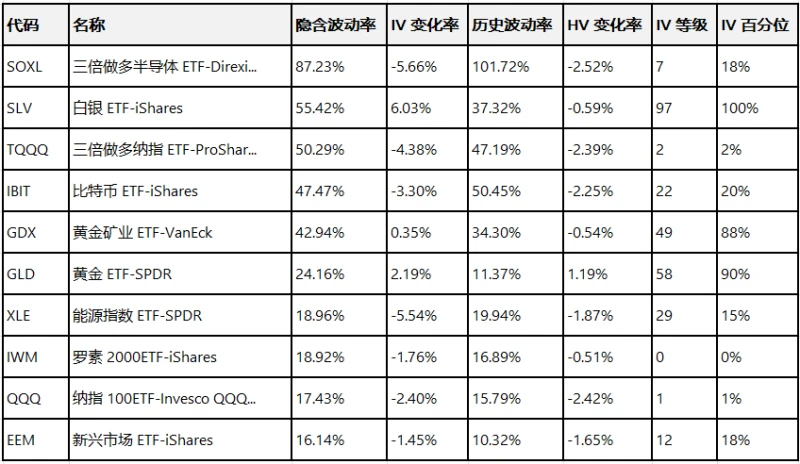

Top 10 US Stock ETFs by Implied Volatility (Based on: Market Cap > $10 billion)

(Article source: Hafu Securities) )